- Sweden

- /

- Real Estate

- /

- OM:NP3

Pulling back 6.6% this week, NP3 Fastigheter's STO:NP3) five-year decline in earnings may be coming into investors focus

It hasn't been the best quarter for NP3 Fastigheter AB (publ) (STO:NP3) shareholders, since the share price has fallen 14% in that time. Looking further back, the stock has generated good profits over five years. After all, the share price is up a market-beating 93% in that time.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Check out our latest analysis for NP3 Fastigheter

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

NP3 Fastigheter's earnings per share are down 8.6% per year, despite strong share price performance over five years.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

In contrast revenue growth of 15% per year is probably viewed as evidence that NP3 Fastigheter is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

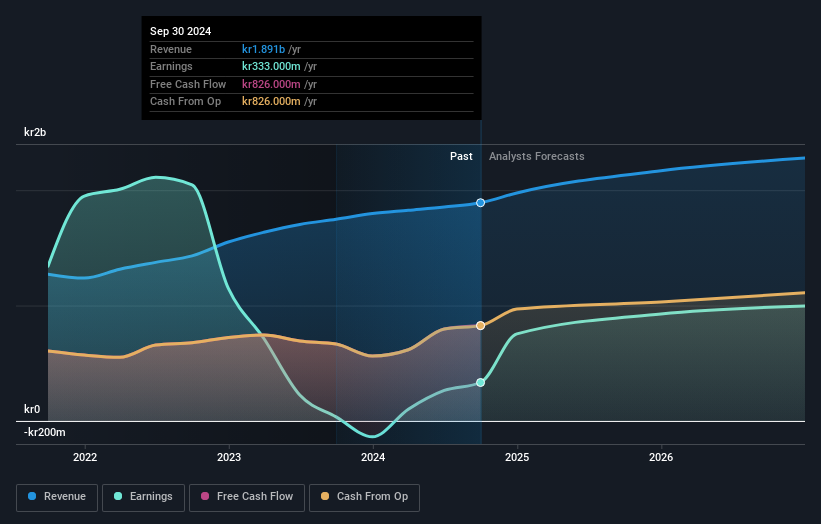

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that NP3 Fastigheter has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for NP3 Fastigheter in this interactive graph of future profit estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, NP3 Fastigheter's TSR for the last 5 years was 118%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

NP3 Fastigheter shareholders are up 8.5% for the year (even including dividends). But that was short of the market average. On the bright side, the longer term returns (running at about 17% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. It's always interesting to track share price performance over the longer term. But to understand NP3 Fastigheter better, we need to consider many other factors. Even so, be aware that NP3 Fastigheter is showing 4 warning signs in our investment analysis , and 1 of those can't be ignored...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if NP3 Fastigheter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NP3

NP3 Fastigheter

A real estate company, engages in commercial investment property business in Sweden.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives