- Sweden

- /

- Life Sciences

- /

- OM:MCAP

Undiscovered Gems with Strong Potential for December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and mixed economic signals, small-cap stocks have faced notable challenges, with the Russell 2000 Index underperforming larger counterparts like the S&P 500. Amid this backdrop of cautious optimism and shifting monetary policies, identifying promising small-cap opportunities requires a keen eye for companies demonstrating resilience, innovation, and strong fundamentals.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Hong Tai Electric Industrial | 0.03% | 11.52% | 12.52% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Pacific Construction | 21.40% | -3.50% | 26.25% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Lion Travel Service | 1.97% | -0.25% | 46.60% | ★★★★★☆ |

| Central Finance | 1.16% | 10.03% | 16.10% | ★★★★★☆ |

| Huang Hsiang Construction | 266.70% | 13.12% | 15.19% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

MedCap (OM:MCAP)

Simply Wall St Value Rating: ★★★★★★

Overview: MedCap AB (publ) is a private equity firm focusing on investments in secondary direct, later stage, industry consolidation, add-on acquisitions, growth capital, middle market, mature companies, turnarounds and buyouts with a market cap of SEK8.78 billion.

Operations: MedCap generates revenue from three primary segments: Support (SEK733.70 million), Specialist Drugs (SEK453.10 million), and Medicine Engineering (SEK602.50 million).

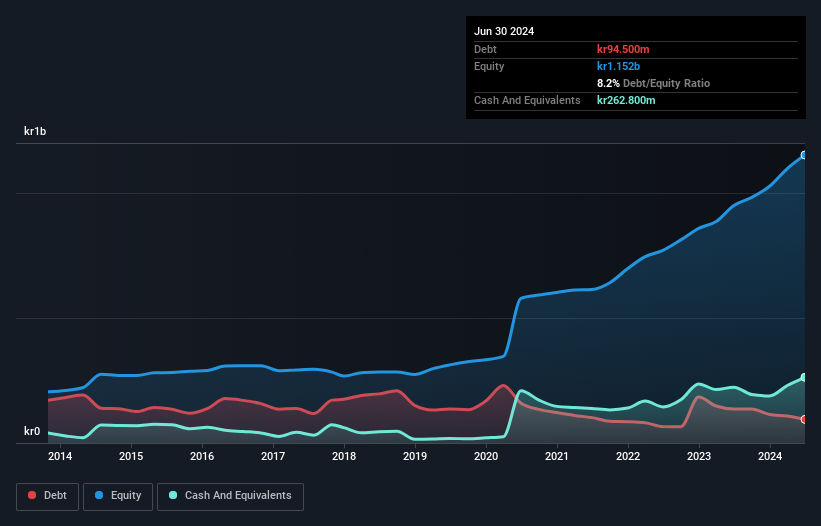

MedCap, a dynamic player in the life sciences sector, has been making waves with its robust financial performance. Earnings surged by 51.7% over the past year, outpacing the industry growth of 36%. The company boasts a healthy balance sheet with more cash than its total debt and has significantly reduced its debt-to-equity ratio from 40.9% to 6.3% over five years. Its price-to-earnings ratio of 38.5x is attractive compared to the industry average of 50.4x, suggesting potential undervaluation in this space. Recent figures show net income for Q3 at SEK 52.9 million, up from SEK 38.3 million last year, highlighting strong earnings momentum.

- Click here to discover the nuances of MedCap with our detailed analytical health report.

Assess MedCap's past performance with our detailed historical performance reports.

Dynamic Holdings (SEHK:29)

Simply Wall St Value Rating: ★★★★★★

Overview: Dynamic Holdings Limited is an investment holding company focused on property investment and development in the People’s Republic of China and Hong Kong, with a market capitalization of approximately HK$2.06 billion.

Operations: Dynamic Holdings generates revenue primarily from property rentals in Beijing and Shanghai, totaling HK$71.57 million. The company incurs a significant share of loss from a joint venture amounting to HK$12.64 billion, which impacts its overall financial performance significantly.

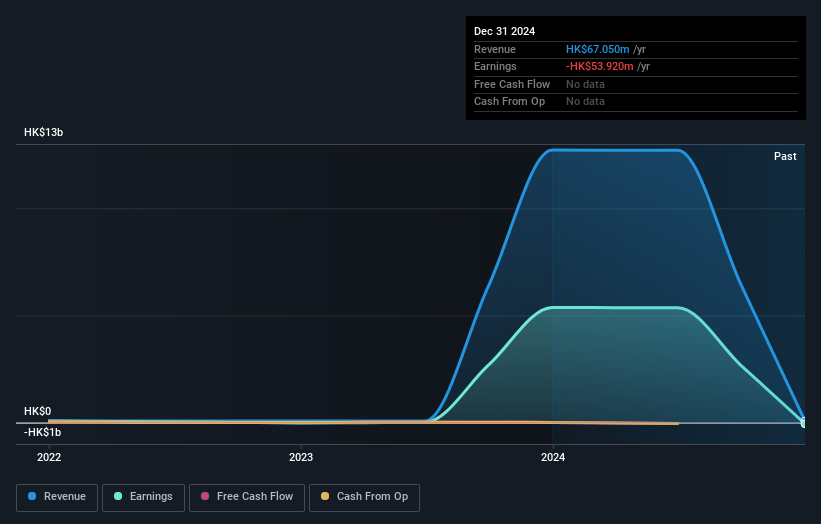

Dynamic Holdings, a relatively small player in the real estate sector, has made significant strides with its financial performance. The company reported an astounding earnings growth of 80,605% over the past year, easily outpacing the broader industry trend of -11%. With no debt on its books now compared to a debt-to-equity ratio of 5.1% five years ago, Dynamic Holdings appears financially stable. Its price-to-earnings ratio stands at just 0.4x against the Hong Kong market's average of 9.9x, suggesting potential undervaluation. Despite sales dropping to HKD 71.57 million from HKD 79.73 million last year, net income surged to HKD 5 billion from HKD 6.63 million previously.

- Click here and access our complete health analysis report to understand the dynamics of Dynamic Holdings.

Gain insights into Dynamic Holdings' past trends and performance with our Past report.

Rongcheer Industrial Technology (Suzhou) (SZSE:301360)

Simply Wall St Value Rating: ★★★★★☆

Overview: Rongcheer Industrial Technology (Suzhou) Co., Ltd. is a company engaged in the production and distribution of electronic test and measurement instruments, with a market cap of CN¥3.20 billion.

Operations: Rongcheer generates its revenue primarily from the electronic test and measurement instruments segment, amounting to CN¥369.29 million.

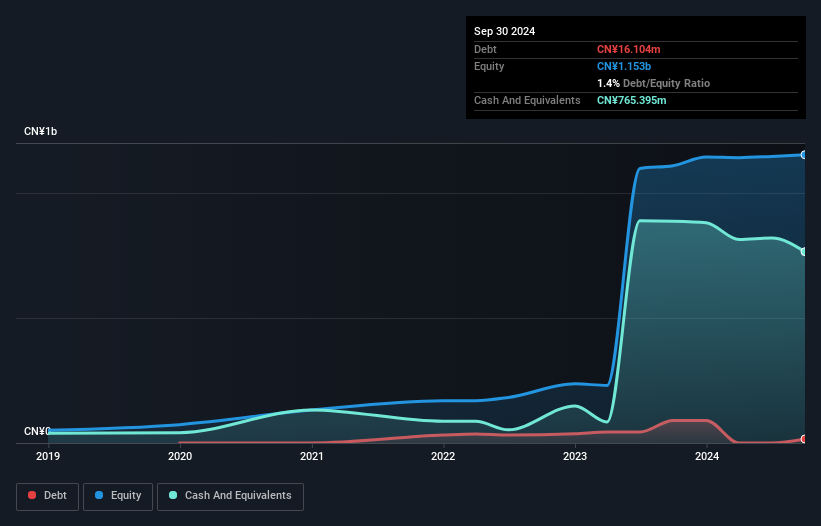

Rongcheer Industrial Technology (Suzhou) has shown a promising performance with its earnings growing by 21% over the past year, outpacing the machinery industry's -0.4%. Despite a volatile share price recently, the company reported net income of CNY 18.43 million for the nine months ending September 2024, up from CNY 10.24 million in the previous year. Basic and diluted earnings per share stood at CNY 0.35 compared to last year's CNY 0.22. While its debt-to-equity ratio increased to 1.4% over five years, Rongcheer holds more cash than total debt, suggesting financial stability amidst growth challenges and opportunities ahead.

Where To Now?

- Get an in-depth perspective on all 4625 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MCAP

MedCap

A private equity firm specializing in investments in secondary direct, later stage, industry consolidation, add-on acquisitions, growth capital, middle market, mature, turnarounds, buyout.

Flawless balance sheet and undervalued.