- Sweden

- /

- Capital Markets

- /

- OM:AJA B

Here's Why We Think Byggmästare Anders J Ahlström Holding (STO:AJA B) Is Well Worth Watching

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Byggmästare Anders J Ahlström Holding (STO:AJA B). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Byggmästare Anders J Ahlström Holding

How Fast Is Byggmästare Anders J Ahlström Holding Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that Byggmästare Anders J Ahlström Holding's EPS went from kr14.51 to kr83.33 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Byggmästare Anders J Ahlström Holding's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Byggmästare Anders J Ahlström Holding shareholders can take confidence from the fact that EBIT margins are up from -14% to 4.6%, and revenue is growing. That's great to see, on both counts.

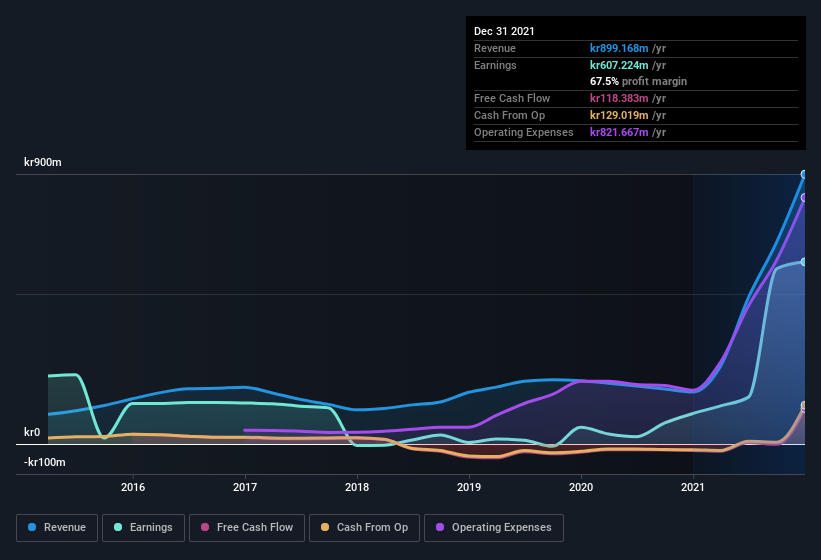

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Byggmästare Anders J Ahlström Holding isn't a huge company, given its market capitalization of kr1.9b. That makes it extra important to check on its balance sheet strength.

Are Byggmästare Anders J Ahlström Holding Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Byggmästare Anders J Ahlström Holding insiders refrain from selling stock during the year, but they also spent kr1.4m buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident. It is also worth noting that it was Independent Director Hidayet Sidea who made the biggest single purchase, worth kr974k, paying kr300 per share.

The good news, alongside the insider buying, for Byggmästare Anders J Ahlström Holding bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold kr291m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 15% of the company; visible skin in the game.

Is Byggmästare Anders J Ahlström Holding Worth Keeping An Eye On?

Byggmästare Anders J Ahlström Holding's earnings have taken off like any random crypto-currency did, back in 2017. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Byggmästare Anders J Ahlström Holding belongs on the top of your watchlist. We should say that we've discovered 3 warning signs for Byggmästare Anders J Ahlström Holding (1 doesn't sit too well with us!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Byggmästare Anders J Ahlström Holding, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Byggmästare Anders J Ahlström Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:AJA B

Byggmästare Anders J Ahlström Holding

Invests in, owns, and develops listed and unlisted small and medium-sized companies in Sweden and rest of the Nordic region.

Excellent balance sheet with low risk.

Market Insights

Community Narratives