Discover August 2024's Top Undervalued Small Caps With Insider Action

Reviewed by Simply Wall St

As global markets react to a cooling U.S. labor market and mixed economic data, small-cap stocks have faced significant volatility, with the Russell 2000 Index pulling back sharply. Despite this, opportunities remain for discerning investors who can identify undervalued small-cap companies showing signs of insider action. In today's market conditions, a good stock often combines strong fundamentals with strategic insider buying, indicating confidence from those closest to the company.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 20.5x | 0.9x | 44.18% | ★★★★★★ |

| Nexus Industrial REIT | 2.6x | 3.2x | 26.24% | ★★★★★☆ |

| PCB Bancorp | 10.4x | 2.6x | 46.09% | ★★★★★☆ |

| Primaris Real Estate Investment Trust | 10.7x | 2.9x | 46.84% | ★★★★★☆ |

| AtriCure | NA | 2.3x | 49.13% | ★★★★★☆ |

| Hemisphere Energy | 6.7x | 2.4x | 15.73% | ★★★★☆☆ |

| Russel Metals | 11.0x | 0.5x | 47.56% | ★★★★☆☆ |

| Guardian Capital Group | 10.4x | 4.0x | 38.78% | ★★★★☆☆ |

| CVS Group | 22.5x | 1.2x | 40.83% | ★★★★☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

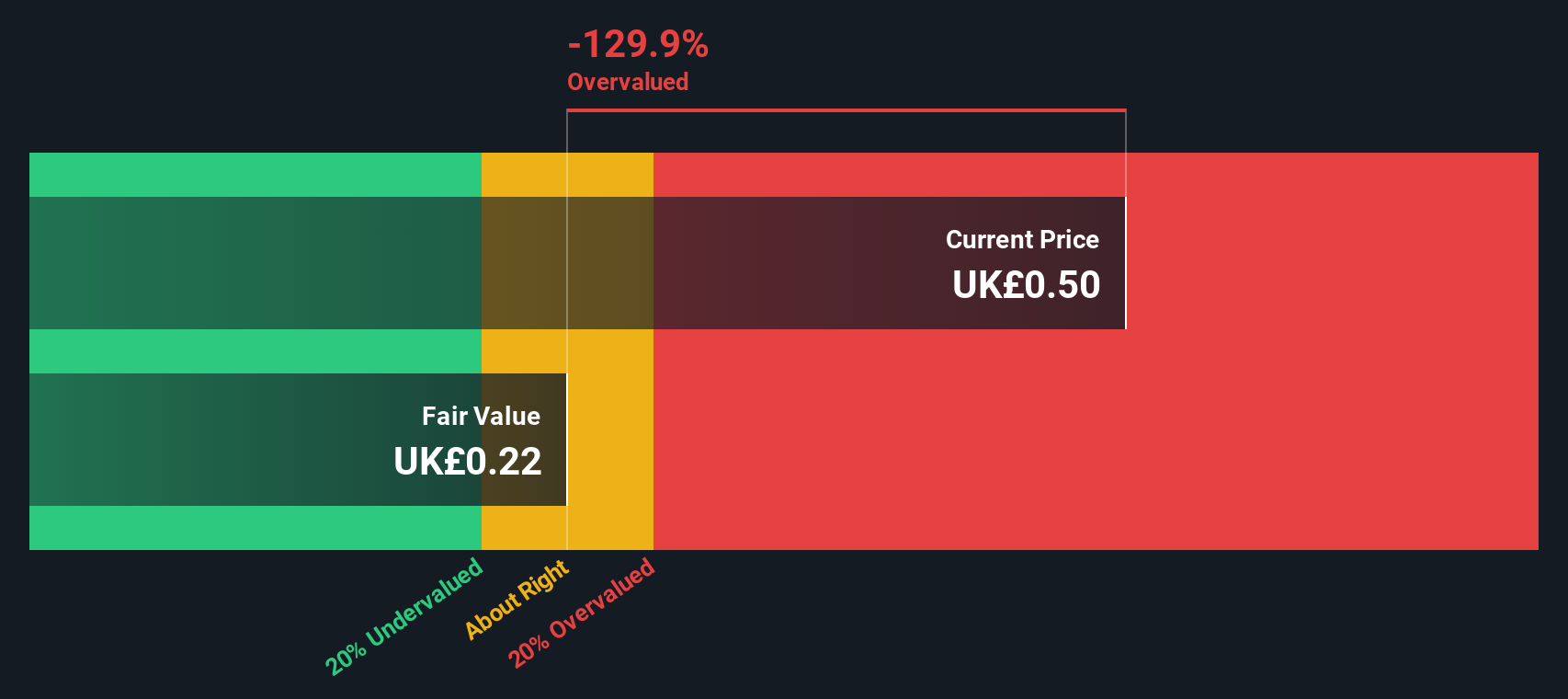

Assura (LSE:AGR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Assura is a UK-based real estate investment trust specializing in the development and management of primary care medical centers, with a market cap of approximately £2.08 billion.

Operations: Assura's primary revenue stream is from its core operations, generating £157.8 million in the latest period. The company has experienced fluctuations in net income margins, with recent periods showing negative margins such as -0.18% and -1.10%. Gross profit margin has shown a slight downward trend, reaching 90.81% in the most recent period.

PE: -43.7x

Assura, a specialist healthcare property investor, recently announced a GBP 250 million joint venture with Universities Superannuation Scheme Limited to support NHS infrastructure. Despite reporting a net loss of GBP 28.8 million for the year ending March 2024, earnings are forecast to grow by 40.91% annually. Notably, insiders have shown confidence through recent share purchases in the last quarter of 2023 and early 2024. The company’s strategic acquisitions and partnerships highlight its potential for future growth in the healthcare sector.

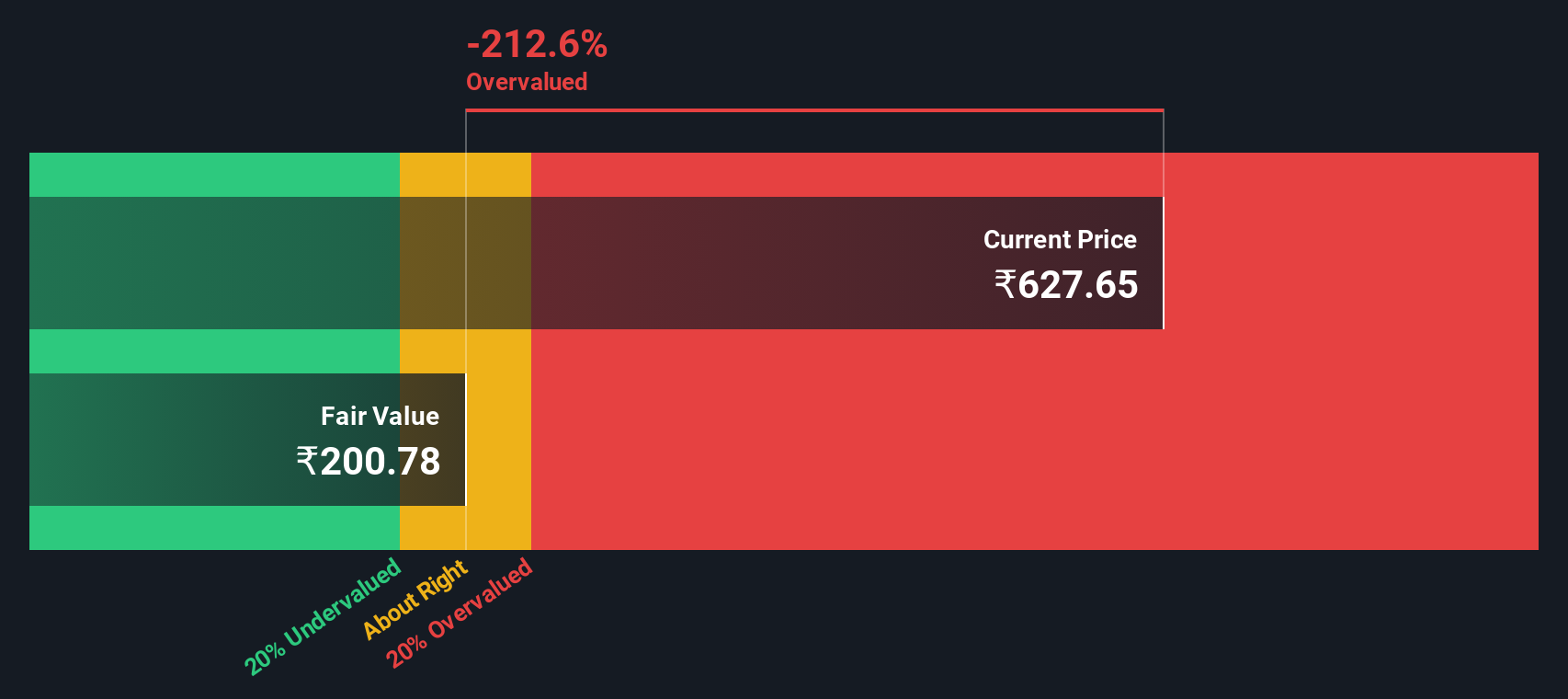

GHCL (NSEI:GHCL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: GHCL is a diversified company primarily engaged in the production of inorganic chemicals, with a market cap of ₹3.27 billion.

Operations: The company generates revenue primarily from inorganic chemicals, with a recent gross profit margin of 41.93%. Over the past periods, net income margins have shown variability, peaking at 27.65% and most recently recorded at 15.90%.

PE: 11.3x

GHCL, a small cap stock, recently reported Q1 2024 earnings showing a decline in sales to ₹8.3 billion from ₹10.2 billion the previous year, with net income dropping to ₹1.5 billion from ₹4.3 billion. Despite this, insider confidence is evident as Anurag Dalmia purchased 5,000 shares worth approximately ₹2.55 million on NSEI recently. Profit margins have decreased from 27.7% last year to 15.9%, but revenue is forecasted to grow by 14.48% annually.

- Dive into the specifics of GHCL here with our thorough valuation report.

Evaluate GHCL's historical performance by accessing our past performance report.

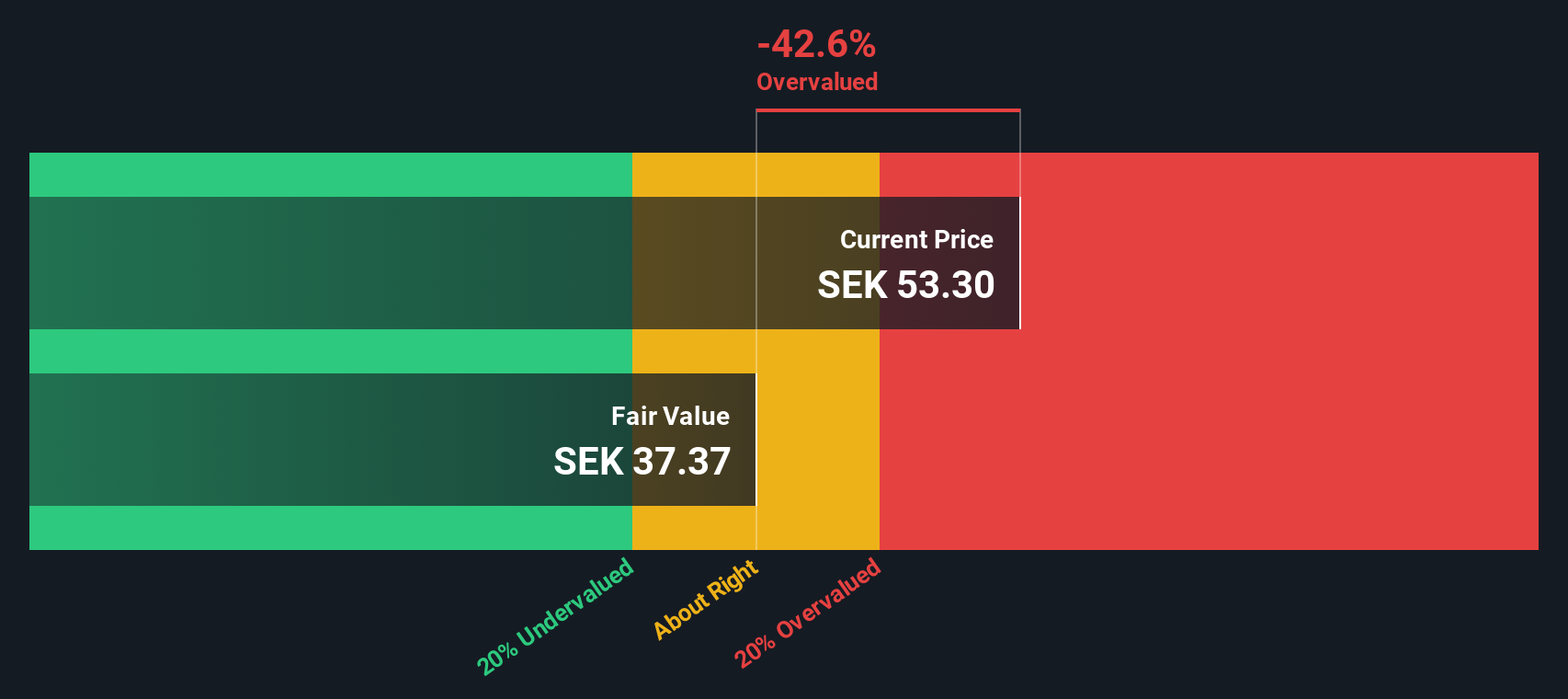

FastPartner (OM:FPAR A)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: FastPartner is a real estate company focused on property management across three regions, with a market cap of approximately SEK 10.71 billion.

Operations: FastPartner generates revenue primarily from property management across three regions, with notable gross profit margins such as 71.86% in Q3 2023. The company's cost of goods sold (COGS) for the same period was SEK 614.9 million, and it reported a net income margin of -89.19%.

PE: -9.9x

FastPartner, a small cap stock, shows promising growth potential with earnings projected to grow 85.73% annually. Despite relying entirely on external borrowing for funding, which carries higher risk, the company demonstrates insider confidence with notable share purchases by executives over the past six months. Although interest payments are not well covered by earnings currently, these insider activities indicate faith in its future prospects and potential for value appreciation in the market.

- Take a closer look at FastPartner's potential here in our valuation report.

Gain insights into FastPartner's past trends and performance with our Past report.

Next Steps

- Unlock more gems! Our Undervalued Small Caps With Insider Buying screener has unearthed 210 more companies for you to explore.Click here to unveil our expertly curated list of 213 Undervalued Small Caps With Insider Buying.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GHCL

GHCL

Manufactures and sells inorganic chemicals in India and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives