Swedencare (OM:SECARE) Margin Decline Challenges Bullish Growth Narrative Despite Strong Long-Term Projections

Reviewed by Simply Wall St

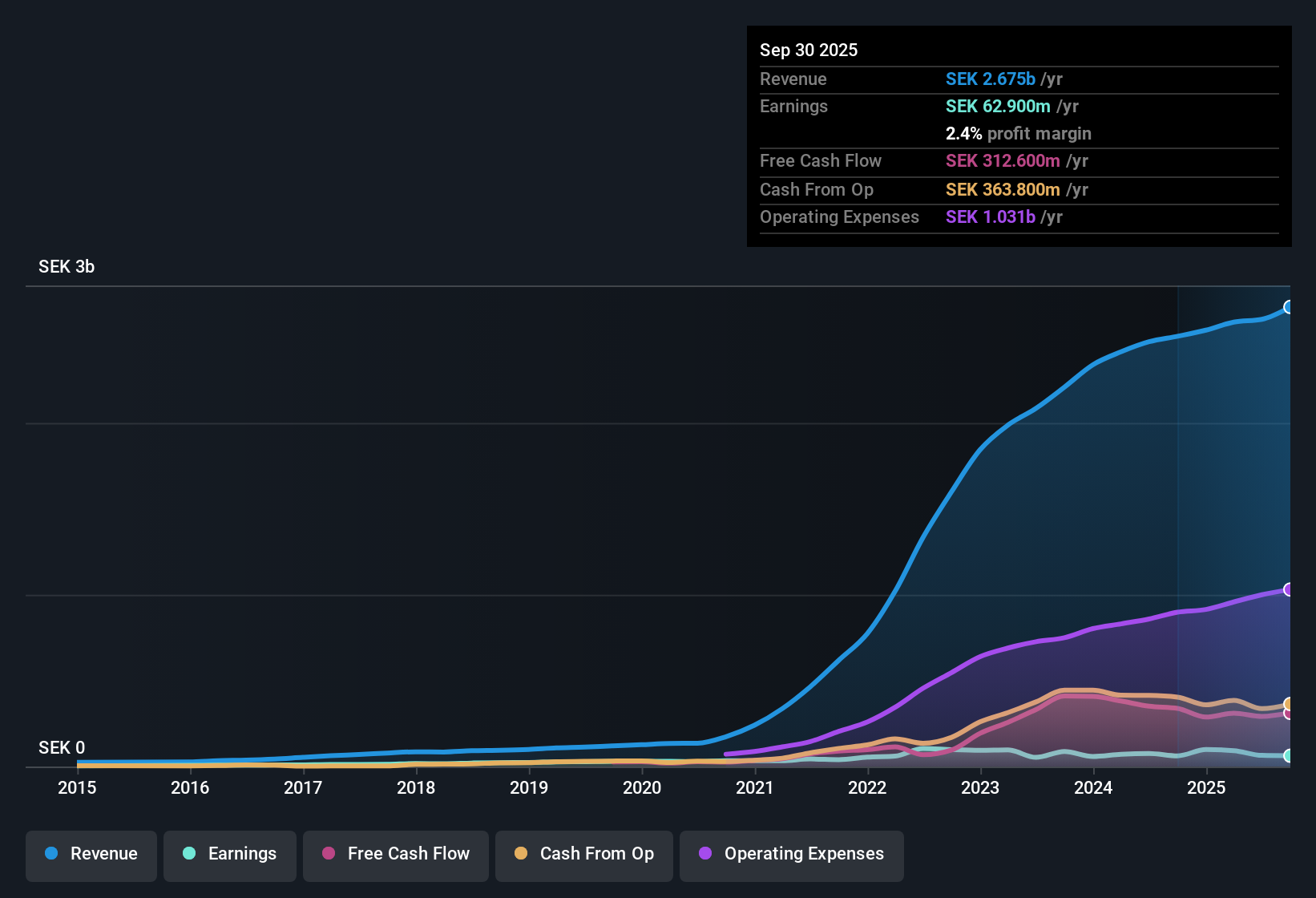

Swedencare (OM:SECARE) posted net profit margins of 2.5%, down from 3.1% last year, interrupting its longer-term earnings trend after a year of negative growth. Over the past five years, annual earnings growth averaged a strong 13.8%. Looking ahead, analysts expect a sharp rebound, with earnings forecast to jump 59.9% per year and revenue to rise 10% annually. These projections significantly outpace both the Swedish market and sector. With a high Price-to-Earnings Ratio of 99.8x and shares trading at SEK 40.45, investors are weighing exceptional growth projections against recent margin pressure and notable share price volatility, identified as the only flagged risk in the past three months.

See our full analysis for Swedencare.The next section will put these headline numbers head-to-head with the current narratives driving market sentiment. This will reveal where the stories align and where opinions might get shaken up.

See what the community is saying about Swedencare

Margins Expected to Rebound by 2028

- Analysts project net profit margins rising from 2.5% today to 14.7% in three years, a dramatic swing that would reverse the squeeze seen in the most recent results.

- According to the analysts' consensus view, process improvements, supply chain upgrades, and integrating recent acquisitions are expected to unlock higher EBITDA margins.

- Operational changes such as internalizing Amazon sales and adding new manufacturing capacity are positioned as catalysts for better cost control and productive scale.

- Despite these upgrades, immediate pressures from rising digital advertising costs and external expenses could continue to affect margins in the short term.

- Sense check how these margin targets stack up as Swedencare attempts to overcome short-term cost hurdles and turn integration gains into sustainable bottom-line growth. 📊 Read the full Swedencare Consensus Narrative.

Projected Profit Surge Meets Industry Jitters

- Earnings are forecast to reach SEK 521.8 million by 2028, moving well ahead of the sector growth rate of 12.5% per year and more than eight times current results.

- The analysts' consensus view highlights that aggressive revenue and earnings targets rely on continuous expansion through digital and retail channels.

- Bears point out persistent reliance on large one-off orders and North American veterinary channel softness as potential stumbling blocks for these forecasts.

- Sustained consumer demand for premium pet health is viewed as necessary to justify such high growth, but intensified competition and regional slowdowns could derail the bullish case.

Valuation Discounts Signal Opportunity and Risk

- Swedencare’s current share price of SEK 40.45 trades at a steep discount to both its DCF fair value (SEK 112.19) and the consensus analyst price target (SEK 51.00), despite a lofty Price-to-Earnings Ratio of 99.8x.

- The analysts' consensus view suggests this pricing gap reflects the market's struggle to balance sky-high future growth expectations against real concerns about recent margin compression and share price volatility.

- Peers in the European pharmaceuticals industry trade at markedly lower valuation multiples, raising questions about Swedencare’s premium relative to underlying risk.

- Bulls argue the discount window is justified by projected operational leverage and a return to industry-leading profitability, as long as integration is executed without major setbacks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Swedencare on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an opportunity the consensus may have missed? Take a fresh look at the data and share your unique angle in just minutes. Do it your way

A great starting point for your Swedencare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Swedencare’s volatile margins, reliance on ambitious growth targets, and a high valuation multiple create genuine concern about sustainable performance and pricing risk.

If you want potential value with less downside risk, use our these 874 undervalued stocks based on cash flows to zero in on companies trading below intrinsic value and backed by more stable fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SECARE

Swedencare

Develops, manufactures, markets, and sells animal healthcare products for cats, dogs, and horses in North America, Europe, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives