The European market has recently experienced mixed performance, with the pan-European STOXX Europe 600 Index edging higher due to dovish signals from U.S. Fed Chair Jerome Powell and easing U.S.-China trade tensions, while major indices like Germany's DAX and the UK's FTSE 100 have seen declines amid economic uncertainties. As investors navigate these fluctuating conditions, identifying small-cap stocks that exhibit strong fundamentals and potential for growth can be crucial in capitalizing on opportunities within this dynamic landscape.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 11.8x | 1.5x | 32.13% | ★★★★★★ |

| Bytes Technology Group | 16.2x | 3.9x | 22.69% | ★★★★★☆ |

| Boozt | 17.7x | 0.8x | 49.67% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 28.23% | ★★★★★☆ |

| BEWI | NA | 0.5x | 40.29% | ★★★★★☆ |

| Senior | 24.6x | 0.8x | 26.20% | ★★★★☆☆ |

| Fastighets AB Trianon | 13.6x | 4.5x | -209.66% | ★★★★☆☆ |

| Nyab | 20.9x | 0.9x | 38.72% | ★★★☆☆☆ |

| Oxford Instruments | 40.2x | 2.1x | 17.08% | ★★★☆☆☆ |

| Renold | 10.7x | 0.7x | -0.43% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

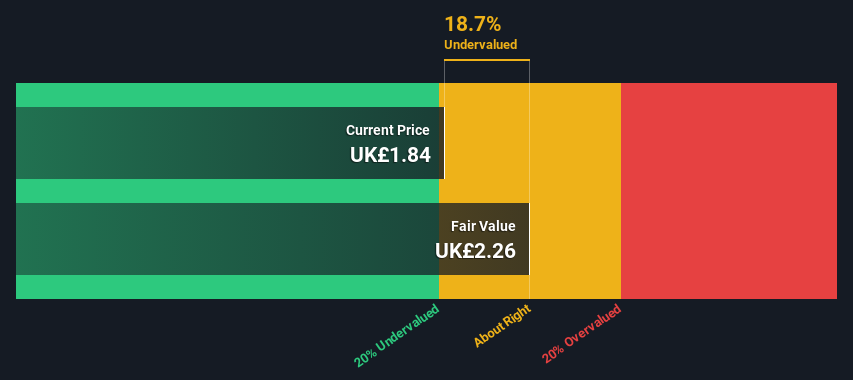

Wickes Group (LSE:WIX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Wickes Group operates as a retailer of home improvement products and services, with a focus on providing DIY and trade solutions, and has a market capitalization of approximately £0.38 billion.

Operations: The company's revenue primarily comes from the retail of home improvement products and services, reaching £1.58 billion recently. The cost of goods sold (COGS) was £999.3 million, leading to a gross profit margin of 36.89%. Operating expenses include significant allocations towards sales and marketing at £351.7 million and general and administrative expenses at £163.8 million, impacting overall profitability with a net income margin of 1.40%.

PE: 23.3x

Wickes Group, a notable player among small European companies, has shown promising dynamics recently. Their earnings for the first half of 2025 rose to £20.9 million from £16.8 million the previous year, with sales reaching £847.9 million. Insider confidence is evident as they completed a share buyback of 4 million shares for £8.2 million between March and June 2025. Despite relying solely on external borrowing, their forecasted annual earnings growth of over 23% suggests potential growth opportunities ahead.

- Dive into the specifics of Wickes Group here with our thorough valuation report.

Examine Wickes Group's past performance report to understand how it has performed in the past.

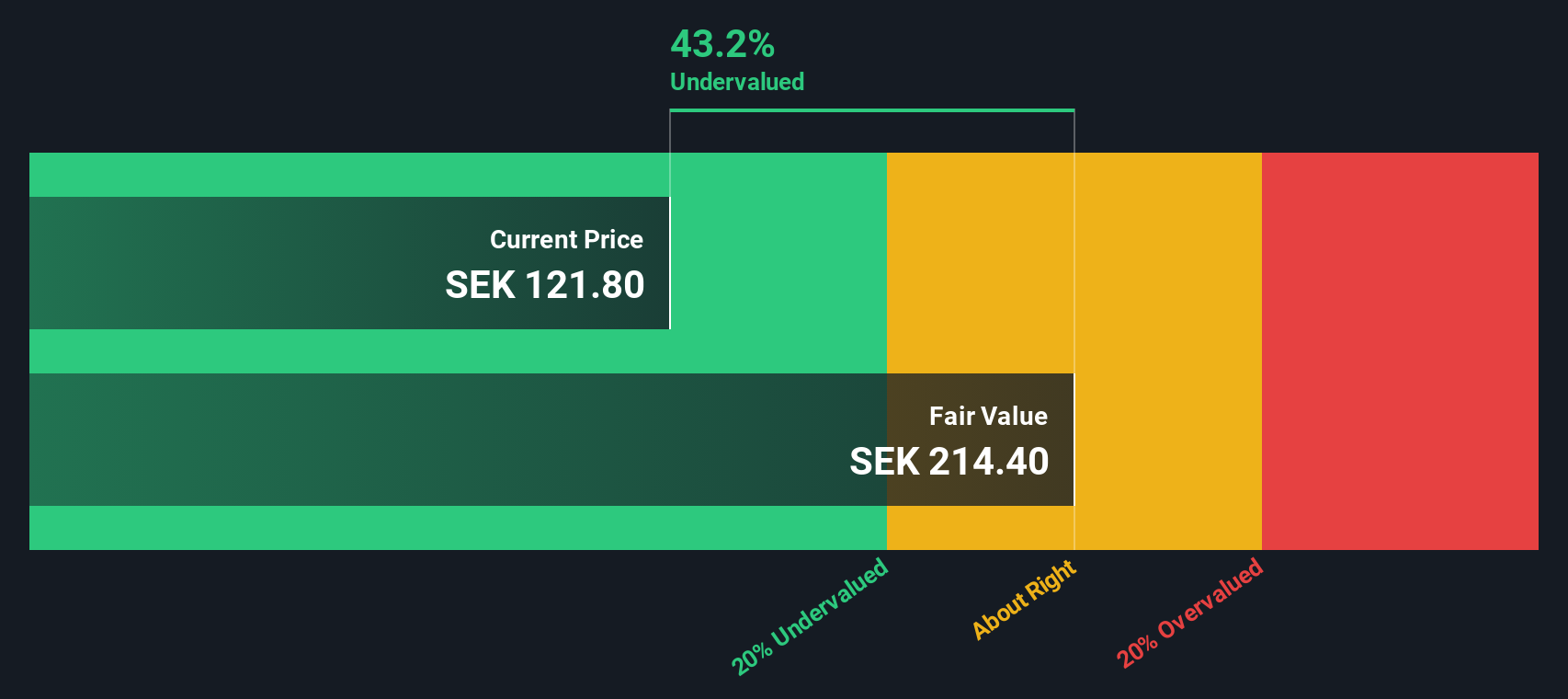

New Wave Group (OM:NEWA B)

Simply Wall St Value Rating: ★★★★★☆

Overview: New Wave Group operates in the corporate, sports & leisure, and gifts & home furnishings sectors, with a market cap of SEK 8.53 billion.

Operations: The company generates revenue primarily from its Corporate and Sports & Leisure segments, with Gifts & Home Furnishings contributing a smaller portion. Over the analyzed periods, the gross profit margin has shown variation, reaching as high as 50.14% in March 2023 and dipping to 43.24% in December 2020. The cost of goods sold (COGS) is a significant component of expenses, impacting profitability alongside operating expenses like general and administrative costs.

PE: 17.7x

New Wave Group, a European small cap, is catching attention with insider confidence shown through recent share purchases. Despite facing a dip in second-quarter sales to SEK 2,300 million from SEK 2,398 million last year and net income dropping to SEK 167 million from SEK 210 million, the company remains resilient. Earnings are projected to grow at over 20% annually. However, reliance on external borrowing for funding highlights potential risks in its financial structure.

- Unlock comprehensive insights into our analysis of New Wave Group stock in this valuation report.

Gain insights into New Wave Group's historical performance by reviewing our past performance report.

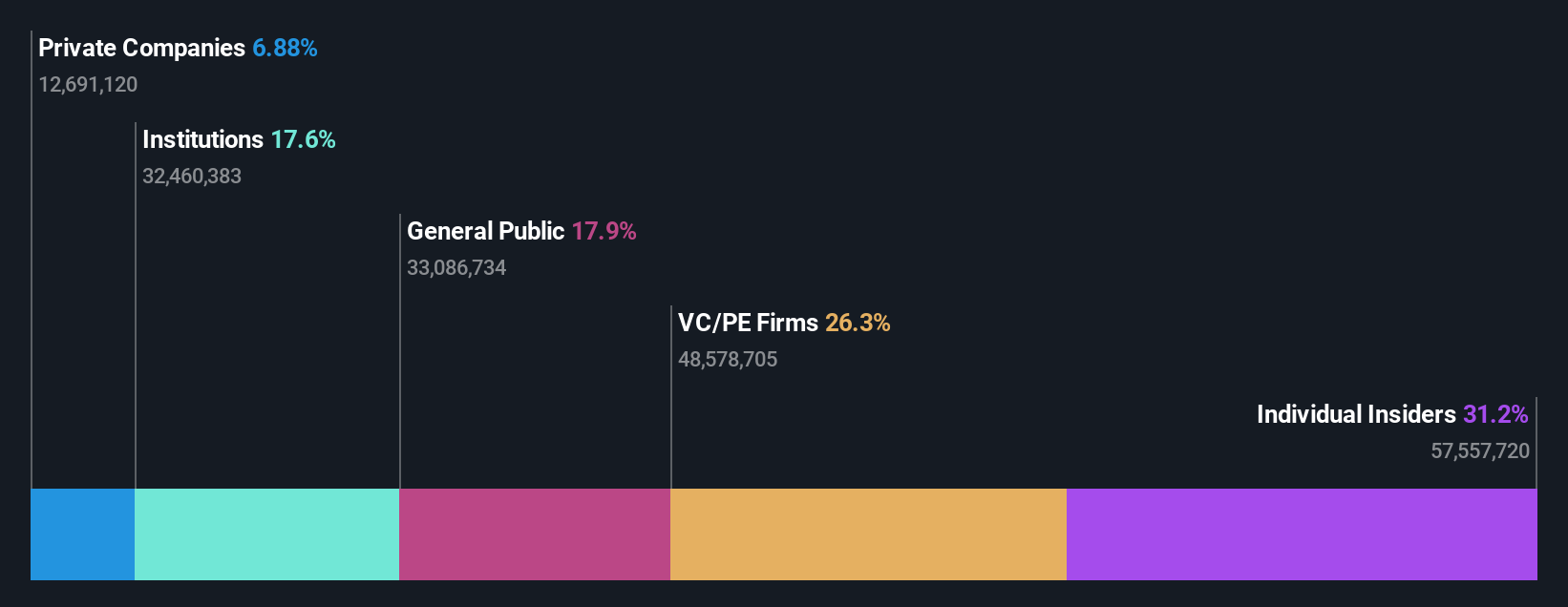

Fastighets AB Trianon (OM:TRIAN B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fastighets AB Trianon is a real estate company focused on residential and community/commercial properties, with operations generating significant revenue from these segments and a market capitalization of SEK 1.39 billion.

Operations: The company generates revenue primarily from its Residential segment, contributing SEK 575.60 million, and the Community/Commercial segment with SEK 217.40 million. Its gross profit margin has shown fluctuations over time, reaching a high of 70.70% in December 2020 before settling at 67.05% by June 2025.

PE: 13.6x

Fastighets AB Trianon, a small European property firm, is catching attention due to its perceived low market valuation. Despite facing challenges with interest payments not fully covered by earnings and relying entirely on higher-risk external borrowing for funding, there's notable insider confidence as insiders have been purchasing shares over the past year. Earnings are projected to grow at 16% annually, hinting at potential future growth amidst these financial hurdles.

- Click here and access our complete valuation analysis report to understand the dynamics of Fastighets AB Trianon.

Explore historical data to track Fastighets AB Trianon's performance over time in our Past section.

Taking Advantage

- Reveal the 52 hidden gems among our Undervalued European Small Caps With Insider Buying screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Wave Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NEWA B

New Wave Group

Designs, acquires, and develops brands and products in the corporate, sports, gifts, and home furnishings sectors in Sweden, the United States, Central Europe, rest of Nordiac countries, Southern Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives