As European markets navigate mixed signals from global economic developments, such as the dovish stance of the U.S. Federal Reserve and ongoing trade tensions, investors are closely monitoring growth stocks with strong insider ownership for potential opportunities. In this context, companies that exhibit robust growth prospects coupled with significant insider investment can offer a compelling alignment of interests between management and shareholders, potentially enhancing investor confidence in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 13% | 112.0% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| KebNi (OM:KEBNI B) | 36.3% | 74% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 97.9% |

| Egetis Therapeutics (OM:EGTX) | 10.4% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.1% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 41.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.3% |

Let's review some notable picks from our screened stocks.

Sanoma Oyj (HLSE:SANOMA)

Simply Wall St Growth Rating: ★★★★☆☆

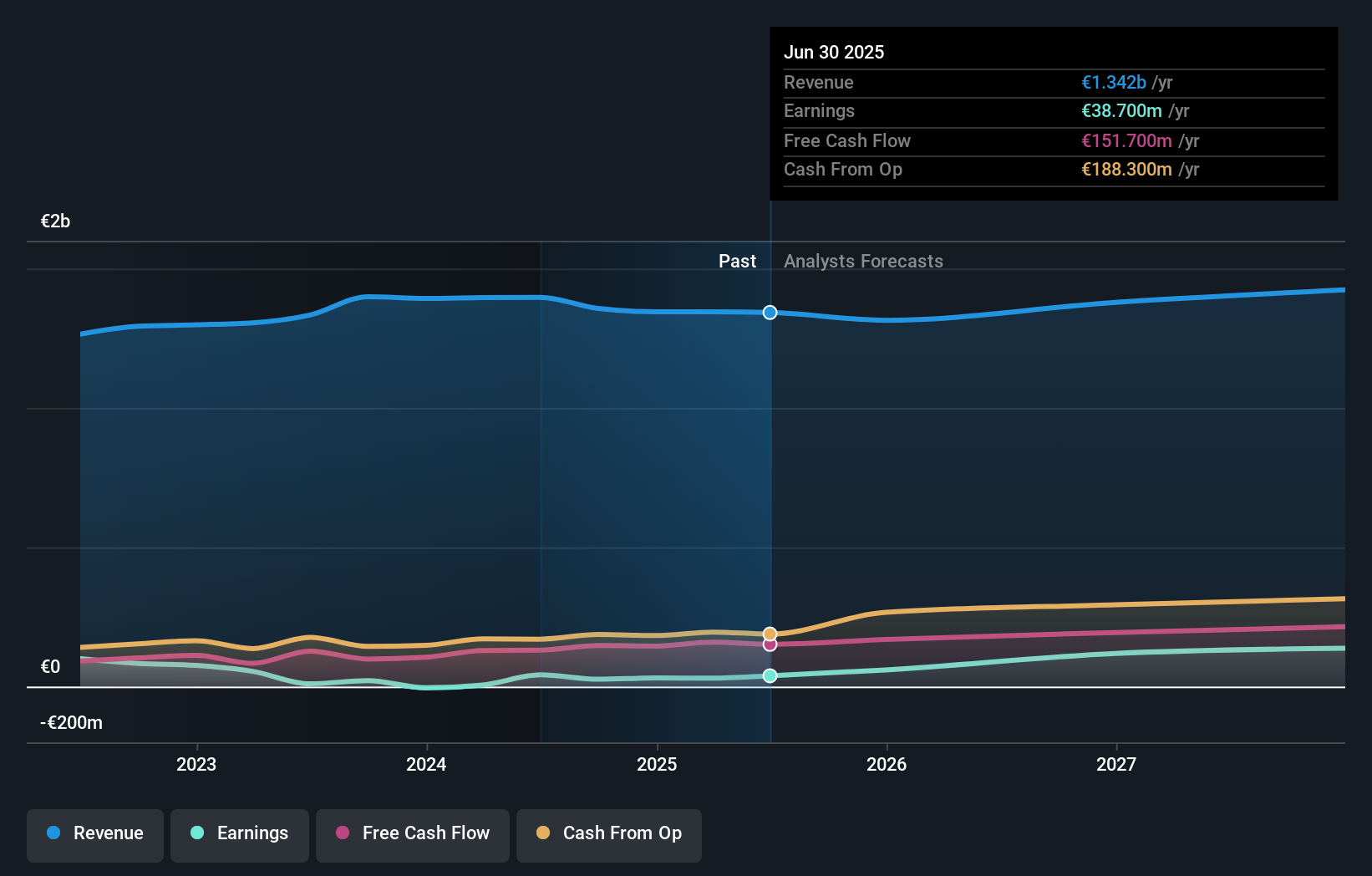

Overview: Sanoma Oyj is a media and learning company with operations in Finland, the Netherlands, Poland, Spain, Belgium, and other international markets; it has a market cap of €1.78 billion.

Operations: The company's revenue is primarily derived from its Learning segment, which generated €773.10 million, and its Media Finland segment, which contributed €569.50 million.

Insider Ownership: 16.8%

Earnings Growth Forecast: 46.7% p.a.

Sanoma Oyj's earnings are forecast to grow significantly at 46.7% annually, outpacing the Finnish market, despite slower revenue growth at 2.5%. The company trades below its estimated fair value but faces challenges with a high debt level and a dividend yield of 3.57% that is not well covered by earnings. Recent financial results show improved net income and earnings per share compared to the previous year, reflecting strong profit growth potential amidst modest sales performance.

- Click to explore a detailed breakdown of our findings in Sanoma Oyj's earnings growth report.

- In light of our recent valuation report, it seems possible that Sanoma Oyj is trading beyond its estimated value.

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★☆☆

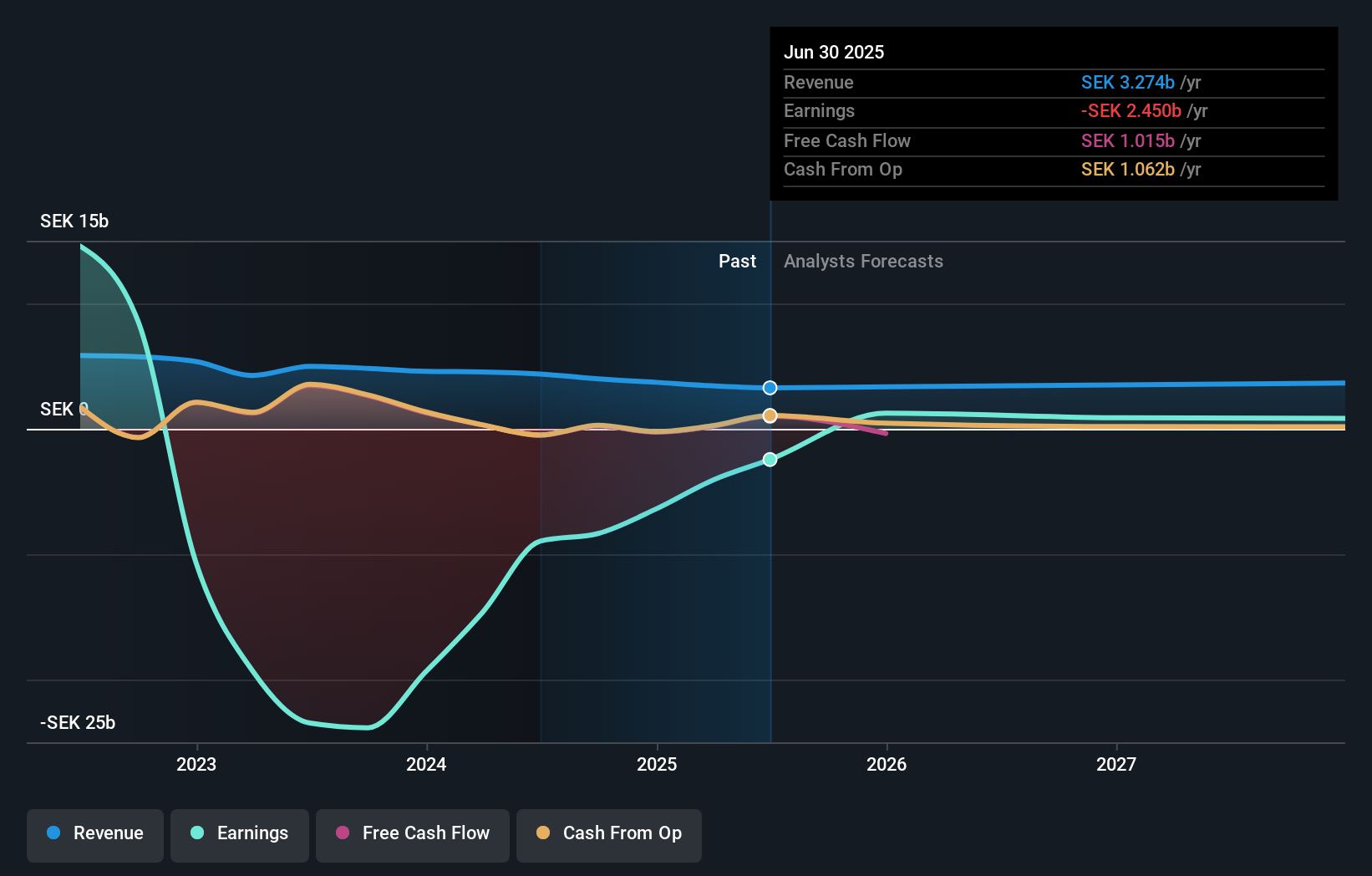

Overview: Hanza AB (publ) offers manufacturing solutions and has a market capitalization of SEK 5.82 billion.

Operations: The company's revenue is derived from Main Markets (SEK 3.11 billion), Other Markets (SEK 2.16 billion), and Business Development and Services (SEK 32 million).

Insider Ownership: 33.4%

Earnings Growth Forecast: 40.8% p.a.

HANZA shows strong growth potential with earnings expected to rise significantly at 40.8% annually, surpassing Swedish market averages. Despite high share price volatility and substantial insider selling recently, the company trades at a notable discount to its estimated fair value. Recent strategic moves include acquiring Milectria to bolster defense sector capabilities and securing an initial SEK 40 million order through its LYNX program, positioning HANZA for expanded manufacturing capacity in high-demand industries.

- Delve into the full analysis future growth report here for a deeper understanding of Hanza.

- Our valuation report here indicates Hanza may be undervalued.

Samhällsbyggnadsbolaget i Norden (OM:SBB B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Samhällsbyggnadsbolaget i Norden AB (publ) owns, develops, and manages residential and social infrastructure properties in Sweden, Norway, Finland, and Denmark with a market cap of approximately SEK10.39 billion.

Operations: The company's revenue segments consist of SEK1.71 billion from community properties, SEK13 million from education properties, and SEK1.56 billion from residential properties.

Insider Ownership: 21.8%

Earnings Growth Forecast: 69.3% p.a.

Samhällsbyggnadsbolaget i Norden shows potential in the growth sector, with earnings projected to increase by 69.28% annually. Despite a decline in sales to SEK 1.68 billion for H1 2025, the net income improved significantly from a SEK 3.20 billion loss last year to SEK 861 million profit. However, revenue growth is modest at an estimated annual rate of 4.4%, and future return on equity remains low at an anticipated 8.9%.

- Take a closer look at Samhällsbyggnadsbolaget i Norden's potential here in our earnings growth report.

- According our valuation report, there's an indication that Samhällsbyggnadsbolaget i Norden's share price might be on the cheaper side.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 191 Fast Growing European Companies With High Insider Ownership now.

- Looking For Alternative Opportunities? Uncover 11 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hanza might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HANZA

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives