Global's Best Undervalued Small Caps With Insider Action December 2025

Reviewed by Simply Wall St

As global markets navigate the implications of the Federal Reserve's interest rate cuts and mixed economic signals, small-cap stocks have shown resilience, with indices like the Russell 2000 outperforming their large-cap counterparts. In this dynamic environment, identifying promising small-cap opportunities involves looking at companies that can leverage favorable interest rates and exhibit strong fundamentals amidst broader market fluctuations.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.7x | 0.7x | 41.21% | ★★★★★☆ |

| Senior | 24.9x | 0.8x | 27.00% | ★★★★★☆ |

| A.G. BARR | 14.5x | 1.6x | 48.06% | ★★★★☆☆ |

| Centurion | 3.6x | 3.0x | -53.26% | ★★★★☆☆ |

| PSC | 9.7x | 0.4x | 20.53% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.56% | ★★★★☆☆ |

| Tristel | 29.5x | 4.2x | 20.23% | ★★★☆☆☆ |

| Kendrion | 29.1x | 0.7x | 42.37% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.3x | 0.4x | -407.64% | ★★★☆☆☆ |

| Paragon Care | 20.9x | 0.1x | 6.18% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Qt Group Oyj (HLSE:QTCOM)

Simply Wall St Value Rating: ★★★★★★

Overview: Qt Group Oyj is a software company specializing in the development of cross-platform software tools, with operations generating €207.66 million from its software development tools segment.

Operations: Qt Group Oyj generates its revenue primarily from software development tools, with a recent gross profit margin of 47.17%. The company's cost structure includes significant operating expenses and non-operating expenses, contributing to a net income margin of 20.11%.

PE: 18.8x

Qt Group Oyj, a smaller company in the tech sector, has been making strategic moves despite recent financial challenges. Their earnings for Q3 2025 showed a decline with sales at €40.72 million and net income dropping to €1.43 million from €7.69 million the previous year. Insider confidence is evident as key individuals have increased their holdings recently, indicating belief in future potential. The launch of Axivion 7.11 enhances compliance capabilities for safety-critical industries, while partnerships like that with Infineon aim to expand their reach into AI-driven consumer products, potentially boosting growth prospects amidst economic uncertainties impacting larger deals this year.

- Click here to discover the nuances of Qt Group Oyj with our detailed analytical valuation report.

Examine Qt Group Oyj's past performance report to understand how it has performed in the past.

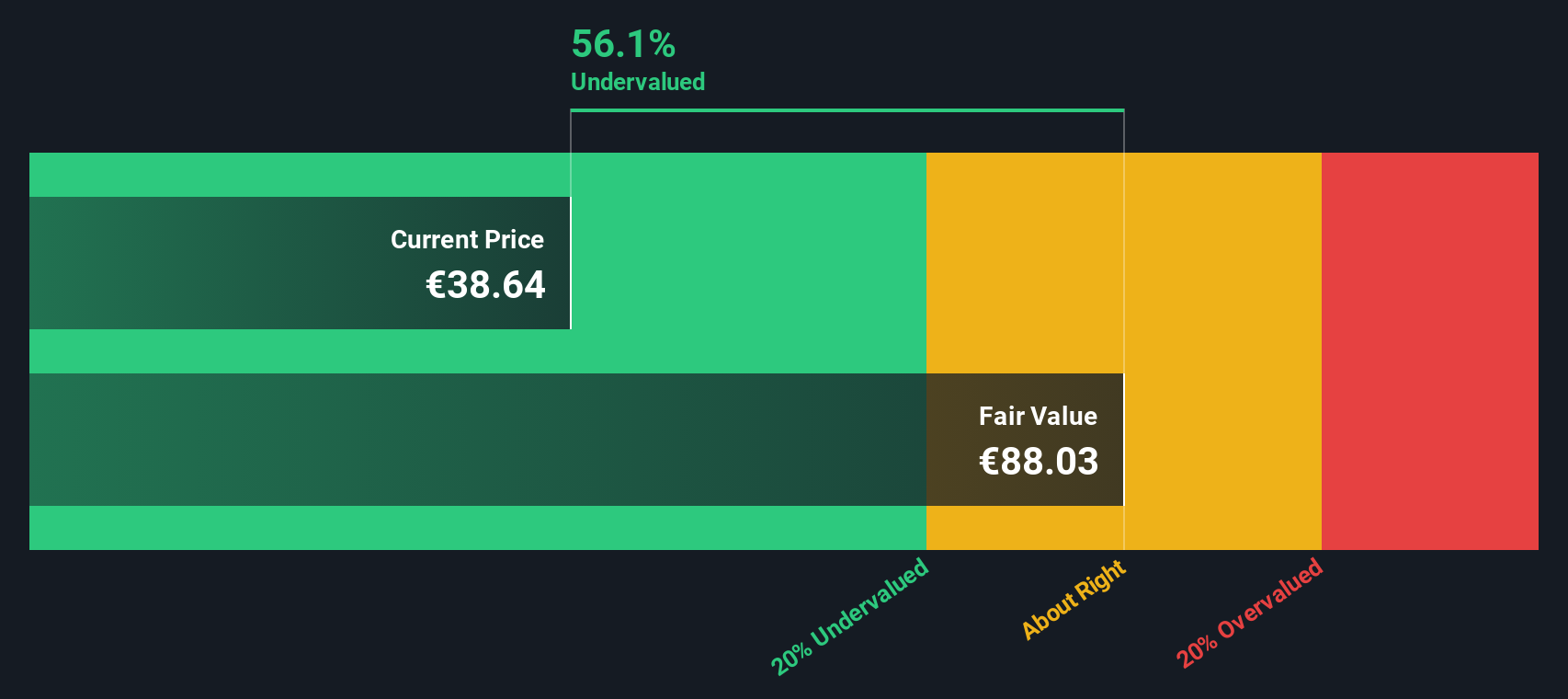

Cibus Nordic Real Estate (OM:CIBUS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Cibus Nordic Real Estate focuses on the ownership and management of properties, with a market capitalization of approximately €0.92 billion.

Operations: Cibus Nordic Real Estate generates revenue primarily through the ownership and management of properties, with a recent revenue figure of €175.30 million. The company's gross profit margin has shown variability, reaching 82.71% in the latest period. Operating expenses have been consistently managed around €13.99 million, impacting overall profitability alongside non-operating expenses that have varied significantly over time.

PE: 16.9x

Cibus Nordic Real Estate, a smaller player in the real estate sector, has shown significant financial improvement with Q3 2025 sales climbing to €42 million from €30.4 million the previous year and net income reaching €19.4 million compared to a loss of €5.6 million. The company recently acquired full ownership of Belgian property firm One+ NV and entered a joint venture with TS33 BV for grocery-anchored assets in Belgium, signaling strategic expansion efforts. Despite its growth prospects, Cibus faces challenges with high-risk funding sources and interest payments not fully covered by earnings. Leadership changes see Stina Lindh Hök stepping in as CEO, potentially bringing fresh strategic direction given her successful tenure at Nyfosa where she achieved over 70% shareholder returns during her leadership from 2020 to 2025.

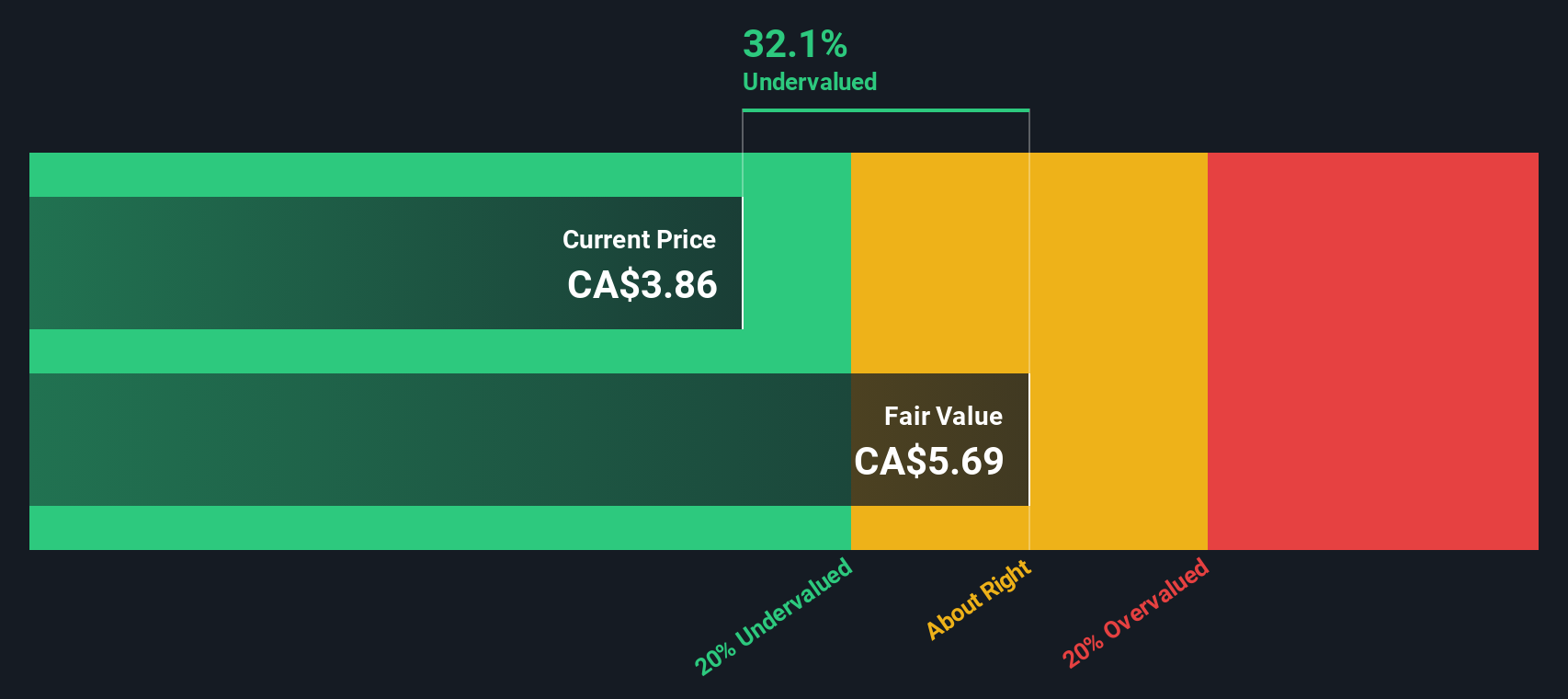

BTB Real Estate Investment Trust (TSX:BTB.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BTB Real Estate Investment Trust is a Canadian company focused on owning and managing a diversified portfolio of industrial, suburban office, and necessity-based retail properties, with a market capitalization of CA$0.31 billion.

Operations: BTB Real Estate Investment Trust generates revenue primarily from suburban office, industrial, and necessity-based retail segments. The company's gross profit margin has been observed at 58.17% as of the latest period. Operating expenses are a notable component of their cost structure, impacting overall profitability alongside non-operating expenses.

PE: 8.4x

BTB Real Estate Investment Trust, a smaller player in the real estate sector, has shown promising financial growth with Q3 2025 net income rising to C$9.5 million from C$5.47 million a year prior. Despite relying solely on external borrowing for funding, which poses higher risk compared to customer deposits, the trust maintains consistent dividends at C$0.025 per unit monthly. Recent insider confidence is evident through share purchases in 2025, suggesting potential value recognition within this undervalued stock category.

Key Takeaways

- Gain an insight into the universe of 146 Undervalued Global Small Caps With Insider Buying by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BTB Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BTB.UN

BTB Real Estate Investment Trust

BTB is a real estate investment trust listed on the Toronto Stock Exchange.

Good value with proven track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion