European Undervalued Small Caps With Insider Action In September 2025

Reviewed by Simply Wall St

In recent weeks, the European market has experienced a mixed performance, with the pan-European STOXX Europe 600 Index ending slightly lower as investors navigated various monetary policy decisions. Amidst this backdrop, small-cap stocks in Europe are garnering attention due to their potential resilience and growth opportunities, especially as interest rate movements and economic indicators play a crucial role in shaping their trajectories. Identifying promising small-cap stocks often involves looking at factors such as financial health, growth prospects, and insider activity—elements that can offer insights into a company's potential to thrive in fluctuating market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 12.0x | 1.5x | 26.55% | ★★★★★★ |

| Kitwave Group | 12.2x | 0.3x | 40.21% | ★★★★★☆ |

| Bytes Technology Group | 17.1x | 4.3x | 12.75% | ★★★★☆☆ |

| Renold | 10.8x | 0.7x | 1.11% | ★★★★☆☆ |

| Fastighets AB Trianon | 13.6x | 4.4x | -209.34% | ★★★★☆☆ |

| Stelrad Group | 40.5x | 0.7x | 38.21% | ★★★☆☆☆ |

| Nyab | 22.6x | 1.0x | 34.25% | ★★★☆☆☆ |

| Oxford Instruments | 41.6x | 2.2x | 13.81% | ★★★☆☆☆ |

| CVS Group | 45.9x | 1.3x | 37.05% | ★★★☆☆☆ |

| Social Housing REIT | NA | 7.0x | 33.28% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

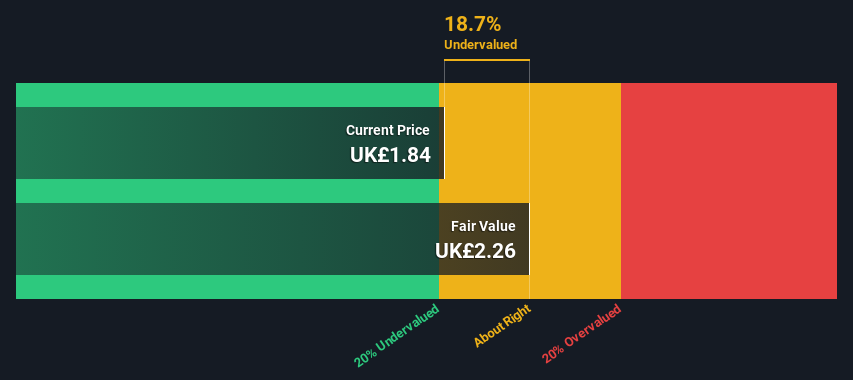

Wickes Group (LSE:WIX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wickes Group operates as a retailer of home improvement products and services, with a market capitalization of approximately £0.35 billion.

Operations: The company generates revenue primarily from the retail of home improvement products and services, with a recent revenue figure of £1.58 billion. The cost of goods sold (COGS) has been recorded at £999.3 million, impacting the gross profit margin which stands at 36.89%. Operating expenses are significant, including sales and marketing costs amounting to £351.7 million, contributing to a net income margin of 1.40%.

PE: 22.6x

Wickes Group, a contender in the European small-cap space, has shown promising financial performance. For the half year ending June 28, 2025, sales reached £847.9 million with net income at £20.9 million, showcasing growth from the previous year. Insider confidence is evident as Christopher Rogers increased their stake by 25%, purchasing shares worth approximately £63K. The company completed a share buyback of 4 million shares for £8.2 million and declared an interim dividend of 3.6 pence per share payable in November 2025. Despite relying solely on external borrowing for funding, earnings are forecasted to grow by over 25% annually, indicating potential for future expansion within its sector.

- Dive into the specifics of Wickes Group here with our thorough valuation report.

Examine Wickes Group's past performance report to understand how it has performed in the past.

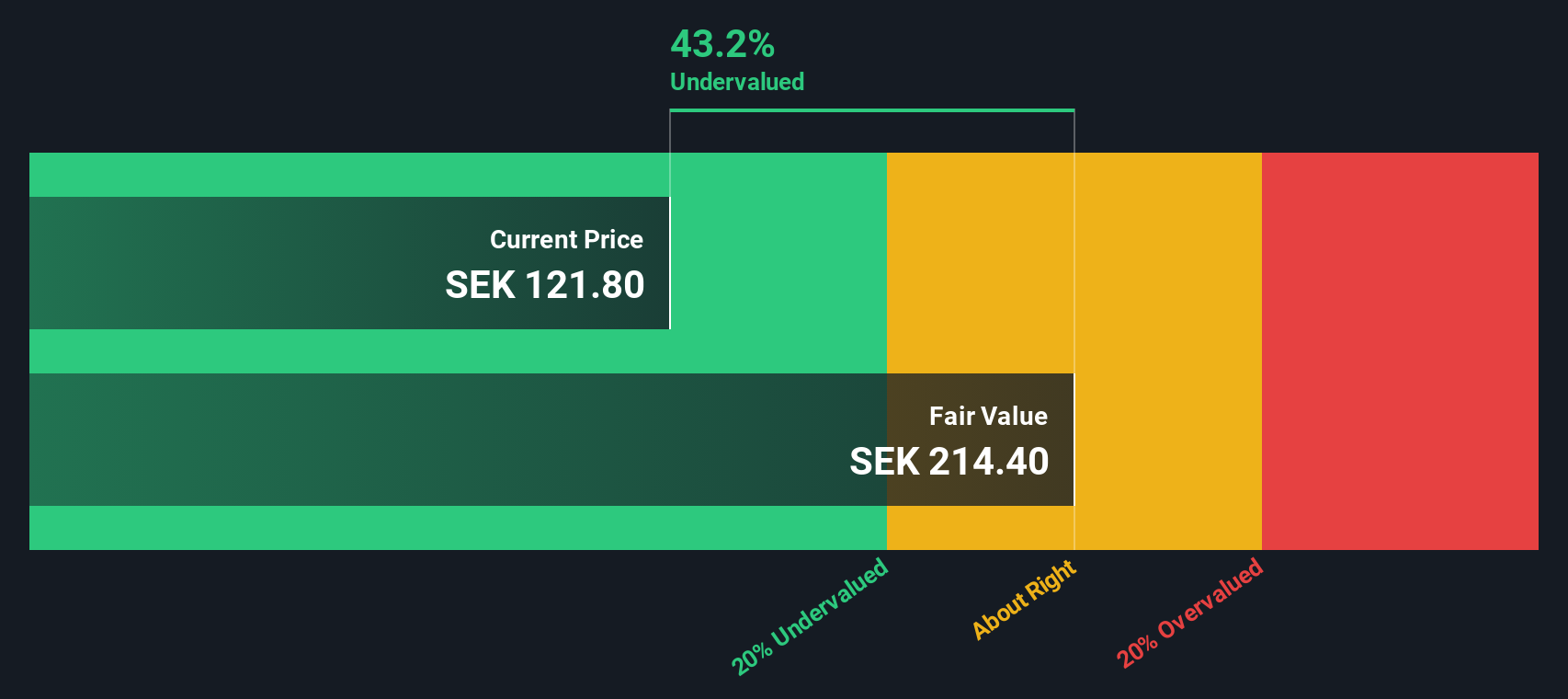

New Wave Group (OM:NEWA B)

Simply Wall St Value Rating: ★★★★★☆

Overview: New Wave Group is a Swedish company that designs, acquires, and develops brands in the corporate, sports & leisure, and gifts & home furnishings sectors with a market cap of SEK 6.85 billion.

Operations: The company generates revenue primarily from its Corporate, Sports & Leisure, and Gifts & Home Furnishings segments. Over recent periods, the gross profit margin has shown an upward trend, reaching 50.14% by March 2025. Operating expenses are a significant part of the cost structure, with General & Administrative expenses being a major component.

PE: 17.1x

New Wave Group, a European company with a small market presence, recently reported second-quarter sales of SEK 2.3 billion and net income of SEK 167 million, both slightly down from the previous year. Despite this dip, the forecast suggests earnings growth at an annual rate of 20.65%. Insiders have shown confidence by purchasing shares over the past quarter. The company's reliance on external borrowing for funding adds risk but also potential for future growth as it navigates its financial strategy effectively.

- Click here and access our complete valuation analysis report to understand the dynamics of New Wave Group.

Explore historical data to track New Wave Group's performance over time in our Past section.

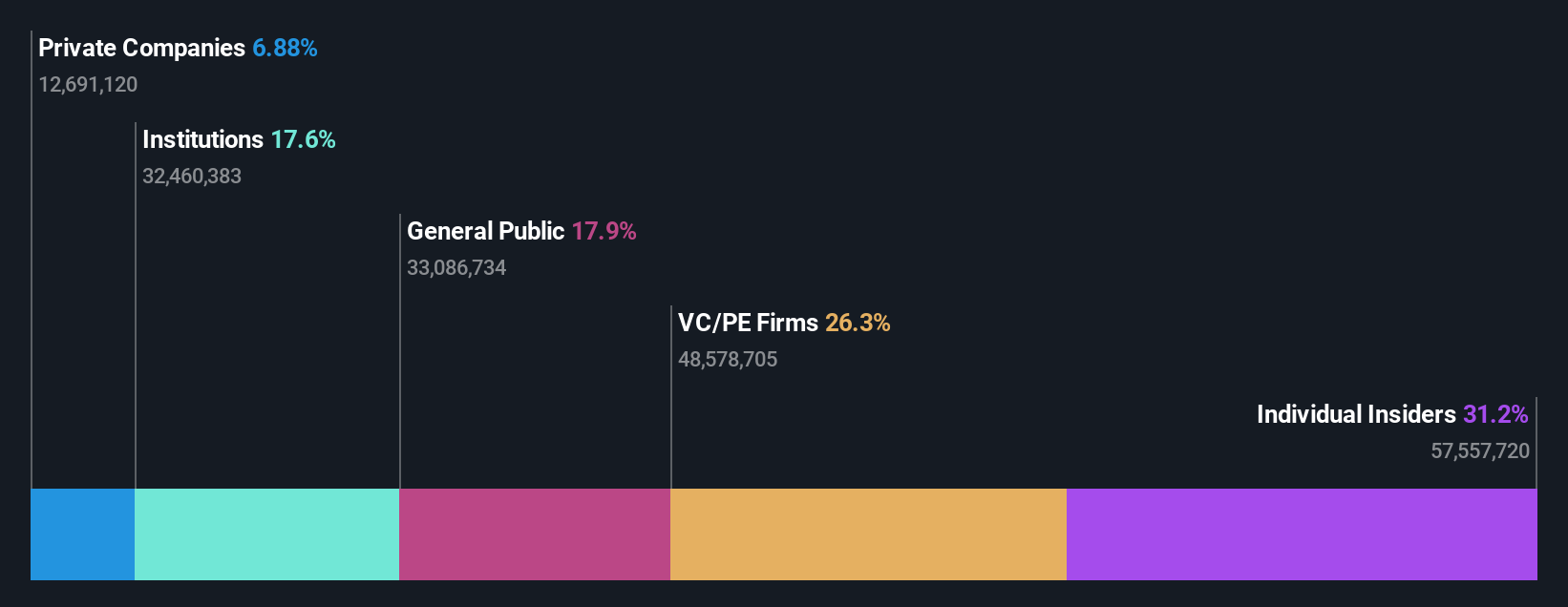

Fastighets AB Trianon (OM:TRIAN B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fastighets AB Trianon is a real estate company focusing on residential and community/commercial properties, with a market cap of SEK 1.54 billion.

Operations: Fastighets AB Trianon's revenue primarily comes from its Residential segment at SEK 575.60 million and Community/Commercial segment at SEK 217.40 million. The company's gross profit margin has shown variability, reaching up to 67.69% in recent periods. Operating expenses have consistently been a significant cost factor, with general and administrative expenses being notable within this category.

PE: 13.6x

Fastighets AB Trianon, a European property firm, shows potential in the small cap space with its recent financial performance. For Q2 2025, sales reached SEK 190.4 million and net income increased to SEK 35.1 million from SEK 24.7 million last year, indicating growth despite reliance on external borrowing for funding. Insider confidence is evident as they have been purchasing shares consistently this year, reflecting optimism about future prospects despite some risk factors associated with their funding strategy.

- Take a closer look at Fastighets AB Trianon's potential here in our valuation report.

Understand Fastighets AB Trianon's track record by examining our Past report.

Where To Now?

- Get an in-depth perspective on all 47 Undervalued European Small Caps With Insider Buying by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Wave Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NEWA B

New Wave Group

Designs, acquires, and develops brands and products in the corporate, sports, gifts, and home furnishings sectors in Sweden, the United States, Central Europe, rest of Nordiac countries, Southern Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives