- Sweden

- /

- Real Estate

- /

- OM:WIHL

Should You Rethink Wihlborgs After Recent 22% Drop in 2025?

Reviewed by Bailey Pemberton

Are you eyeing Wihlborgs Fastigheter and wondering whether it is a hidden gem or just another value trap? You are not alone. The stock has seen some turbulence lately, with a slight drop of 2.0% over the past week and a 3.9% dip in the last month. Zoom out and the story gets a little more complicated, with year-to-date and one-year declines of 14.8% and 22.4%, respectively. Yet, if you are a long-term holder, you know the longer view is much brighter. Over three years, Wihlborgs is up a solid 58.1%, with five-year returns at 19.7%.

This price movement tracks with broader shifts in the Swedish real estate market. Rising interest rates and shifting risk appetites have nudged many investors to rethink positions in property stocks. Wihlborgs, being a major player in this sector, has felt the impact but also attracts attention thanks to its resilience and strategic asset base.

But is the market pricing Wihlborgs fairly right now? According to a six-point value scoring system, the company earns a valuation score of 4, meaning it appears undervalued in four out of the six key checks. That is a solid mark, but numbers only tell part of the story.

To really get to the heart of whether Wihlborgs is truly undervalued or if there is more to the picture than meets the eye, let us dig into the common valuation methods investors use and set the stage for an even more insightful approach coming up at the end of this analysis.

Approach 1: Wihlborgs Fastigheter Discounted Cash Flow (DCF) Analysis

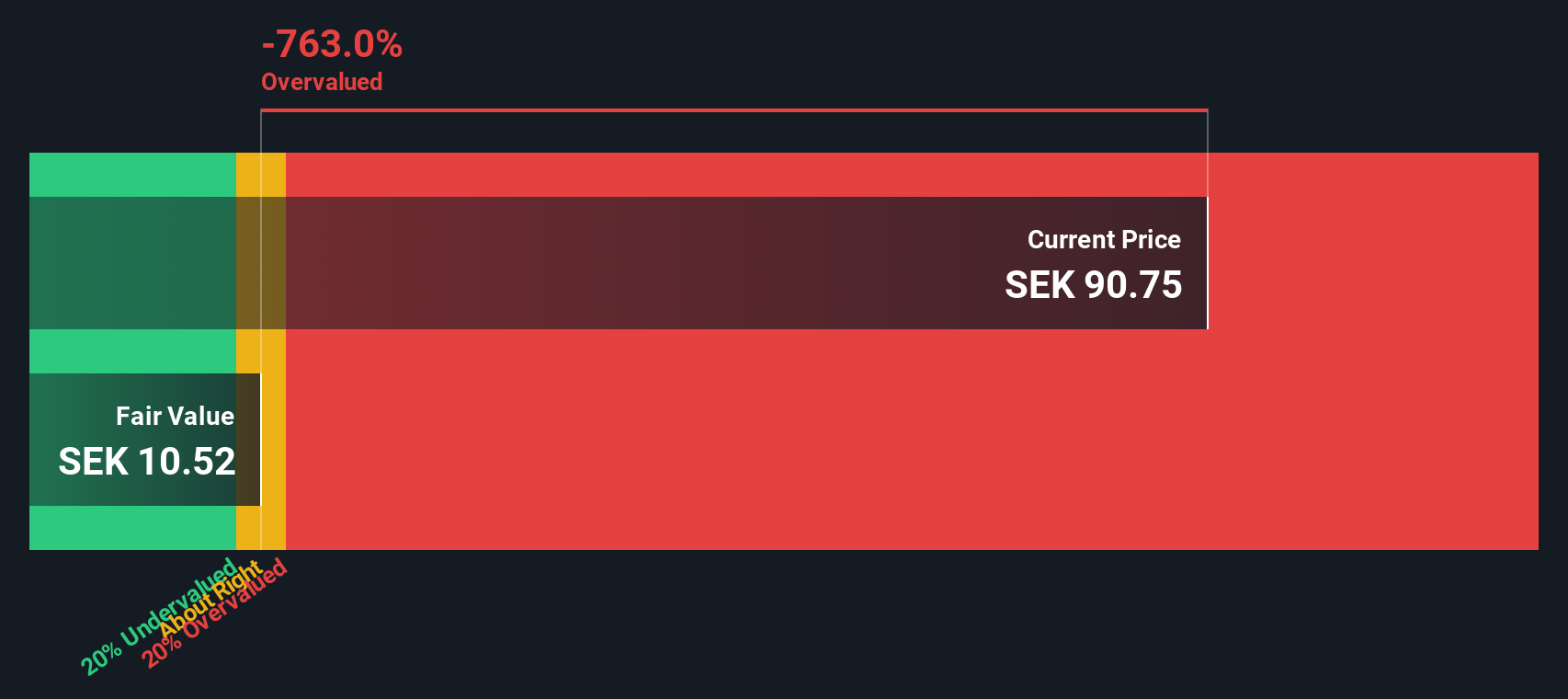

A Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future free cash flows and then discounting them back to their present value. In the case of Wihlborgs Fastigheter, the latest twelve-month free cash flow sits at SEK 1.94 billion, highlighting the company’s robust cash-generating ability.

Looking ahead, analysts expect cash flow growth to continue, though at varying rates. For example, the forecast for 2027 suggests free cash flow could climb to SEK 480.5 million. Beyond the next five years, estimates are extended using historical patterns, resulting in a ten-year projection of gradually increasing but more moderately paced cash flows, all quoted in SEK. These projections are based on the 2 Stage Free Cash Flow to Equity approach, which helps capture both the near-term analyst consensus and longer-term trends.

Running these numbers through the DCF model produces a calculated intrinsic value of SEK 19.95 per share. Notably, this is significantly below Wihlborgs Fastigheter’s current market price, implying the stock is around 349.2% overvalued according to DCF. While cash generation is healthy, the current share price appears to factor in far more optimism than the fundamentals suggest.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Wihlborgs Fastigheter may be overvalued by 349.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Wihlborgs Fastigheter Price vs Earnings

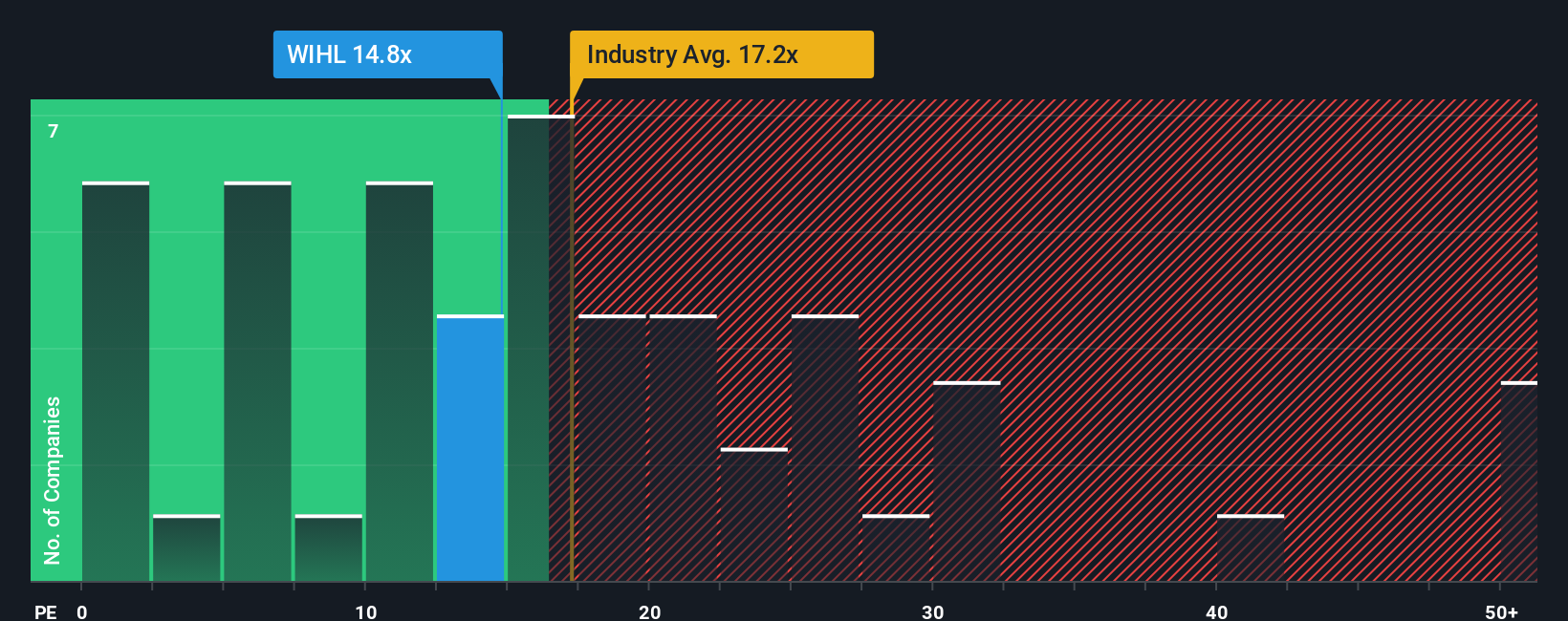

For profitable companies like Wihlborgs Fastigheter, the Price-to-Earnings (PE) ratio is a time-tested valuation metric. The PE ratio offers a quick way to benchmark how much investors are willing to pay today for each SEK of earnings generated by the company. Typically, a higher PE signals stronger growth expectations, a safer business model, or a combination of both. A lower PE can point to perceived risks or weaker growth prospects.

Wihlborgs currently trades at a PE ratio of 14.57x. To put this number in context, the average for the Swedish real estate sector sits at 16.96x, while the peer group’s average is 48.78x. At a glance, this suggests Wihlborgs is trading below both the industry and peer averages. However, simply matching multiples to similar companies does not provide the complete picture, as differences in profitability, growth rates, and risk profiles can be significant.

That is where the "Fair Ratio" from Simply Wall St comes in. For Wihlborgs, it stands at 16.45x. Unlike industry or peer comparisons, the Fair Ratio incorporates specific factors such as the company’s growth outlook, profit margins, size, and risk, giving a more tailored view of the valuation. Because it is based on what the multiple should be for Wihlborgs specifically, this approach often leads to a much fairer assessment.

Comparing the company’s actual PE (14.57x) to its Fair Ratio (16.45x), Wihlborgs appears moderately undervalued on this basis. The numbers suggest the current market price could offer a reasonable entry point relative to the company's fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Wihlborgs Fastigheter Narrative

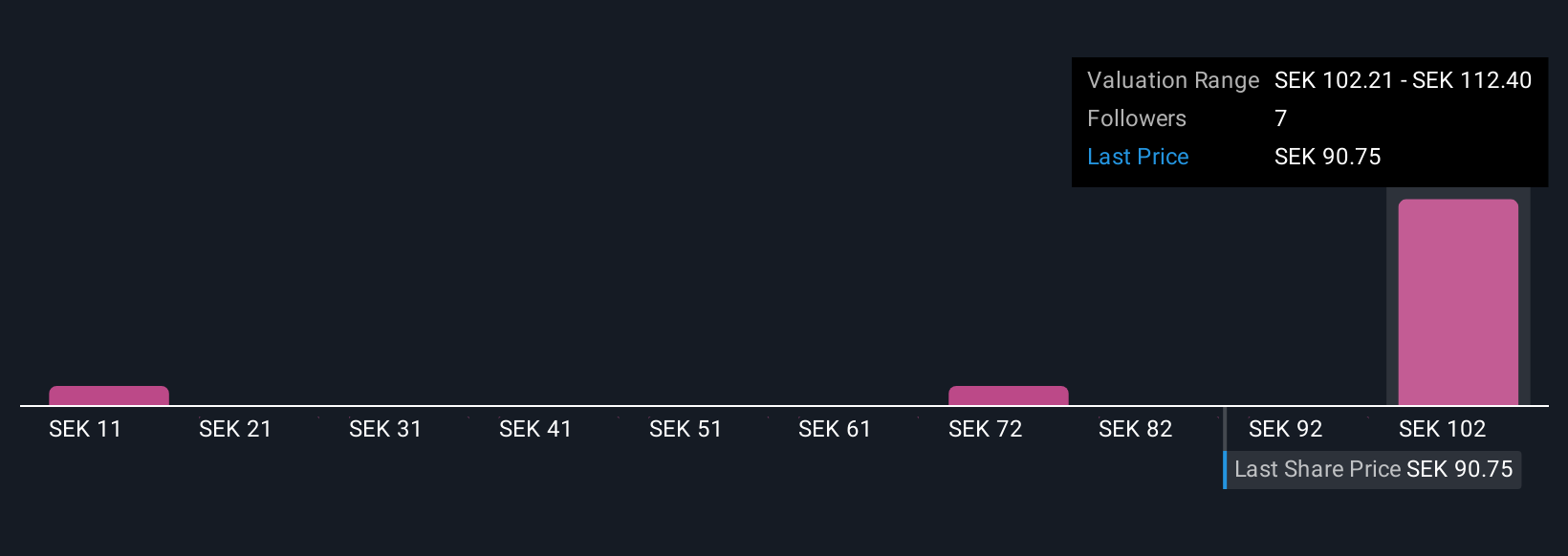

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a clear story you create about a company, combining your perspective and expectations with hard numbers, specifically your own estimates of fair value, future revenue, earnings, and margins. Unlike static valuation models, a Narrative connects the company’s current situation, your financial forecast, and what you believe its fair value should be.

Narratives are available in the Simply Wall St Community page, where millions of investors contribute their views, making it simple for you to build and compare different investment stories. By setting your Narrative, you can quickly see if Wihlborgs Fastigheter is under- or overvalued as the market moves, helping you decide when to buy or sell, and your view will update automatically when new earnings or news is released.

For example, some investors see record new leases, improved occupancy, and acquisitions fueling future growth and set a Fair Value as high as SEK120, while others focus on risks, such as higher vacancy or leverage, and assign a Fair Value as low as SEK100.

Do you think there's more to the story for Wihlborgs Fastigheter? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wihlborgs Fastigheter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:WIHL

Wihlborgs Fastigheter

A property company, owns, develops, rents, and manages commercial properties in the Öresund region, Sweden.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives