The board of Catena AB (publ) (STO:CATE) has announced that it will be paying its dividend of SEK4.13 on the 7th of November, an increased payment from last year's comparable dividend. Even though the dividend went up, the yield is still quite low at only 2.3%.

Check out our latest analysis for Catena

Catena's Earnings Easily Cover The Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Prior to this announcement, the company was paying out 393% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 41%. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

Analysts expect a massive rise in earnings per share in the next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 53% which is fairly sustainable.

Catena Has A Solid Track Record

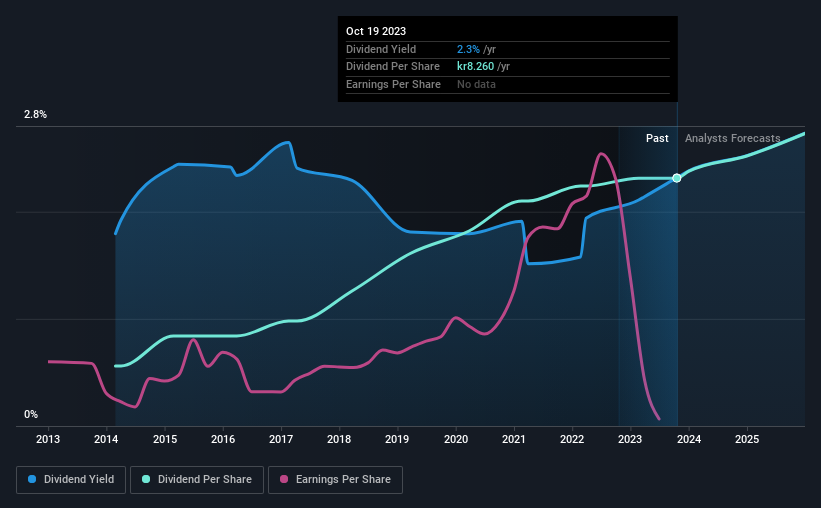

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The annual payment during the last 10 years was SEK2.00 in 2013, and the most recent fiscal year payment was SEK8.26. This works out to be a compound annual growth rate (CAGR) of approximately 15% a year over that time. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately things aren't as good as they seem. Catena's earnings per share has shrunk at 36% a year over the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

An additional note is that the company has been raising capital by issuing stock equal to 11% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Our Thoughts On Catena's Dividend

Overall, we always like to see the dividend being raised, but we don't think Catena will make a great income stock. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 5 warning signs for Catena (of which 1 shouldn't be ignored!) you should know about. Is Catena not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CATE

Catena

Owns, develops, manages, and sells logistics properties in Sweden and Denmark.

Established dividend payer with very low risk.

Similar Companies

Market Insights

Community Narratives