Three European Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As European markets experience a notable upswing, with the pan-European STOXX Europe 600 Index and major national indexes showing gains, investors are increasingly on the lookout for opportunities that may be priced below their estimated value. In this context of rising indices and steady economic indicators, identifying stocks that are undervalued can offer potential for growth, especially when considering factors such as strong fundamentals and favorable market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK29.02 | SEK57.18 | 49.2% |

| Robit Oyj (HLSE:ROBIT) | €1.10 | €2.18 | 49.5% |

| Pandora (CPSE:PNDORA) | DKK879.40 | DKK1752.74 | 49.8% |

| Nordisk Bergteknik (OM:NORB B) | SEK11.90 | SEK23.59 | 49.5% |

| Mo-BRUK (WSE:MBR) | PLN294.00 | PLN585.04 | 49.7% |

| Lingotes Especiales (BME:LGT) | €5.60 | €11.02 | 49.2% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.362 | €0.71 | 48.8% |

| Bonesupport Holding (OM:BONEX) | SEK224.80 | SEK443.21 | 49.3% |

| Axfood (OM:AXFO) | SEK260.50 | SEK509.15 | 48.8% |

| Aquafil (BIT:ECNL) | €1.94 | €3.85 | 49.5% |

Let's review some notable picks from our screened stocks.

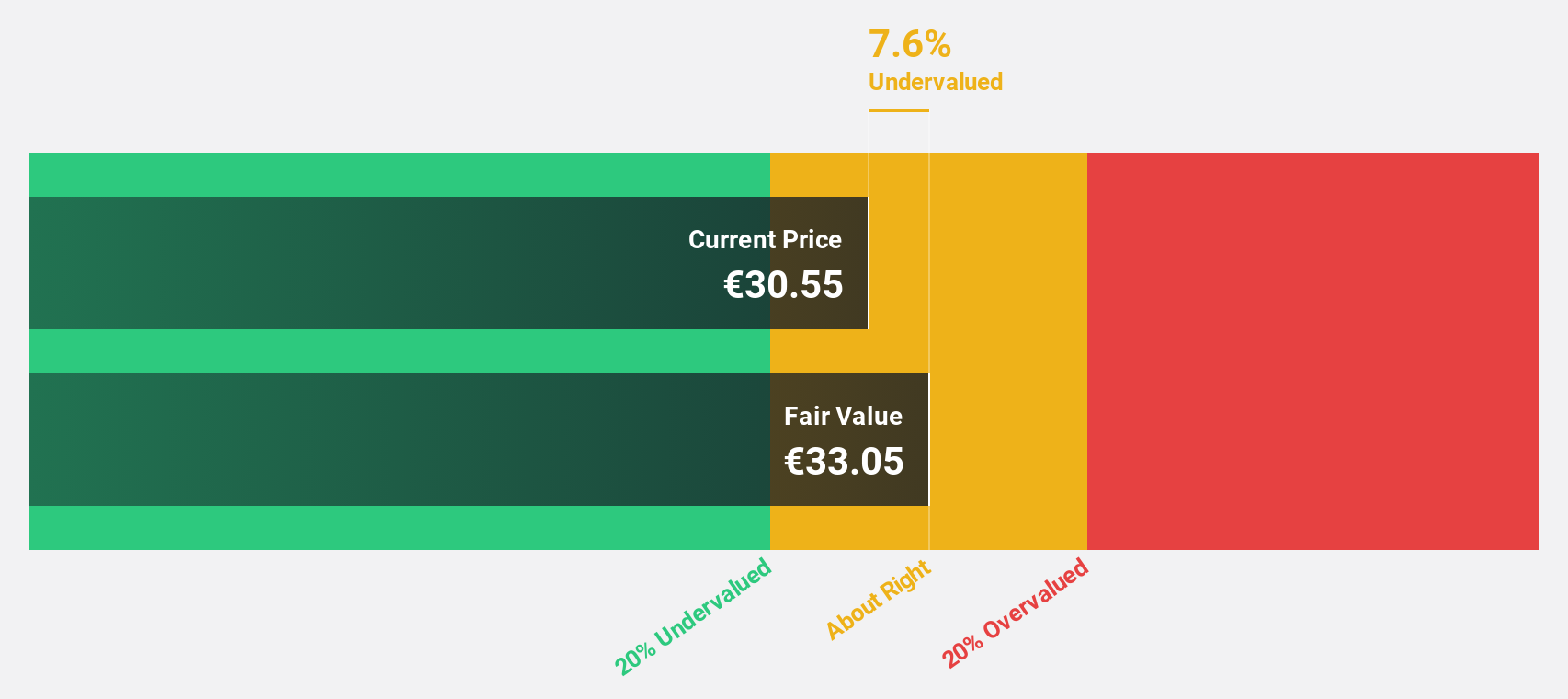

Theon International (ENXTAM:THEON)

Overview: Theon International Plc specializes in the development and manufacturing of customizable night vision, thermal imaging, and electro-optical ISR systems for military and security applications globally, with a market cap of €2.04 billion.

Operations: The company's revenue is primarily derived from its Optronics segment, which generated €383.71 million.

Estimated Discount To Fair Value: 11.8%

Theon International is trading at €29.1, below its estimated fair value of €32.98, indicating some undervaluation based on cash flows. Despite recent share price volatility, analysts expect a 29.6% rise in stock price due to strong earnings growth forecasts of 23.95% annually and revenue growth outpacing the Dutch market. Recent strategic moves include a €300 million financing agreement and significant contracts enhancing mid-term revenue visibility, particularly with the IRIS-C thermal clip-on product in Europe.

- In light of our recent growth report, it seems possible that Theon International's financial performance will exceed current levels.

- Take a closer look at Theon International's balance sheet health here in our report.

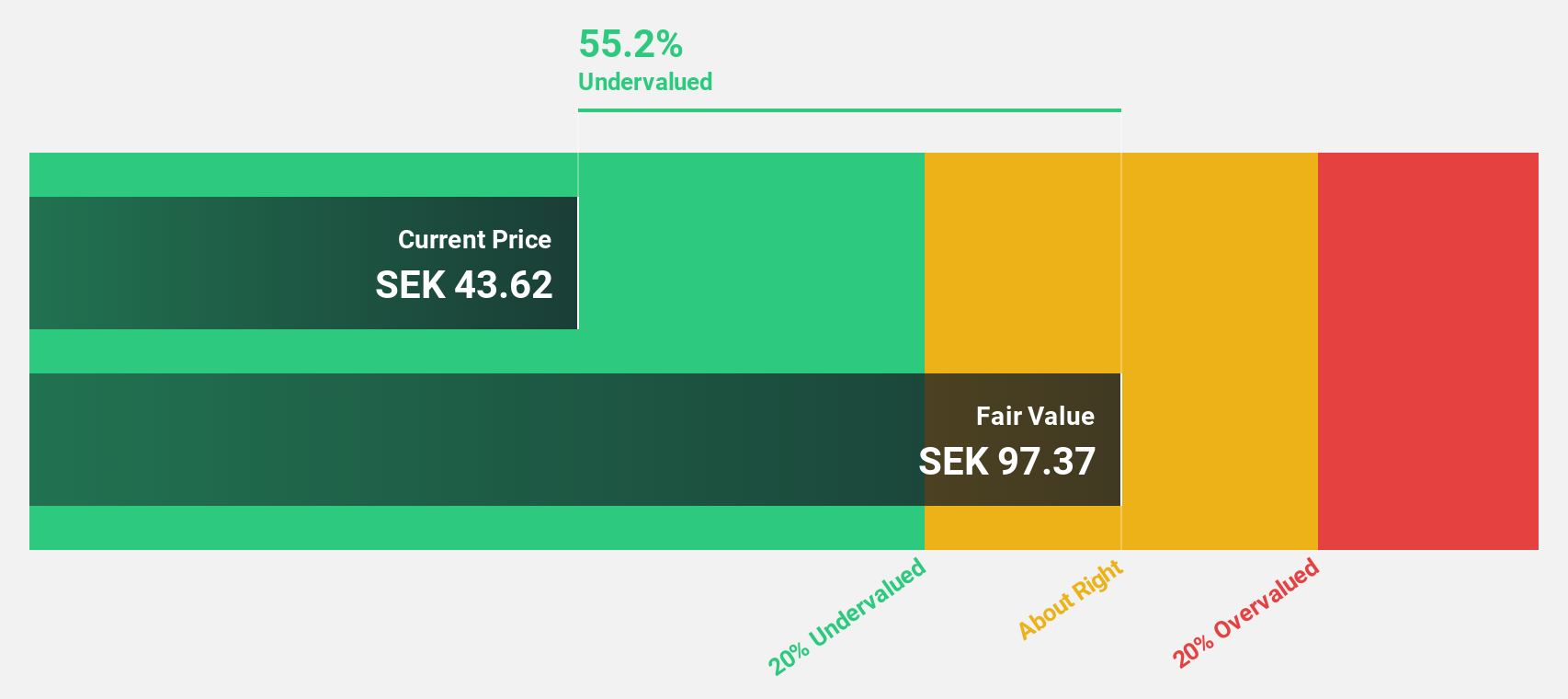

RVRC Holding (OM:RVRC)

Overview: RVRC Holding AB (publ) operates in the e-commerce outdoor clothing sector across Germany, Sweden, and internationally, with a market cap of SEK6.89 billion.

Operations: The company generates revenue primarily from its retail apparel segment, amounting to SEK1.97 billion.

Estimated Discount To Fair Value: 22.9%

RVRC Holding is trading at SEK 64.75, below its estimated fair value of SEK 83.96, reflecting undervaluation based on cash flows. The company's revenue is forecast to grow at 10.4% annually, outpacing the Swedish market's growth rate. Recent earnings showed improvement with net income rising to SEK 58 million from SEK 46 million year-on-year for Q1 FY2025. A recent M&A transaction involved a significant stake acquisition for approximately SEK 980 million, highlighting investor interest.

- Our earnings growth report unveils the potential for significant increases in RVRC Holding's future results.

- Get an in-depth perspective on RVRC Holding's balance sheet by reading our health report here.

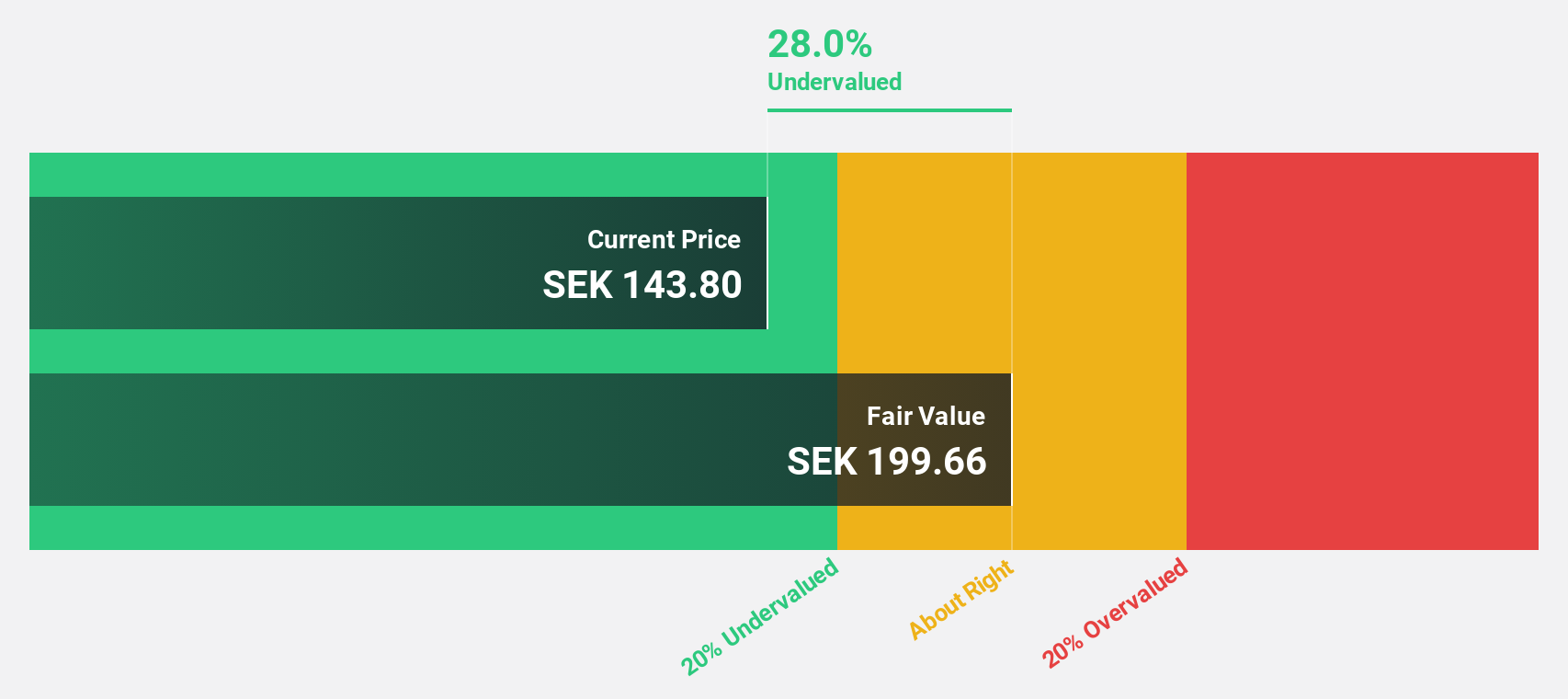

Vitrolife (OM:VITR)

Overview: Vitrolife AB (publ) is a company that offers assisted reproduction products across Europe, the Middle East, Africa, Asia-Pacific, and the Americas with a market cap of SEK20.15 billion.

Operations: The company's revenue segments include Genetics at SEK1.44 billion, Consumables at SEK1.38 billion, and Technologies at SEK694 million.

Estimated Discount To Fair Value: 27%

Vitrolife is trading at SEK 148.8, significantly undervalued based on cash flows with a fair value estimate of SEK 203.97. Despite recent declines in quarterly sales and net income, earnings are expected to grow substantially at 22.6% annually over the next three years, surpassing the Swedish market's growth rate. However, its Return on Equity is forecasted to remain low at 4.5%, and revenue growth is projected to be moderate at 6.7% per year.

- The growth report we've compiled suggests that Vitrolife's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Vitrolife stock in this financial health report.

Key Takeaways

- Unlock more gems! Our Undervalued European Stocks Based On Cash Flows screener has unearthed 202 more companies for you to explore.Click here to unveil our expertly curated list of 205 Undervalued European Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VITR

Vitrolife

Provides assisted reproduction products in Europe, the Middle East, Africa, Asia-Pacific, and the Americas.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives