3 European Undervalued Small Caps With Recent Insider Buying

Reviewed by Simply Wall St

As European markets continue to rally, with the STOXX Europe 600 Index reaching record levels and major indices like Germany’s DAX and France’s CAC 40 showing significant gains, the sentiment is buoyed by expectations of lower U.S. borrowing costs. Amid this optimistic backdrop, small-cap stocks in Europe present intriguing opportunities for investors seeking value, especially when recent insider buying suggests confidence in their potential. Identifying a good stock in this environment often involves looking at companies that not only show strong fundamentals but also have insiders who are willing to invest their own capital, indicating a positive outlook on future performance.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 11.9x | 1.5x | 31.62% | ★★★★★★ |

| BEWI | NA | 0.5x | 38.17% | ★★★★★☆ |

| Basic-Fit | NA | 1.2x | 35.64% | ★★★★★☆ |

| Bytes Technology Group | 17.4x | 4.4x | 11.88% | ★★★★☆☆ |

| Social Housing REIT | NA | 6.9x | 35.44% | ★★★★☆☆ |

| Fastighets AB Trianon | 13.3x | 4.3x | -201.06% | ★★★★☆☆ |

| Pexip Holding | 35.5x | 5.2x | 41.68% | ★★★☆☆☆ |

| Nyab | 21.4x | 0.9x | 37.39% | ★★★☆☆☆ |

| Renold | 10.7x | 0.7x | -0.00% | ★★★☆☆☆ |

| FastPartner | 16.6x | 4.3x | -28.93% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

FastPartner (OM:FPAR A)

Simply Wall St Value Rating: ★★★☆☆☆

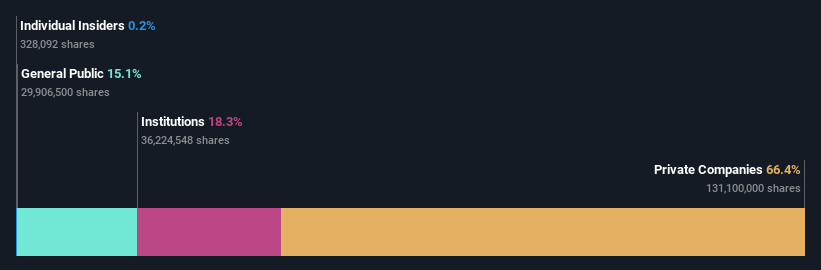

Overview: FastPartner is a Swedish real estate company focused on property management across multiple regions, with a market cap of approximately SEK 12.34 billion.

Operations: FastPartner's revenue primarily comes from property management across three regions, with a total of SEK 2.29 billion as of the latest reporting period. The company has experienced fluctuations in its net income margin, which reached -88.19% in Q3 2023 before improving to 25.69% by Q1 2025. Its gross profit margin showed a general upward trend, peaking at 71.59% in Q4 2020 and remaining above 69% thereafter. Operating expenses have remained relatively stable around SEK 46-47 million in recent periods, indicating controlled cost management despite variations in non-operating expenses impacting net income significantly over time.

PE: 16.6x

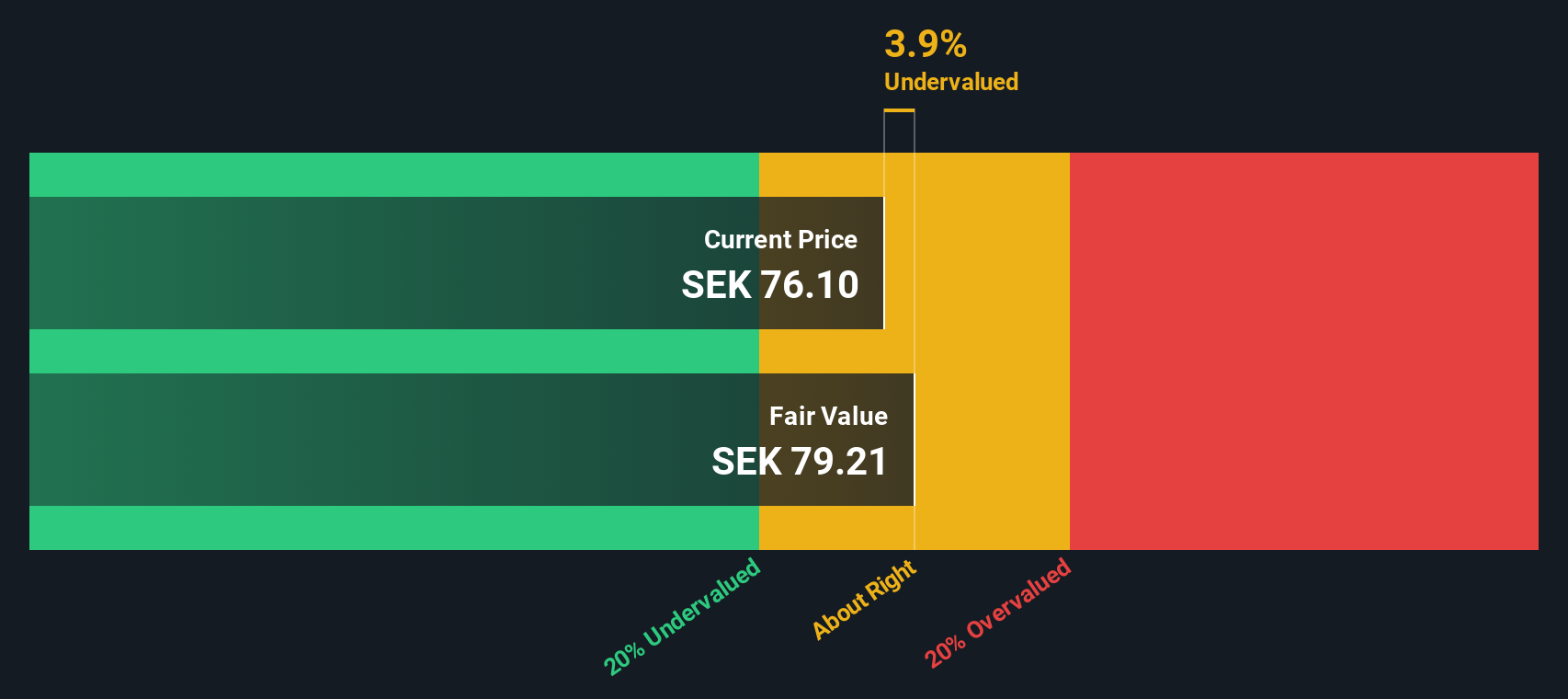

FastPartner, a European small-cap company, has caught attention for its potential as an undervalued investment. Despite relying solely on external borrowing for funding, which poses higher risk without customer deposits, the company's earnings are projected to grow at 22% annually. Insider confidence is evident with share purchases made in the last quarter of 2024. However, interest payments currently exceed earnings coverage. These factors paint a mixed picture but suggest room for growth if financial management improves.

- Click here to discover the nuances of FastPartner with our detailed analytical valuation report.

Review our historical performance report to gain insights into FastPartner's's past performance.

Platzer Fastigheter Holding (OM:PLAZ B)

Simply Wall St Value Rating: ★★★☆☆☆

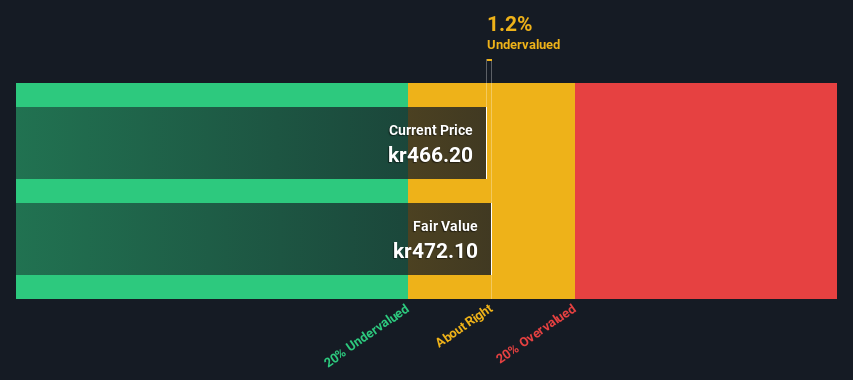

Overview: Platzer Fastigheter Holding is a Swedish real estate company focused on managing and developing office, industrial, and logistics properties with a market capitalization of approximately SEK 8.45 billion.

Operations: Platzer Fastigheter Holding generates revenue primarily from its Offices and Industrial/Logistics segments, with the former contributing significantly to its total income. The company has experienced fluctuations in net income margin, notably reaching a high of 3.29% and later recording negative margins in subsequent periods. Gross profit margin has shown a trend around the mid-70% range, with recent figures indicating an increase to 79.02%.

PE: 21.3x

Platzer Fastigheter Holding, a European property company, is characterized by insider confidence as evidenced by Henrik Schoultz's purchase of 2,500 shares valued at approximately SEK 181,250. This move suggests belief in the company's potential despite its reliance on external borrowing for funding. While earnings growth is projected at an impressive 31% annually, interest payments currently strain earnings coverage. The combination of insider activity and growth forecasts positions Platzer as an intriguing prospect within its industry landscape.

Vitec Software Group (OM:VIT B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vitec Software Group is a company that specializes in developing and delivering software solutions primarily for niche markets, with a market capitalization of approximately SEK 12.34 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to SEK 3.53 billion. Gross profit margin has fluctuated over the years, with a recent figure of 47.25%. Operating expenses have been significant, with General & Administrative Expenses reaching SEK 382.48 million in the latest period.

PE: 35.2x

Vitec Software Group, a European tech-focused company, is actively seeking acquisitions with a solid M&A pipeline as stated by their CEO in July 2025. Despite reporting lower net income of SEK 104.91 million for Q2 2025 compared to the previous year, sales rose to SEK 813.37 million. The company repurchased 107,000 shares for SEK 58.3 million by mid-2025, signaling insider confidence in its potential growth amidst high debt levels and external borrowing reliance. Earnings are projected to grow annually by nearly 19%, suggesting promising future prospects despite current financial challenges.

- Click here and access our complete valuation analysis report to understand the dynamics of Vitec Software Group.

Assess Vitec Software Group's past performance with our detailed historical performance reports.

Make It Happen

- Investigate our full lineup of 50 Undervalued European Small Caps With Insider Buying right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VIT B

Vitec Software Group

Develops and delivers vertical market software solutions in Sweden, Denmark, Finland, Norway, the Netherlands, the United States, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives