Swedish Exchange Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets react to new stimulus measures from China, the Swedish market has seen a mix of cautious optimism and strategic positioning. Amid these conditions, growth companies with high insider ownership have attracted attention for their potential resilience and alignment with shareholder interests. In this context, identifying stocks where insiders hold significant stakes can be particularly appealing, as it often signals confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Fortnox (OM:FNOX) | 21.1% | 22.2% |

| Biovica International (OM:BIOVIC B) | 17.6% | 78.5% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Below we spotlight a couple of our favorites from our exclusive screener.

NIBE Industrier (OM:NIBE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB (publ) develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort and intelligent heating and control components across the Nordic countries, Europe, North America, and internationally, with a market cap of SEK109.15 billion.

Operations: The company's revenue segments are composed of SEK5.33 billion from Stoves, SEK13.48 billion from Element, and SEK35.22 billion from Climate Solutions.

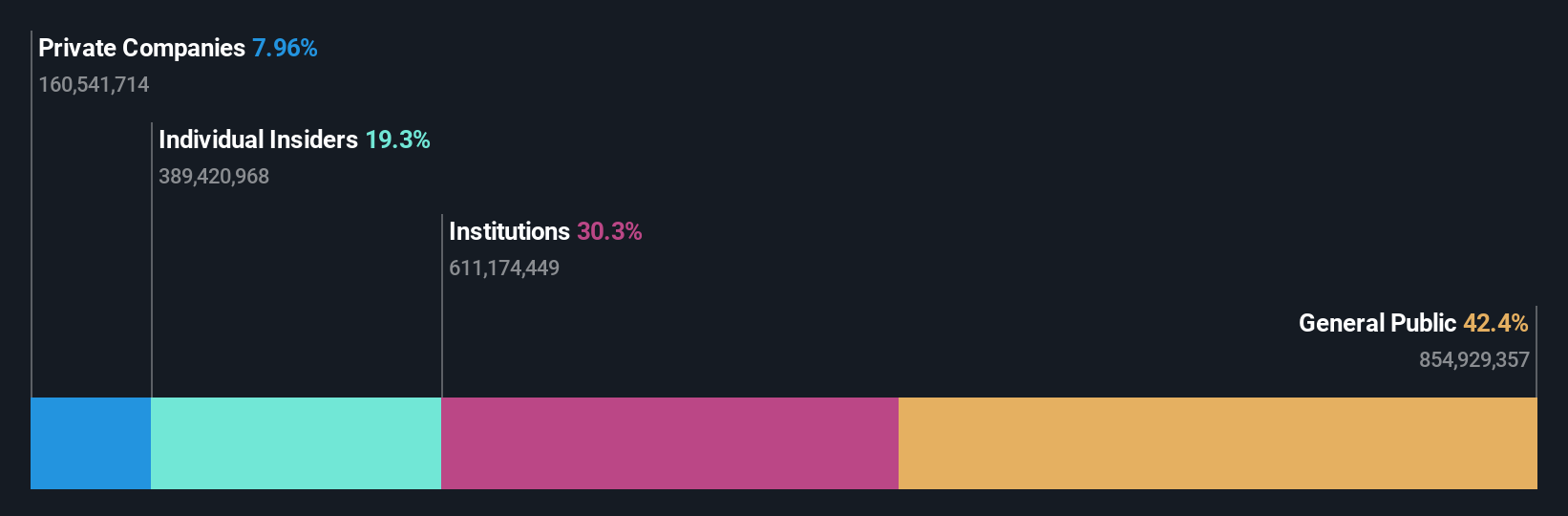

Insider Ownership: 20.2%

NIBE Industrier, a Swedish growth company with high insider ownership, faces mixed financial prospects. Recent earnings reports show a decline in sales and net income compared to the previous year, with Q2 2024 sales at SEK 10.04 billion and net income at SEK 219 million. Despite this, NIBE's earnings are forecast to grow significantly at 42.5% per year over the next three years, outpacing both its revenue growth of 6.8% annually and the broader Swedish market's profit growth expectations.

- Delve into the full analysis future growth report here for a deeper understanding of NIBE Industrier.

- Insights from our recent valuation report point to the potential overvaluation of NIBE Industrier shares in the market.

Nolato (OM:NOLA B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nolato AB (publ) develops, manufactures, and sells plastic, silicone, and thermoplastic elastomer products for various sectors including medical technology, pharmaceutical, consumer electronics, telecom, automotive, hygiene, and other industrial markets globally; it has a market cap of SEK14.10 billion.

Operations: Revenue Segments (in millions of SEK): Medical Solutions: 5340, Segment Adjustment: 4147, Group Adjustments, Parent Company: -14 The company's revenue segments include SEK5.34 billion from Medical Solutions and SEK4.15 billion from Segment Adjustments.

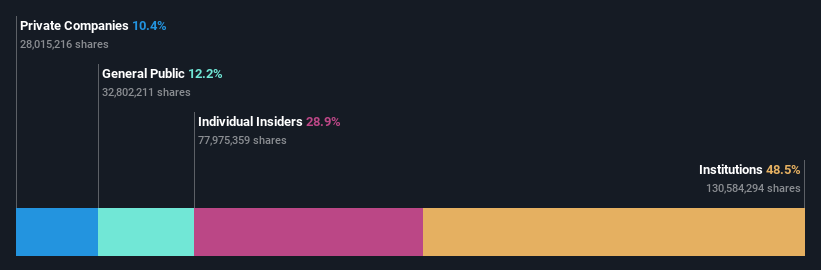

Insider Ownership: 28.9%

Nolato, a Swedish growth company with high insider ownership, is trading 47% below its estimated fair value and has seen more insider buying than selling recently. Despite an unstable dividend track record and a forecasted low Return on Equity (14.6%) in three years, Nolato's revenue is expected to grow at 5.9% annually, outpacing the Swedish market. Recent earnings reports show improved net income of SEK 169 million for Q2 2024 compared to SEK 155 million a year ago.

- Navigate through the intricacies of Nolato with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Nolato shares in the market.

Pandox (OM:PNDX B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB (publ) is a hotel property company that owns, develops, and leases hotel properties globally, with a market cap of SEK40.67 billion.

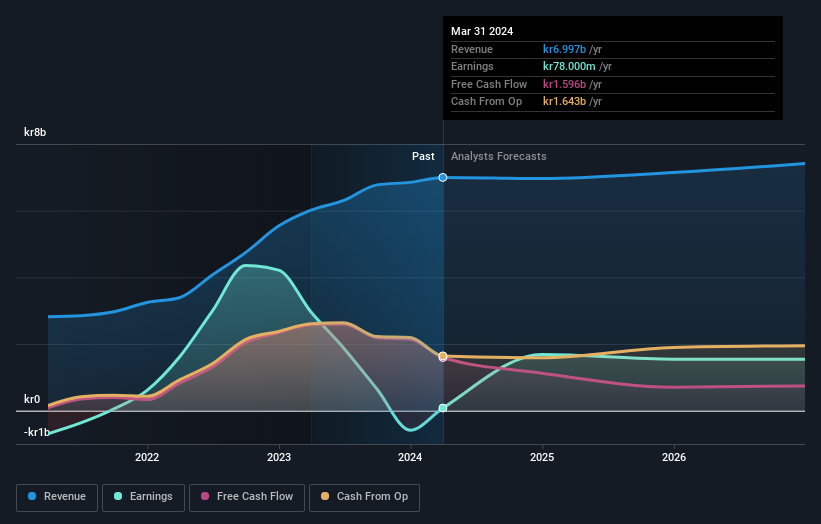

Operations: Pandox AB (publ) generates revenue through its own hotel operations, amounting to SEK3.27 billion, and rental agreements, totaling SEK3.82 billion.

Insider Ownership: 10.3%

Pandox, a Swedish growth company with high insider ownership, recently completed a SEK 2 billion follow-on equity offering and acquired DoubleTree by Hilton Edinburgh City Centre for MGBP 49. The acquisition is expected to generate an initial yield of over 7.5%, with potential increases through operational improvements. Despite recent shareholder dilution, Pandox's earnings are forecasted to grow at 27% annually, significantly outpacing the Swedish market average of 15.1%.

- Click here to discover the nuances of Pandox with our detailed analytical future growth report.

- Our expertly prepared valuation report Pandox implies its share price may be too high.

Make It Happen

- Embark on your investment journey to our 91 Fast Growing Swedish Companies With High Insider Ownership selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if NIBE Industrier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NIBE B

NIBE Industrier

Develops, manufactures, markets, and sells various energy-efficient solutions for indoor climate comfort, and components and solutions for intelligent heating and control in Nordic countries, rest of Europe, North America, and internationally.

Reasonable growth potential with questionable track record.