- China

- /

- Electrical

- /

- SZSE:301168

3 Growth Companies With High Insider Ownership Boasting 43% Earnings Growth

Reviewed by Simply Wall St

Amidst a backdrop of geopolitical tensions and concerns over consumer spending, global markets have experienced volatility, with major U.S. indices ending the week lower despite early gains. This uncertain environment underscores the importance of identifying growth companies with strong insider ownership, as these firms often demonstrate resilience and commitment to long-term success.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.1% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 43.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

Underneath we present a selection of stocks filtered out by our screen.

Wallenstam (OM:WALL B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wallenstam AB (publ) is a Swedish property company with a market cap of SEK31.49 billion, focusing on real estate operations within Sweden.

Operations: The company's revenue is primarily derived from its operations in Gothenburg, contributing SEK1.99 billion, and Stockholm, contributing SEK963 million.

Insider Ownership: 35.2%

Earnings Growth Forecast: 23.3% p.a.

Wallenstam's earnings are forecast to grow significantly at 23.3% per year, outpacing the Swedish market. This growth potential is supported by substantial insider buying, indicating confidence in future performance. Despite a low return on equity forecast and revenue growth trailing behind earnings, Wallenstam has returned to profitability with a net income of SEK 774 million for 2024. Recent developments include new residential projects and expanded leases with the University of Gothenburg, enhancing its growth trajectory.

- Navigate through the intricacies of Wallenstam with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Wallenstam is priced higher than what may be justified by its financials.

Arctech Solar Holding (SHSE:688408)

Simply Wall St Growth Rating: ★★★★★☆

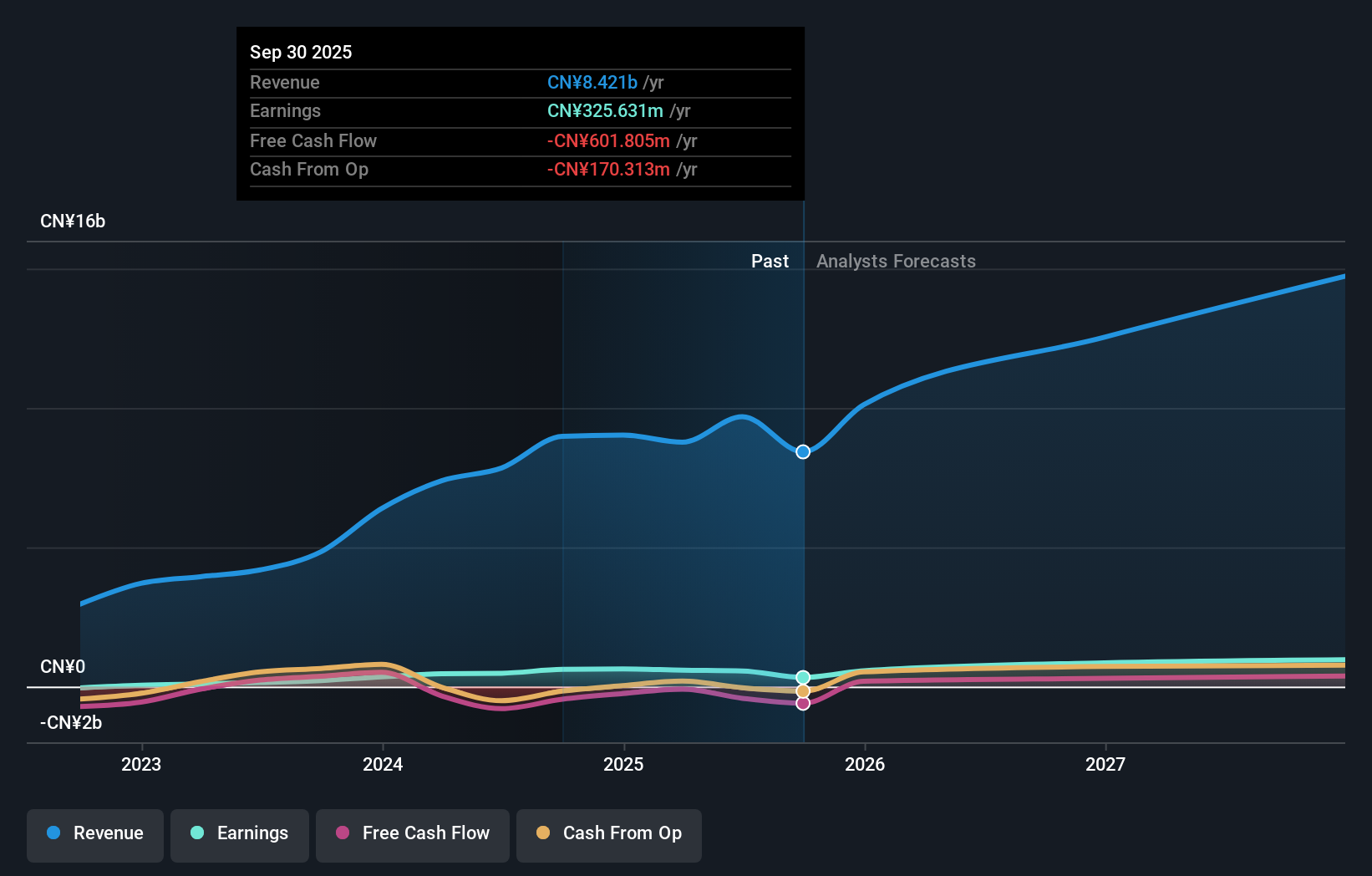

Overview: Arctech Solar Holding Co., Ltd. specializes in manufacturing and supplying solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for utility-scale and commercial solar projects globally, with a market cap of approximately CN¥10.76 billion.

Operations: Arctech Solar generates revenue through the production and distribution of solar trackers, fixed-tilt structures, and BIPV solutions for large-scale and commercial solar installations worldwide.

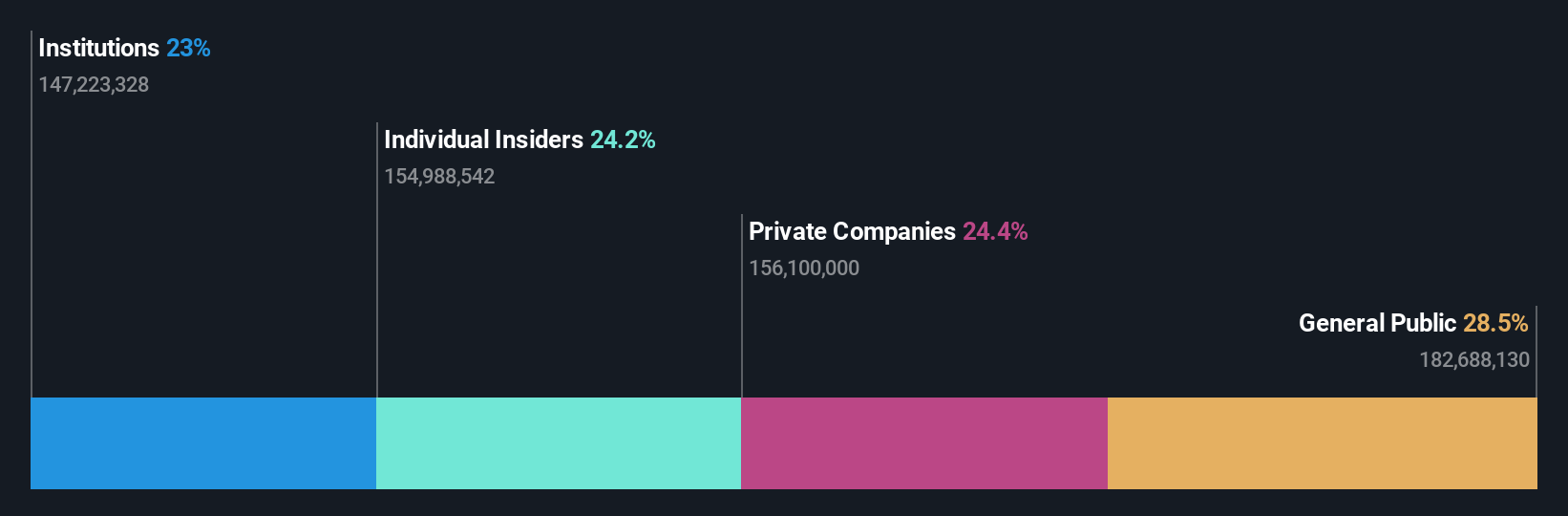

Insider Ownership: 37.9%

Earnings Growth Forecast: 24.4% p.a.

Arctech Solar Holding's revenue growth of 20.1% annually is expected to surpass the Chinese market average, while its earnings are forecasted to grow at 24.4% per year. Despite this, earnings growth slightly lags behind the market estimate of 25.4%. The company's recent financial results show robust sales and net income increases for 2024, with CNY 8.97 billion in sales and CNY 647.31 million in net income, reflecting strong operational performance amidst favorable valuation metrics compared to industry peers.

- Take a closer look at Arctech Solar Holding's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Arctech Solar Holding is priced lower than what may be justified by its financials.

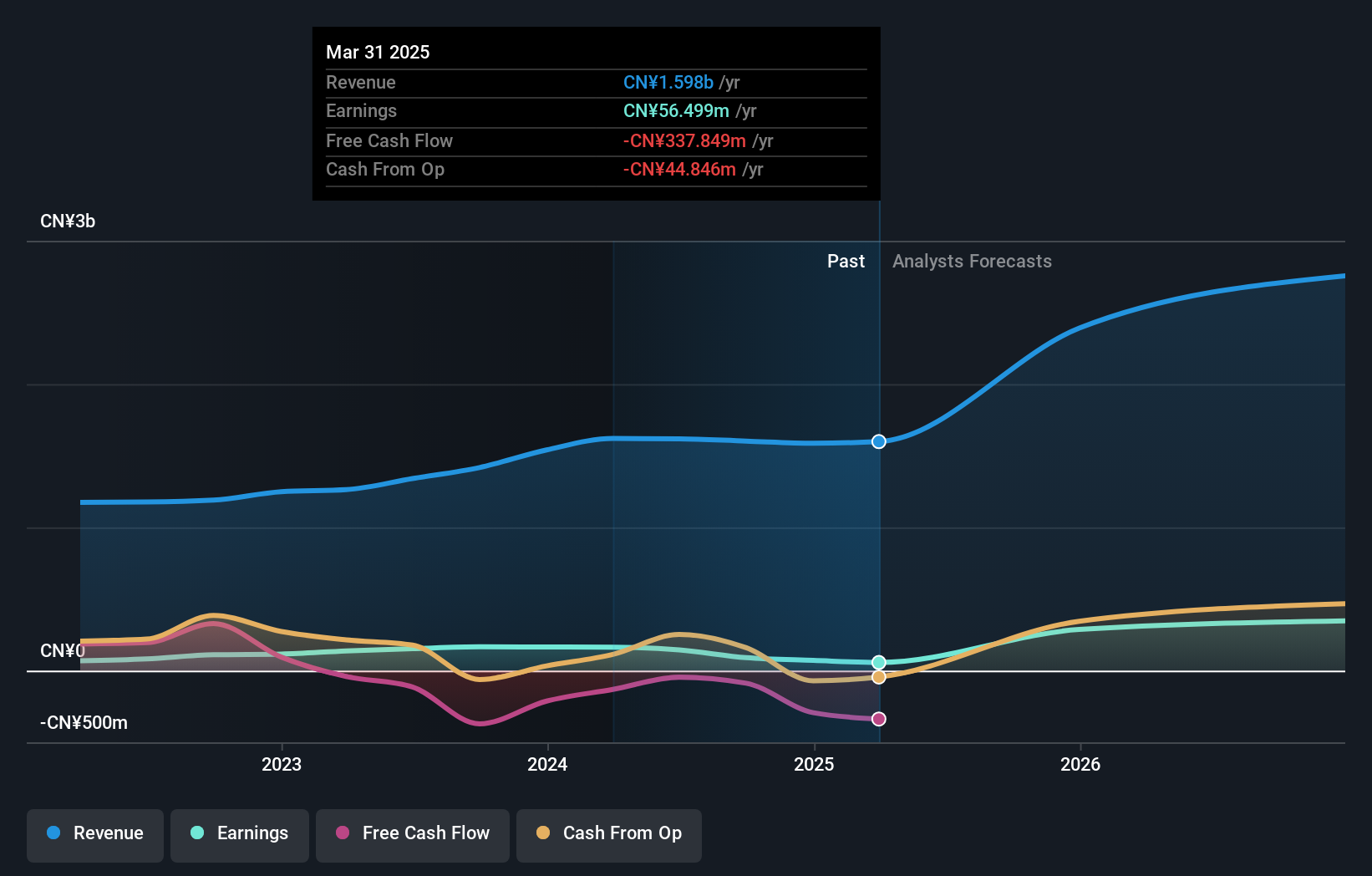

Jiangsu TongLin ElectricLtd (SZSE:301168)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu TongLin Electric Co., Ltd. specializes in the research, development, and manufacture of photovoltaic connection systems, PV power stations, electrical equipment, cables and wires, and industrial automation solutions in China with a market cap of approximately CN¥3.26 billion.

Operations: The company's revenue is derived from its activities in photovoltaic connection systems, PV power stations, electrical equipment, cables and wires, and industrial automation solutions within China.

Insider Ownership: 29.8%

Earnings Growth Forecast: 43.3% p.a.

Jiangsu TongLin Electric is poised for significant growth, with revenue expected to rise 26.2% annually, outpacing the Chinese market's 13.4%. Earnings are projected to grow at a robust 43.3% per year, well above the market average of 25.4%. However, profit margins have decreased from last year and its dividend yield of 0.55% isn't fully covered by free cash flows. Recent events include being dropped from the S&P Global BMI Index and an upcoming shareholders meeting discussing financial strategies for 2025.

- Click here and access our complete growth analysis report to understand the dynamics of Jiangsu TongLin ElectricLtd.

- The valuation report we've compiled suggests that Jiangsu TongLin ElectricLtd's current price could be inflated.

Taking Advantage

- Access the full spectrum of 1449 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301168

Jiangsu TongLin ElectricLtd

Engages in the research, development, and manufacture of photovoltaic (PV) connection systems, PV power stations, electrical equipment, cables and wires, and industrial automation solutions in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives