Orexo AB (publ) (STO:ORX) Soars 28% But It's A Story Of Risk Vs Reward

Despite an already strong run, Orexo AB (publ) (STO:ORX) shares have been powering on, with a gain of 28% in the last thirty days. The annual gain comes to 111% following the latest surge, making investors sit up and take notice.

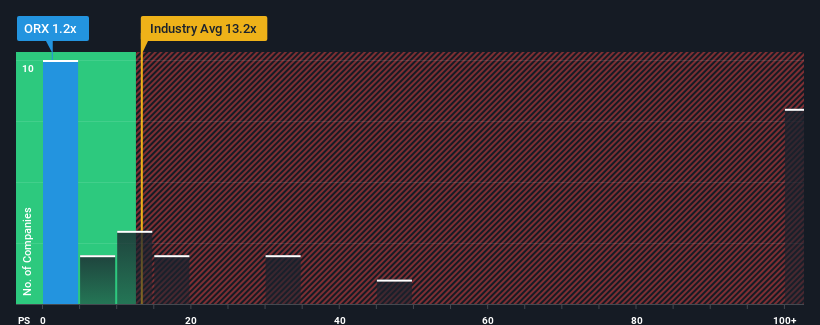

Even after such a large jump in price, Orexo may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.2x, since almost half of all companies in the Pharmaceuticals industry in Sweden have P/S ratios greater than 13.2x and even P/S higher than 141x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Orexo

How Orexo Has Been Performing

While the industry has experienced revenue growth lately, Orexo's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Orexo will help you uncover what's on the horizon.How Is Orexo's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Orexo's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The longer-term trend has been no better as the company has no revenue growth to show for over the last three years either. Therefore, it's fair to say that revenue growth has definitely eluded the company recently.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 15% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 11% per annum, which is noticeably less attractive.

In light of this, it's peculiar that Orexo's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Even after such a strong price move, Orexo's P/S still trails the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Orexo's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Orexo, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ORX

Orexo

A specialty pharmaceutical company, develops and commercializes pharmaceuticals and digital therapies in the United States, European Union, the United Kingdom, and internationally.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives