- Sweden

- /

- Real Estate

- /

- OM:WIHL

Wihlborgs Fastigheter (OM:WIHL): Assessing Valuation After Portfolio Optimization and Strategic Leasing Moves

Reviewed by Kshitija Bhandaru

Wihlborgs Fastigheter (OM:WIHL) has been busy recalibrating its property portfolio. The company recently acquired an industrial property in Vala Norra with a ten-year lease, while also selling assets in southern Helsingborg that require major upkeep.

See our latest analysis for Wihlborgs Fastigheter.

Wihlborgs Fastigheter has kept up a steady pace of portfolio optimization and new leasing agreements, including recent headlines about a major restaurant debut and a growing industrial tenant. Despite that, its share price has shed ground this year, with a year-to-date share price return of -8.5%. However, taking a longer view, the three-year total shareholder return stands at an impressive 62.9%, which highlights solid long-term momentum even as the market weighs short-term risks and opportunities around property repositioning.

If these strategic moves have you thinking about where momentum might strike next, it is worth exploring fast growing stocks with high insider ownership.

With the stock trading at a notable discount to analyst targets, but already showing strong multi-year returns, the question now is whether Wihlborgs Fastigheter offers further upside or if the market has already priced in future growth.

Most Popular Narrative: 12.8% Undervalued

Compared to Wihlborgs Fastigheter’s last close of SEK96.25, the most widely followed narrative sees significant upside, calculating a fair value some 13% higher. This perspective weighs ongoing operational improvements and portfolio moves as the basis for future gains.

"Record high volume of new leases in 2024 and continued strong leasing activity in 2025 indicates potential for increased rental income, especially as new leases come into effect and contribute to revenue growth. Ongoing project investments with successful outcomes suggest future enhancements in rental value and operating surplus, which can boost earnings and profit margins."

Want to unravel the forces behind this bullish outlook? The real intrigue lies in how ambitious revenue growth, margin resilience, and a premium profit multiple all combine to justify the higher price target. Step inside to discover what powers these bold projections, only in the full narrative.

Result: Fair Value of $110.4 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising vacancy rates in key areas and Wihlborgs Fastigheter’s high leverage could quickly change the outlook if market conditions weaken further.

Find out about the key risks to this Wihlborgs Fastigheter narrative.

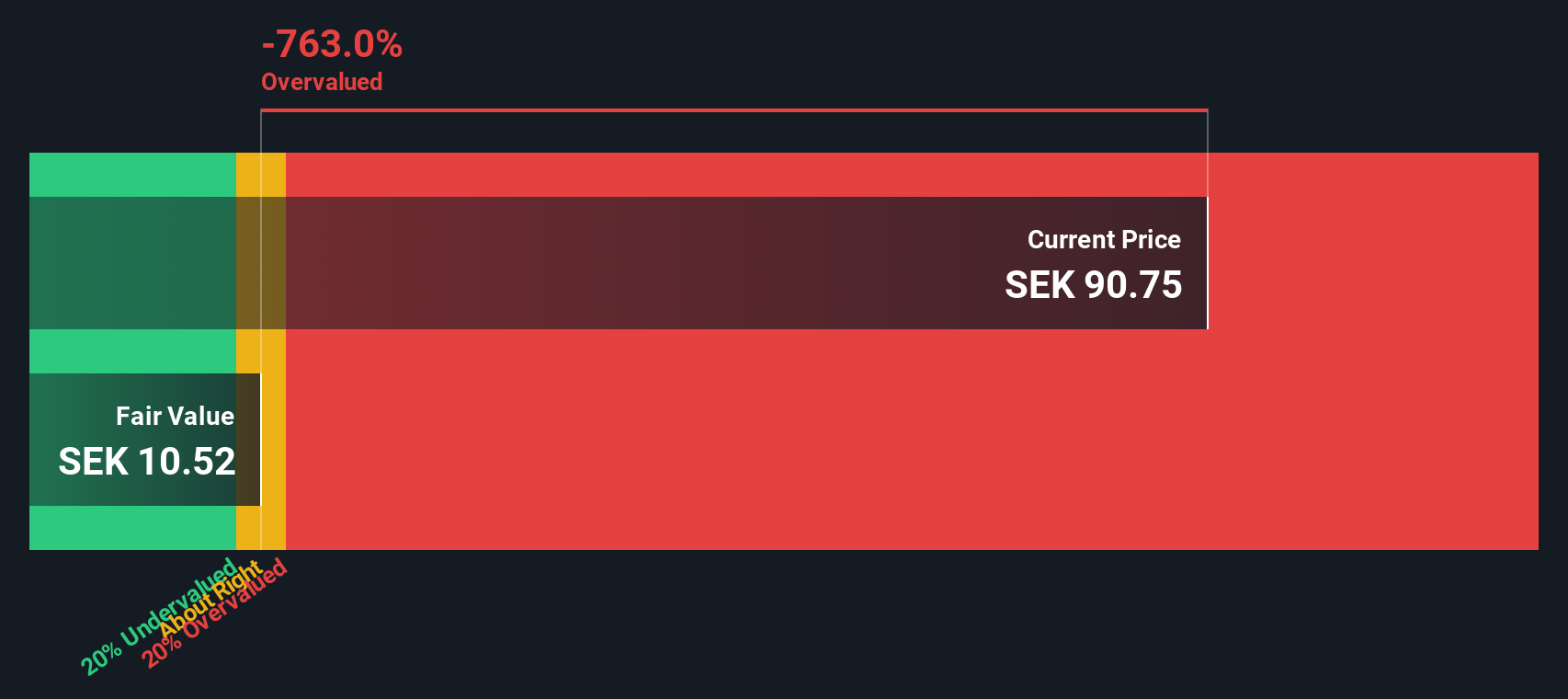

Another View: DCF Model Results Diverge Sharply

While analyst targets suggest Wihlborgs Fastigheter is undervalued, the SWS DCF model arrives at a strikingly different result, pegging fair value far below the current share price. This approach presents a much more cautious picture of potential upside. Which valuation method tells the more accurate story for the years ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wihlborgs Fastigheter for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wihlborgs Fastigheter Narrative

If you have a different perspective or want to take matters into your own hands, building your own view on Wihlborgs Fastigheter takes just a few minutes. Do it your way.

A great starting point for your Wihlborgs Fastigheter research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want an edge on tomorrow’s opportunities, don’t sit back. Now is the time to act. Use the Simply Wall Street Screener and you’ll quickly uncover stocks with exceptional potential. Bold moves come from the right starting points. Here are three smart ways to broaden your investing horizons:

- Accelerate your search for steady income by targeting top yield-generators through these 18 dividend stocks with yields > 3% and spot stocks with robust dividends above 3%.

- Break into the future of finance with these 79 cryptocurrency and blockchain stocks, where you’ll track down companies transforming markets through blockchain and digital currencies.

- Unlock tomorrow’s trends by pinpointing standout innovators using these 33 healthcare AI stocks and see which healthcare leaders are harnessing artificial intelligence to power their growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wihlborgs Fastigheter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:WIHL

Wihlborgs Fastigheter

A property company, owns, develops, rents, and manages commercial properties in the Öresund region, Sweden.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives