Those who invested in Swedish Orphan Biovitrum (STO:SOBI) three years ago are up 101%

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. Just take a look at Swedish Orphan Biovitrum AB (publ) (STO:SOBI), which is up 92%, over three years, soundly beating the market decline of 0.6% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 30%, including dividends.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Swedish Orphan Biovitrum

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last three years, Swedish Orphan Biovitrum failed to grow earnings per share, which fell 12% (annualized).

So we doubt that the market is looking to EPS for its main judge of the company's value. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

It may well be that Swedish Orphan Biovitrum revenue growth rate of 16% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

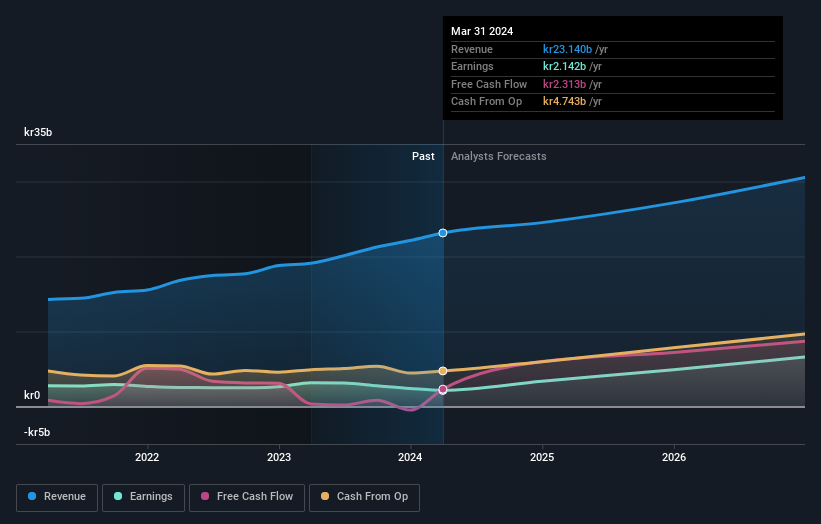

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Swedish Orphan Biovitrum is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Swedish Orphan Biovitrum in this interactive graph of future profit estimates.

What About The Total Shareholder Return (TSR)?

We've already covered Swedish Orphan Biovitrum's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Swedish Orphan Biovitrum's TSR, at 101% is higher than its share price return of 92%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's good to see that Swedish Orphan Biovitrum has rewarded shareholders with a total shareholder return of 30% in the last twelve months. That gain is better than the annual TSR over five years, which is 11%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Swedish Orphan Biovitrum you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SOBI

Swedish Orphan Biovitrum

A biopharma company, provides medicines in the areas of haematology, immunology, and specialty care in Europe, North America, the Middle East, Asia, and Australia.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives