- Sweden

- /

- Real Estate

- /

- OM:SLP B

3 Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As global markets respond to easing inflation and strong earnings reports, particularly in the U.S., investors are witnessing a rebound in major stock indices. Amidst this backdrop, growth companies with high insider ownership can present intriguing opportunities, as insider stakes often signal confidence in a company's future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| CD Projekt (WSE:CDR) | 29.7% | 30.6% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Findi (ASX:FND) | 35.8% | 110.9% |

Let's take a closer look at a couple of our picks from the screened companies.

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ABL Bio Inc., a biotech research company, develops therapeutic drugs for immuno-oncology and neurodegenerative diseases with a market cap of ₩1.54 trillion.

Operations: The company's revenue segment is derived entirely from its biotechnology startups, amounting to ₩32.32 billion.

Insider Ownership: 30.4%

Earnings Growth Forecast: 50.3% p.a.

ABL Bio is poised for substantial growth, with earnings forecasted to rise 50.32% annually and revenue expected to outpace the market at 25.5% per year. Despite a highly volatile share price recently, the company aims for profitability within three years, surpassing average market growth rates. However, its projected Return on Equity remains low at 9.1%. Recent conference presentations highlight ongoing innovation efforts in protein engineering without significant insider trading activity noted recently.

- Click here and access our complete growth analysis report to understand the dynamics of ABL Bio.

- Our comprehensive valuation report raises the possibility that ABL Bio is priced higher than what may be justified by its financials.

Swedish Logistic Property (OM:SLP B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swedish Logistic Property AB is a real estate company focused on acquiring, developing, and managing logistics properties in Sweden with a market cap of SEK10.26 billion.

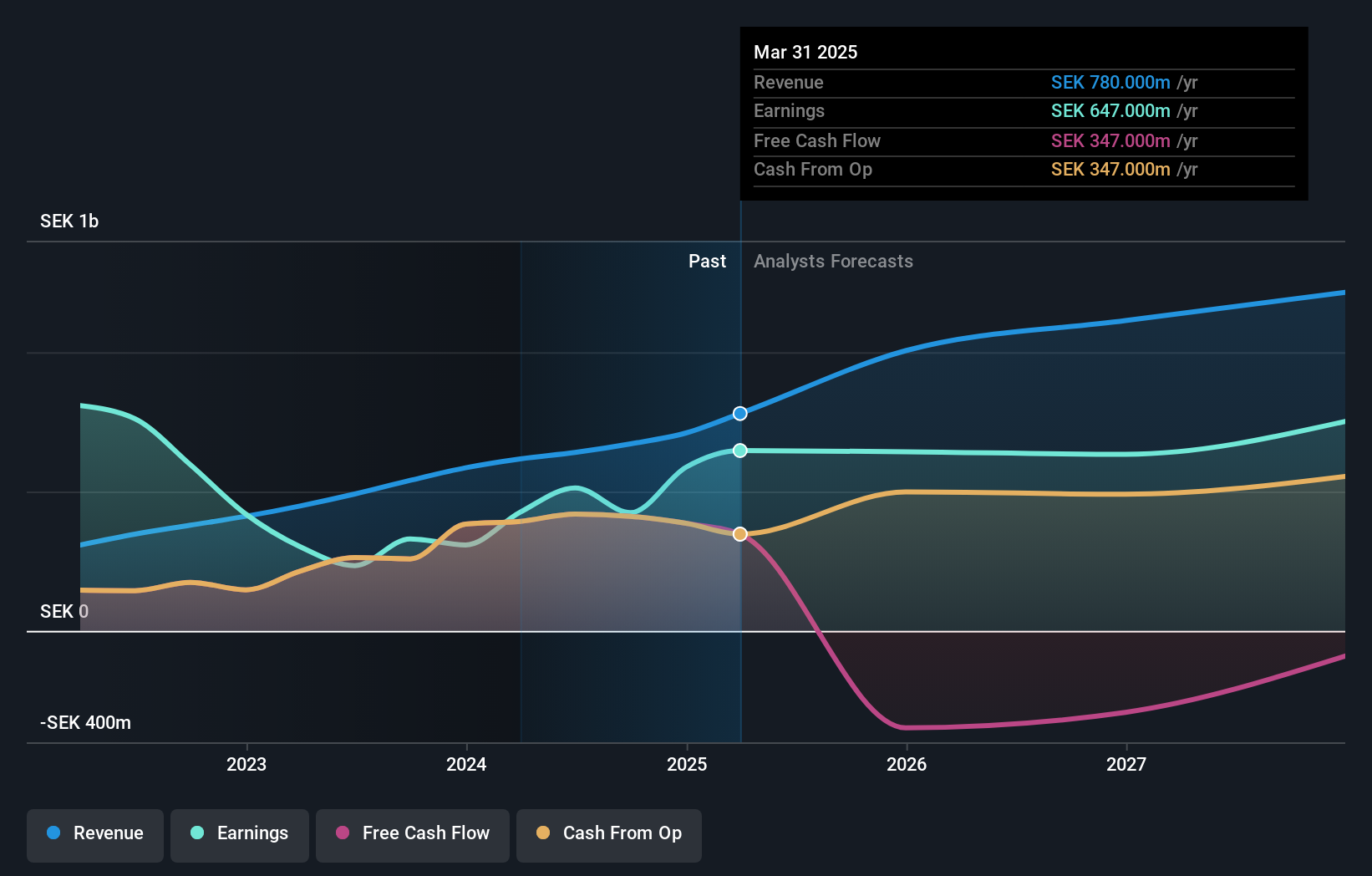

Operations: The company's revenue primarily comes from its investment properties, amounting to SEK671 million.

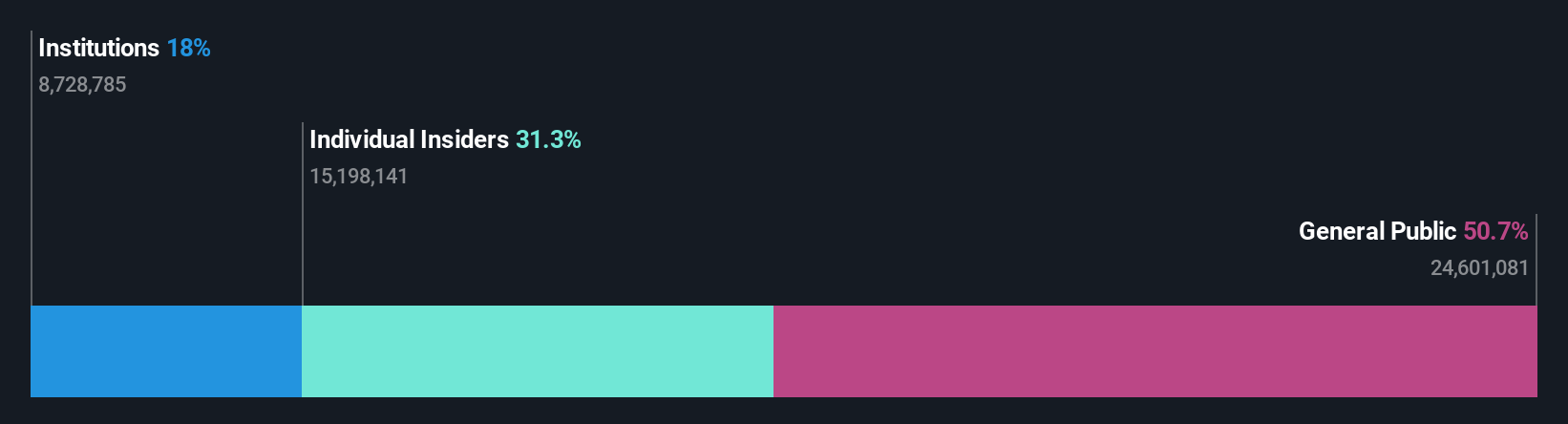

Insider Ownership: 11.3%

Earnings Growth Forecast: 21.2% p.a.

Swedish Logistic Property is experiencing significant expansion, acquiring multiple logistics properties with a total value exceeding SEK 2 billion. These acquisitions are strategically located and include long-term leases with major tenants like PostNord and Mitsubishi. Despite forecasted earnings growth of 21.2% annually, the company's interest coverage remains a concern. Trading at a favorable price-to-earnings ratio of 24.2x compared to industry peers, SLP's revenue growth outpaces the Swedish market but remains under 20%.

- Navigate through the intricacies of Swedish Logistic Property with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Swedish Logistic Property is trading behind its estimated value.

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★☆

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on discovering, developing, and commercializing biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of HK$12.65 billion.

Operations: The company's revenue from biopharmaceutical research, service, production, and sales amounts to CN¥1.52 billion.

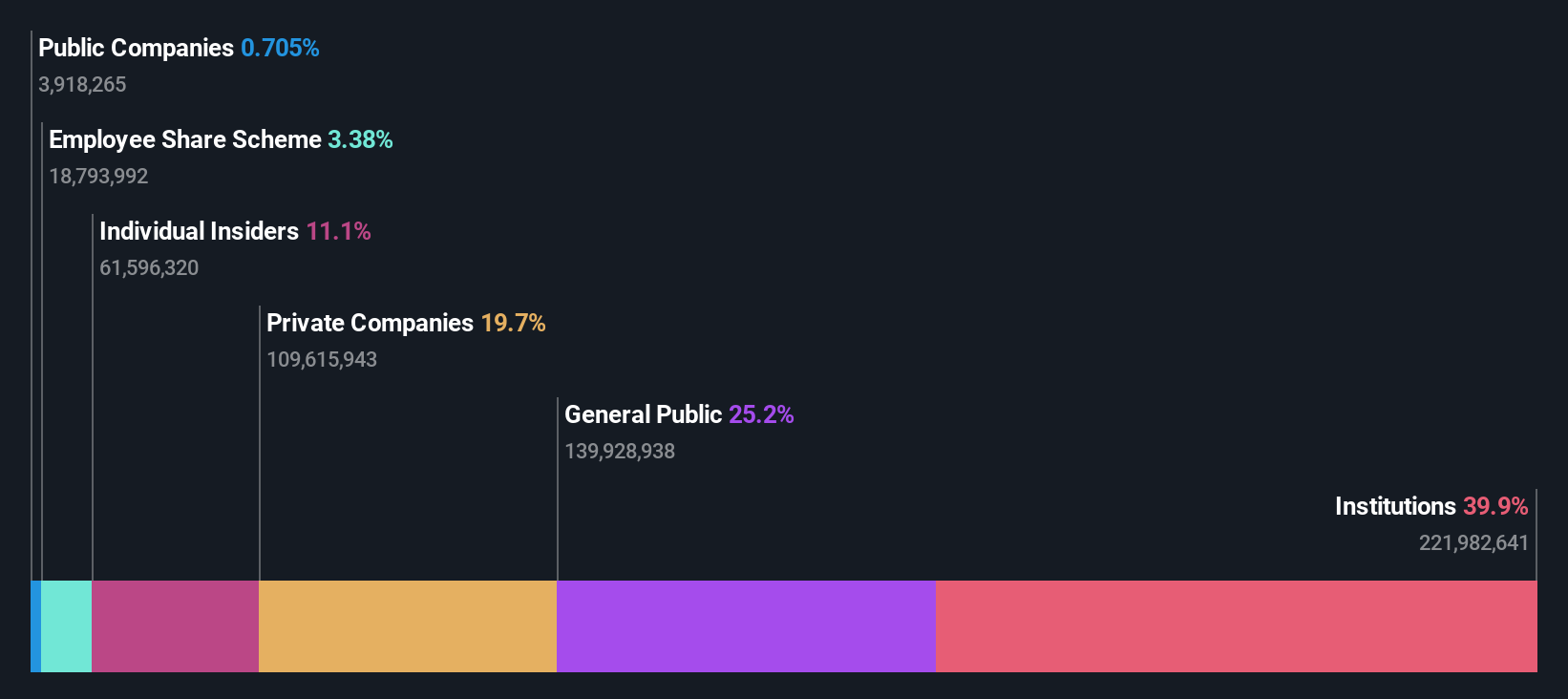

Insider Ownership: 11.4%

Earnings Growth Forecast: 51.2% p.a.

RemeGen Co., Ltd. is experiencing robust revenue growth, with a 58% year-on-year increase projected for 2024, reaching RMB 1.72 billion. Despite this, the company remains unprofitable but has reduced its net loss by approximately 3%. Recent board changes include appointing Mr. Huang Guobin as an independent non-executive director, potentially influencing strategic decisions. RemeGen's innovative HER2-targeting ADC therapy shows significant promise in treating advanced breast cancer, supporting its growth trajectory amidst forecasted annual revenue growth of over 23%.

- Unlock comprehensive insights into our analysis of RemeGen stock in this growth report.

- The analysis detailed in our RemeGen valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Unlock our comprehensive list of 1467 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SLP B

Swedish Logistic Property

Engages in acquiring, developing, and managing properties in Sweden.

Fair value low.

Market Insights

Community Narratives