- Sweden

- /

- Real Estate

- /

- OM:WBGR B

Wästbygg Gruppen AB (publ) (STO:WBGR B) Stock Catapults 29% Though Its Price And Business Still Lag The Industry

Despite an already strong run, Wästbygg Gruppen AB (publ) (STO:WBGR B) shares have been powering on, with a gain of 29% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 4.9% isn't as attractive.

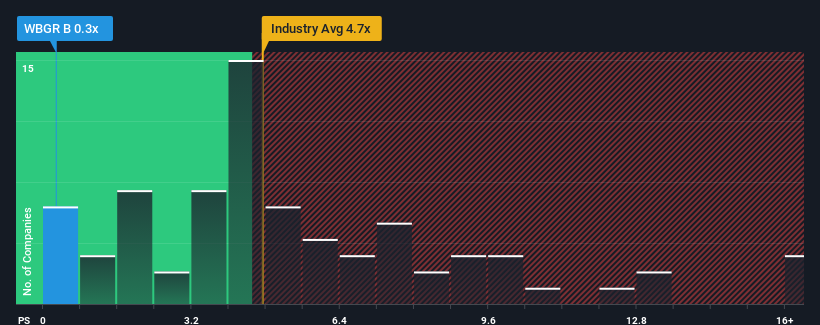

In spite of the firm bounce in price, Wästbygg Gruppen's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a strong buy right now compared to the wider Real Estate industry in Sweden, where around half of the companies have P/S ratios above 4.7x and even P/S above 8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Wästbygg Gruppen

What Does Wästbygg Gruppen's P/S Mean For Shareholders?

Recent times haven't been great for Wästbygg Gruppen as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Wästbygg Gruppen will help you uncover what's on the horizon.How Is Wästbygg Gruppen's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Wästbygg Gruppen's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. Pleasingly, revenue has also lifted 46% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 12% as estimated by the only analyst watching the company. With the industry predicted to deliver 5.7% growth, that's a disappointing outcome.

With this information, we are not surprised that Wästbygg Gruppen is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Wästbygg Gruppen's P/S?

Shares in Wästbygg Gruppen have risen appreciably however, its P/S is still subdued. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Wästbygg Gruppen maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Wästbygg Gruppen's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You should always think about risks. Case in point, we've spotted 2 warning signs for Wästbygg Gruppen you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wästbygg Gruppen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:WBGR B

Wästbygg Gruppen

Operates as a construction and project development company in Sweden, Norway, Denmark, and Finland.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives