- Sweden

- /

- Real Estate

- /

- OM:SLP B

Swedish Logistic Property AB (STO:SLP B) Released Earnings Last Week And Analysts Lifted Their Price Target To kr39.67

Investors in Swedish Logistic Property AB (STO:SLP B) had a good week, as its shares rose 7.2% to close at kr38.70 following the release of its quarterly results. Results look mixed - while revenue fell marginally short of analyst estimates at kr169m, statutory earnings were in line with expectations, at kr1.55 per share. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Swedish Logistic Property after the latest results.

Check out our latest analysis for Swedish Logistic Property

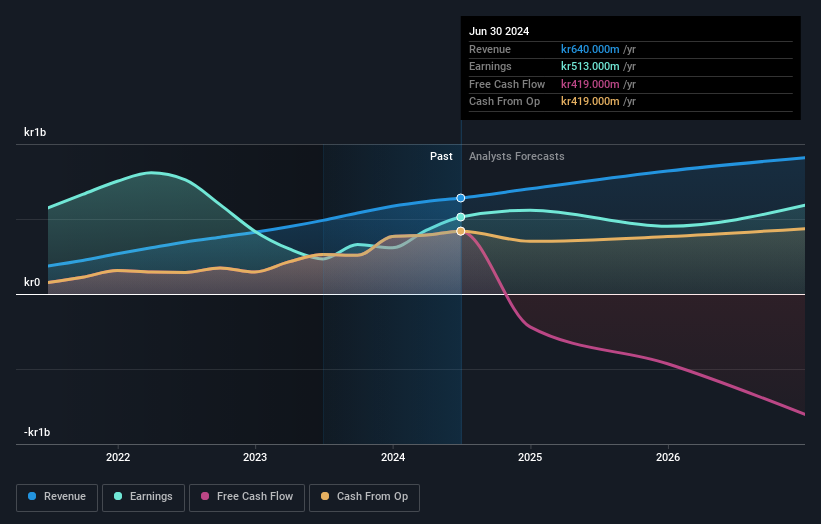

Taking into account the latest results, the most recent consensus for Swedish Logistic Property from twin analysts is for revenues of kr701.5m in 2024. If met, it would imply a solid 9.6% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to increase 9.0% to kr2.47. In the lead-up to this report, the analysts had been modelling revenues of kr701.3m and earnings per share (EPS) of kr2.06 in 2024. There was no real change to the revenue estimates, but the analysts do seem more bullish on earnings, given the solid gain to earnings per share expectations following these results.

The analysts have been lifting their price targets on the back of the earnings upgrade, with the consensus price target rising 5.3% to kr39.67.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that Swedish Logistic Property's revenue growth is expected to slow, with the forecast 20% annualised growth rate until the end of 2024 being well below the historical 37% p.a. growth over the last three years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 4.2% annually. So it's pretty clear that, while Swedish Logistic Property's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Swedish Logistic Property following these results. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Swedish Logistic Property going out as far as 2026, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Swedish Logistic Property (at least 1 which can't be ignored) , and understanding these should be part of your investment process.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SLP B

Swedish Logistic Property

Engages in acquiring, developing, and managing properties in Sweden.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026