As the pan-European STOXX Europe 600 Index remains relatively flat amid ongoing U.S. and European trade discussions, and with mixed performances across major stock indexes in the region, investors are keenly watching for opportunities in sectors poised for growth. In this context, identifying high-growth tech stocks that can capitalize on economic expansions such as the recent uptick in eurozone industrial output becomes crucial for those looking to navigate Europe's dynamic market landscape.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Archos | 24.72% | 39.34% | ★★★★★★ |

| Pharma Mar | 26.67% | 43.29% | ★★★★★★ |

| innoscripta | 24.76% | 26.32% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Bonesupport Holding | 23.98% | 62.26% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Rubean | 45.56% | 108.82% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Dynavox Group (OM:DYVOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dynavox Group AB (publ) develops and sells assistive technology products for individuals with impaired communication skills, with a market cap of SEK13.47 billion.

Operations: Dynavox Group AB focuses on assistive technology products, generating revenue primarily from computer hardware sales, amounting to SEK2.25 billion.

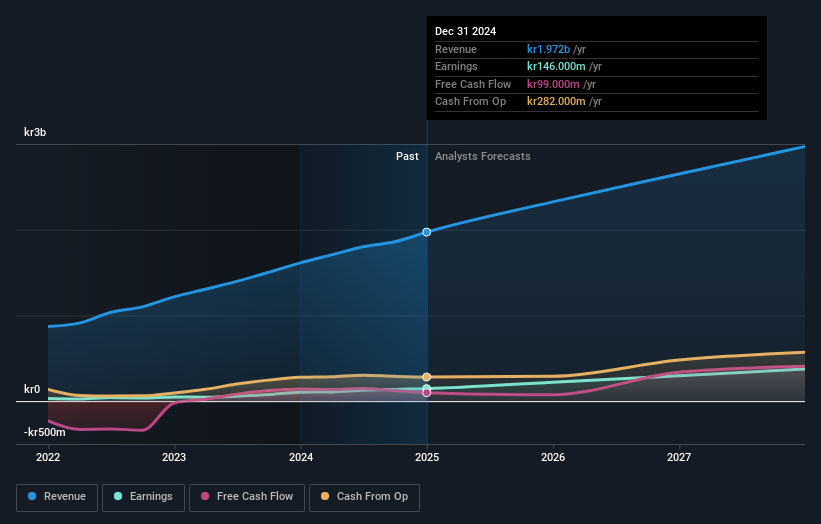

Despite recent volatility in its share price, Dynavox Group demonstrates robust potential within Europe's tech sector, marked by a notable 15.4% annual revenue growth outpacing the Swedish market's 5.2%. The firm recently reported a significant uptick in sales to SEK 1.18 billion over six months, up from SEK 904 million the previous year, underscoring strong market demand. Moreover, with earnings forecasted to surge by an impressive 48.7% annually, Dynavox is strategically leveraging its R&D investments to innovate and stay competitive in high-tech arenas. This focus on development is crucial as it aligns with industry shifts towards more integrated tech solutions. Additionally, the company repurchased shares under a new program starting May 9, emphasizing confidence in its future trajectory and commitment to shareholder value amidst strategic expansions.

- Navigate through the intricacies of Dynavox Group with our comprehensive health report here.

Review our historical performance report to gain insights into Dynavox Group's's past performance.

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hanza AB (publ) offers comprehensive manufacturing solutions and has a market capitalization of approximately SEK5.27 billion.

Operations: The company generates revenue primarily from its Main Markets segment, contributing SEK3.11 billion, and Other Markets segment with SEK2.16 billion. Business Development and Services add a smaller portion at SEK32 million.

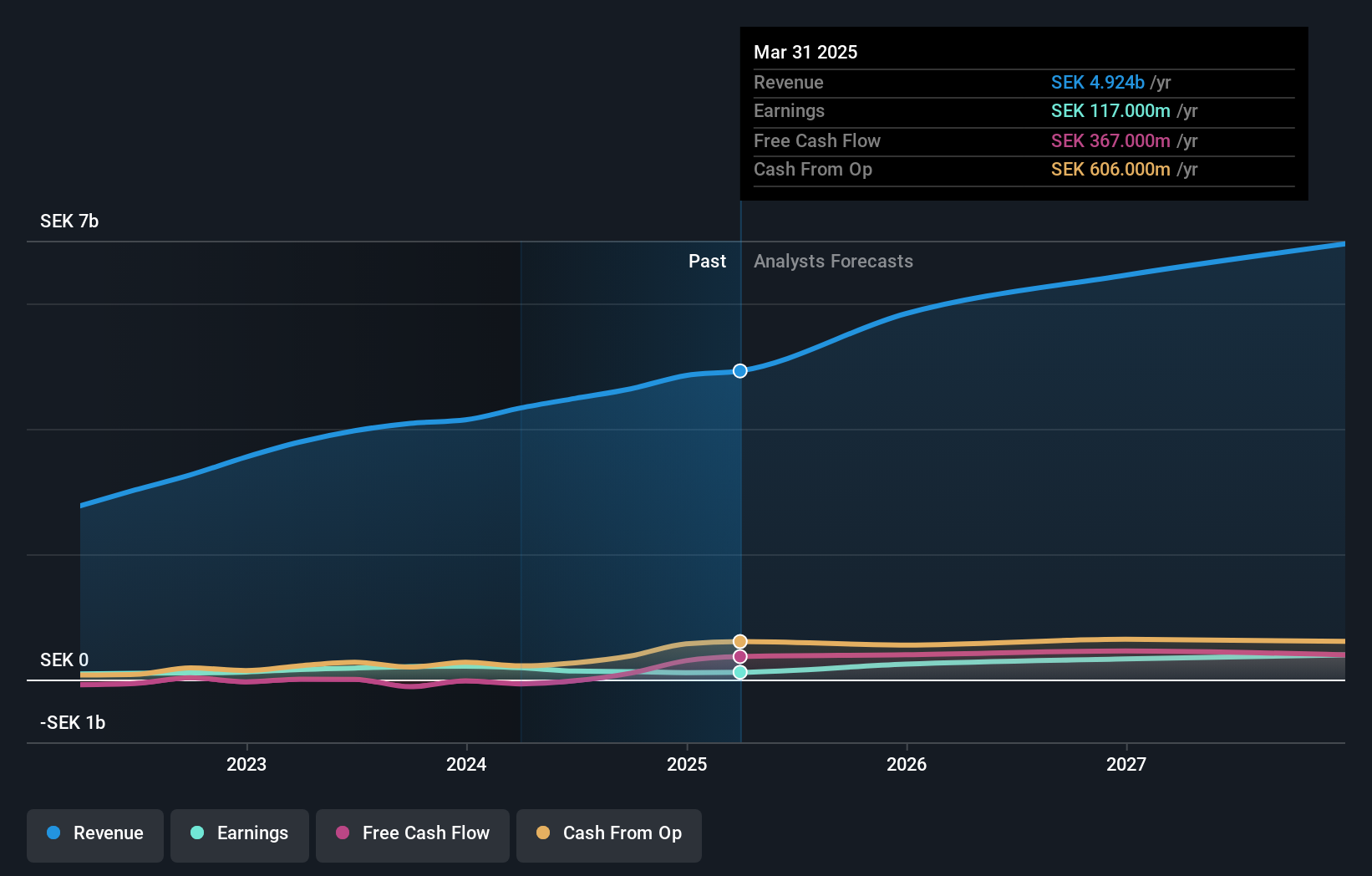

Amidst a dynamic European tech landscape, Hanza stands out with its impressive financial performance. Over the past year, the company's earnings surged by 19.9%, significantly outpacing the electronic industry's growth of 6.6%. This trend is expected to continue, with projected annual earnings growth of 34.7%, well above Sweden's market average of 16.9%. Moreover, Hanza's commitment to innovation is evident in its R&D investments, which are crucial as it adapts to evolving technological demands and maintains competitive edge in integrated tech solutions. Recent financial reports underscore this trajectory: for Q2 2025 alone, sales hit SEK 1.52 billion—a substantial increase from SEK 1.22 billion in the previous year—while net income soared to SEK 52 million from just SEK 6 million, reflecting robust operational efficiency and market responsiveness.

Vitrolife (OM:VITR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitrolife AB (publ) is a company that offers assisted reproduction products across Europe, the Middle East, Africa, Asia-Pacific, and the Americas with a market capitalization of approximately SEK19.95 billion.

Operations: Vitrolife generates revenue primarily from three segments: Genetics (SEK1.46 billion), Consumables (SEK1.39 billion), and Technologies (SEK691 million).

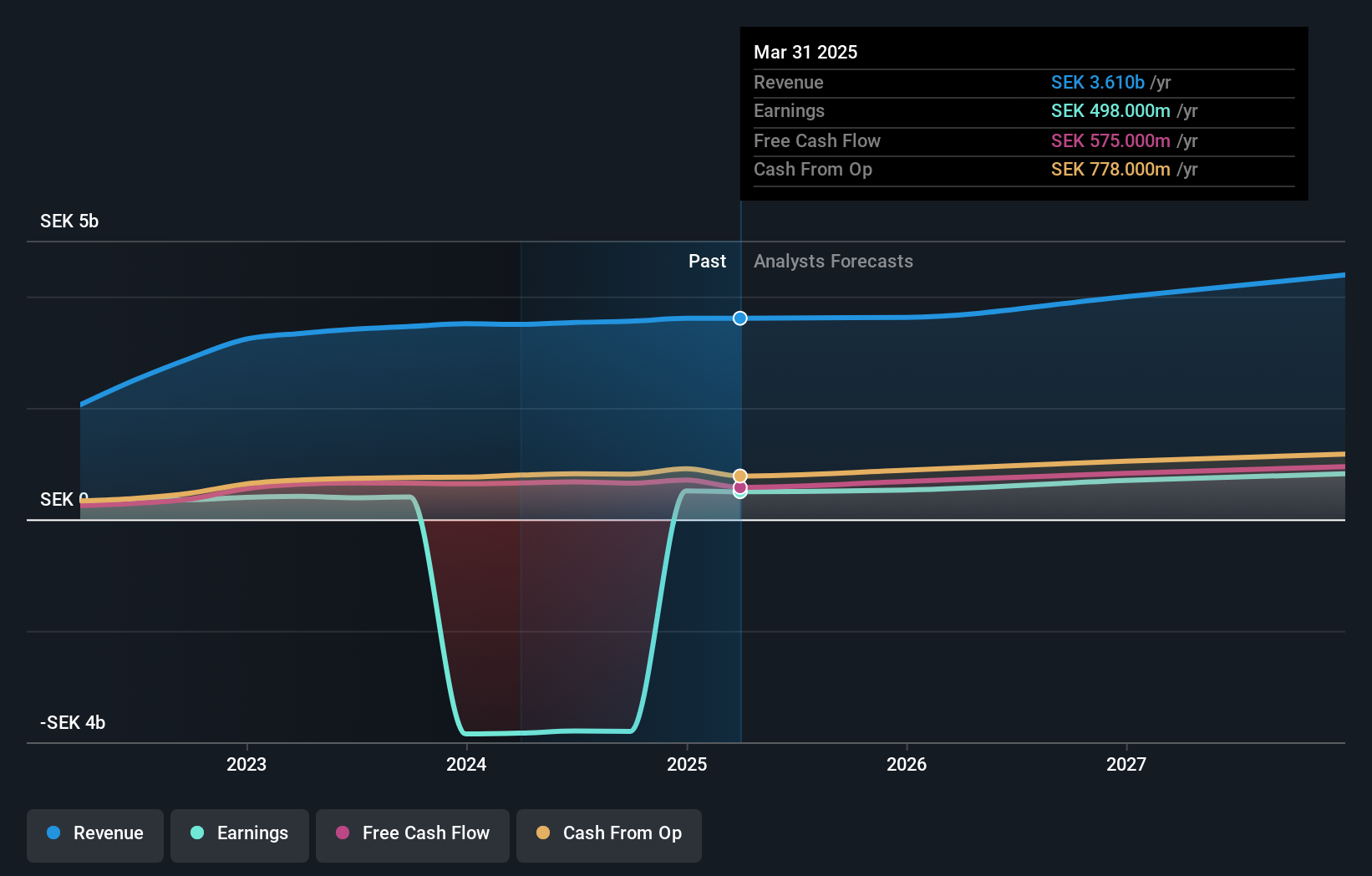

Vitrolife, a player in the European biotech sector, has shown resilience with a revenue growth forecast of 6.7% per year, outpacing the Swedish market's 5.2%. This growth is complemented by an earnings projection of 22.3% annually, significantly above the market average. Despite recent dips in quarterly sales and net income—SEK 871 million and SEK 100 million respectively compared to higher figures last year—the company's strategic financial maneuvers like securing a EUR 300 million loan indicate robust credit confidence and potential for sustained expansion.

- Get an in-depth perspective on Vitrolife's performance by reading our health report here.

Understand Vitrolife's track record by examining our Past report.

Key Takeaways

- Embark on your investment journey to our 232 European High Growth Tech and AI Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanza might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HANZA

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives