- Sweden

- /

- Real Estate

- /

- OM:TRIAN B

Further weakness as Fastighets AB Trianon (STO:TRIAN B) drops 11% this week, taking three-year losses to 67%

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the long term shareholders of Fastighets AB Trianon (publ) (STO:TRIAN B) have had an unfortunate run in the last three years. So they might be feeling emotional about the 68% share price collapse, in that time. And the share price decline continued over the last week, dropping some 11%.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Fastighets AB Trianon

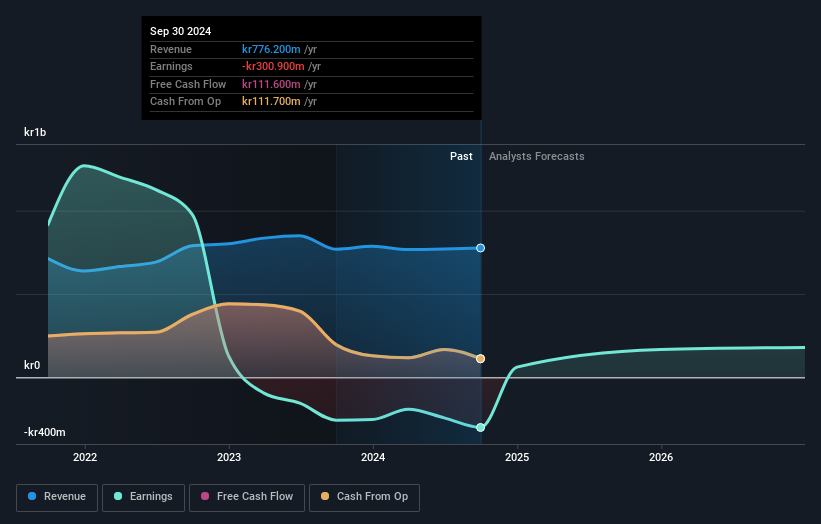

Because Fastighets AB Trianon made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Fastighets AB Trianon saw its revenue grow by 5.0% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. It's likely this weak growth has contributed to an annualised return of 19% for the last three years. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. After all, growing a business isn't easy, and the process will not always be smooth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Fastighets AB Trianon shareholders have received a total shareholder return of 54% over the last year. That certainly beats the loss of about 1.3% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Fastighets AB Trianon has 2 warning signs (and 1 which can't be ignored) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TRIAN B

Fastighets AB Trianon

A real estate company, owns, builds, develops, and manages residential and commercial properties in Sweden.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives