- Sweden

- /

- Real Estate

- /

- OM:FABG

Fabege (OM:FABG): Large One-Off SEK1.1B Loss Highlights Ongoing Concerns Over Earnings Quality

Reviewed by Simply Wall St

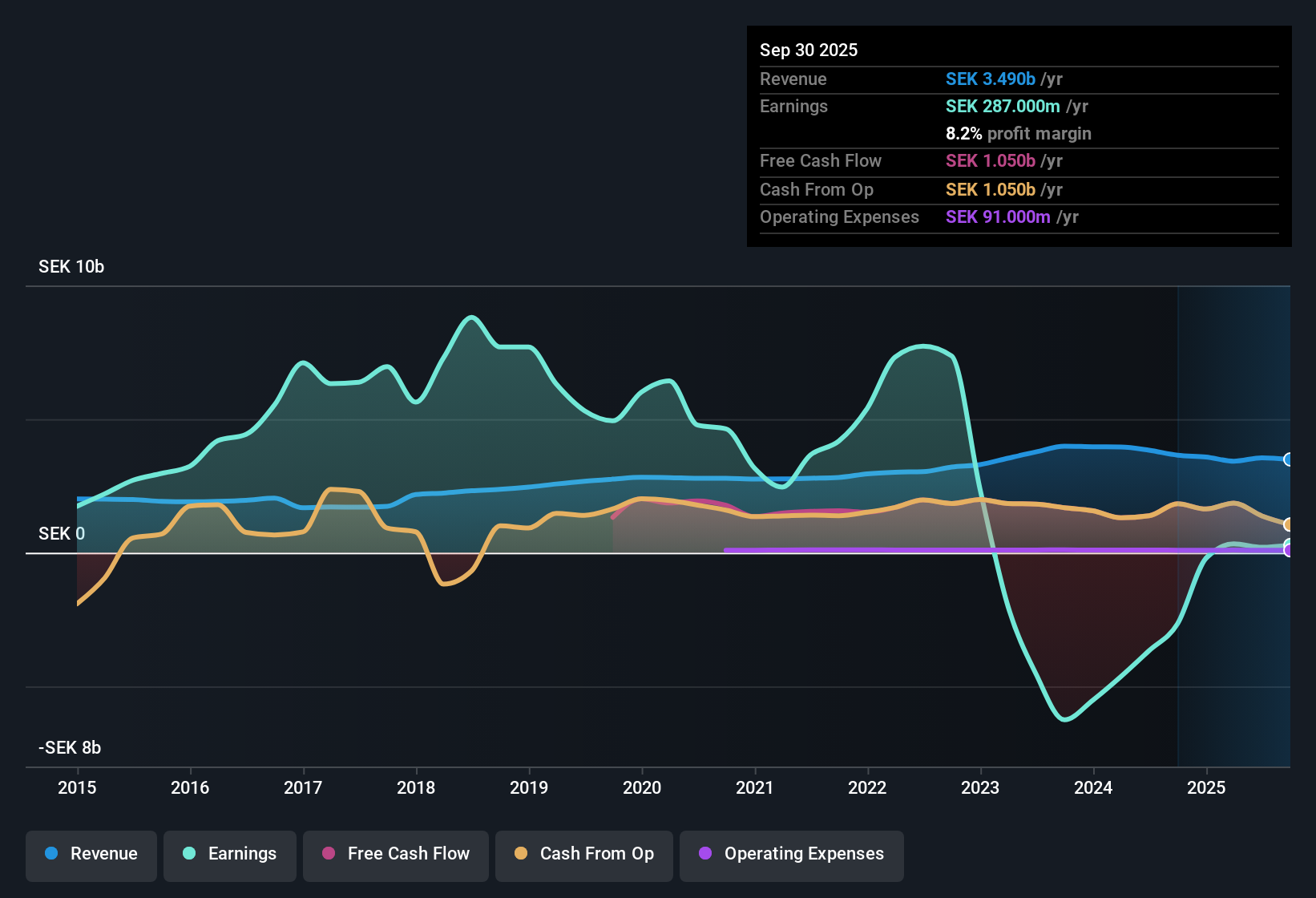

Fabege (OM:FABG) has returned to profitability in the past year following a challenging period marked by persistent losses, but the turnaround is nuanced. Over the last five years, earnings have slipped by 44.7% per year, with a significant one-off loss of SEK1.1 billion weighing on the most recent twelve months through September 30, 2025. While revenue is expected to grow by 2.9% per year, lagging the broader Swedish market, earnings are forecast to climb at a robust 75.6% annual rate, outpacing the market's 12.5% growth. Margins have shifted back into the black, but comparing to previous performance is complicated given the scale of recent events.

See our full analysis for Fabege.Next up, we’ll see how the numbers hold up against the main narratives driving investor debates. Some long-standing views may be confirmed, while others could be due for a rethink.

See what the community is saying about Fabege

DCF Fair Value Far Below Market Price

- With shares trading at SEK88.05, Fabege’s DCF fair value is calculated at just SEK17.39. This means the share price is five times higher than this fair value estimate.

- Analysts' consensus view highlights ongoing debate about whether robust future earnings can justify current price levels.

- Consensus price target is SEK85.66, which is below today’s share price. This suggests the market already prices in aggressive earnings and margin recovery.

- Property value declines of SEK650 million and ongoing like-for-like rental reductions (a decrease of 3.3%) fuel the argument that downside valuation risk has not been fully absorbed.

- Expectations that margins could reach 81.2% within three years reflect a bullish profitability outlook. However, the company’s high Price-to-Earnings ratio of 96.5x, compared to 16.4x for the industry, underscores the significant demands placed on future results.

See how analysts' targets stack up against today’s price and the DCF fair value in the consensus narrative below. 📊 Read the full Fabege Consensus Narrative.

Margins Projected to Skyrocket by 2028

- Forecasts show profit margins climbing dramatically from 5.7% today to 81.2% over the next three years, pointing to major operational leverage if market conditions hold.

- Analysts' consensus view contends that this sharp margin expansion supports a fair valuation near consensus price targets.

- Reaching SEK3.0 billion in earnings with stable share count would bring the company to a PE ratio of 10.7x, comparable to or lower than the broader sector despite current premium multiples.

- Consensus narrative notes that continued digitalization and sustainable property upgrades could lift rental income and efficiency, allowing margins to expand if Stockholm demand improves as anticipated.

Asset Value Declines and Rental Pressures Test Recovery Story

- SEK650 million in unrealized property value write-downs combined with negative like-for-like rental growth (a decrease of 3.3%) show business pressure lurking behind recent profitability gains.

- Analysts' consensus view flags ongoing risks to occupancy and rent levels despite a prime portfolio.

- Heavy exposure to fragile Stockholm office demand and slow tenant renegotiations challenge the bullish case for a swift or durable earnings rebound.

- Execution risk around activating new developments and maintaining high occupancy could weigh on revenue if market conditions soften further.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Fabege on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from another angle? Take just a few minutes to turn your unique viewpoint into a personal narrative by using Do it your way.

A great starting point for your Fabege research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Fabege’s high valuation, heavy reliance on rapid earnings growth, and ongoing property value declines suggest current prices may not be fully justified by fundamentals.

If you’re concerned about overpaying for future growth, check out these 879 undervalued stocks based on cash flows to discover companies trading below their intrinsic value, offering stronger upside and less downside risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FABG

Fabege

A property company, primarily engages in the development, investment, and management of commercial premises in Sweden.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives