Market Might Still Lack Some Conviction On Xbrane Biopharma AB (publ) (STO:XBRANE) Even After 32% Share Price Boost

Those holding Xbrane Biopharma AB (publ) (STO:XBRANE) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 100% share price decline over the last year.

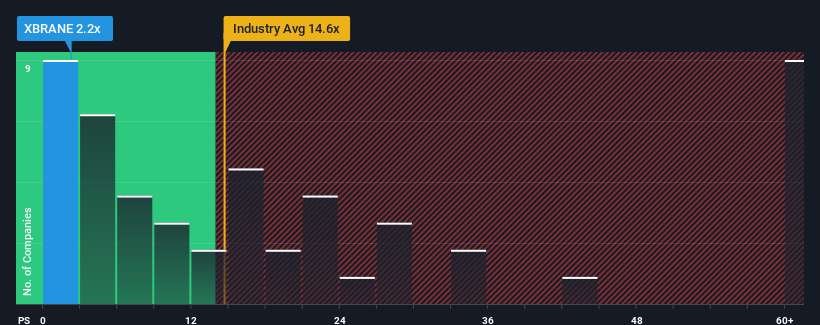

Although its price has surged higher, Xbrane Biopharma may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2.2x, considering almost half of all companies in the Biotechs industry in Sweden have P/S ratios greater than 14.6x and even P/S higher than 30x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Xbrane Biopharma

What Does Xbrane Biopharma's P/S Mean For Shareholders?

Recent times haven't been great for Xbrane Biopharma as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Xbrane Biopharma.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Xbrane Biopharma's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 70%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 123% as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 44% growth forecast for the broader industry.

In light of this, it's peculiar that Xbrane Biopharma's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Xbrane Biopharma's P/S?

Shares in Xbrane Biopharma have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Xbrane Biopharma's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Xbrane Biopharma (2 can't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Xbrane Biopharma's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:XBRANE

Xbrane Biopharma

A biotechnology company, engages in the development, manufacture, and sale of biosimilars.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives