We Think Intervacc (STO:IVACC) Can Easily Afford To Drive Business Growth

We can readily understand why investors are attracted to unprofitable companies. For example, Intervacc (STO:IVACC) shareholders have done very well over the last year, with the share price soaring by 127%. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So notwithstanding the buoyant share price, we think it's well worth asking whether Intervacc's cash burn is too risky. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Intervacc

How Long Is Intervacc's Cash Runway?

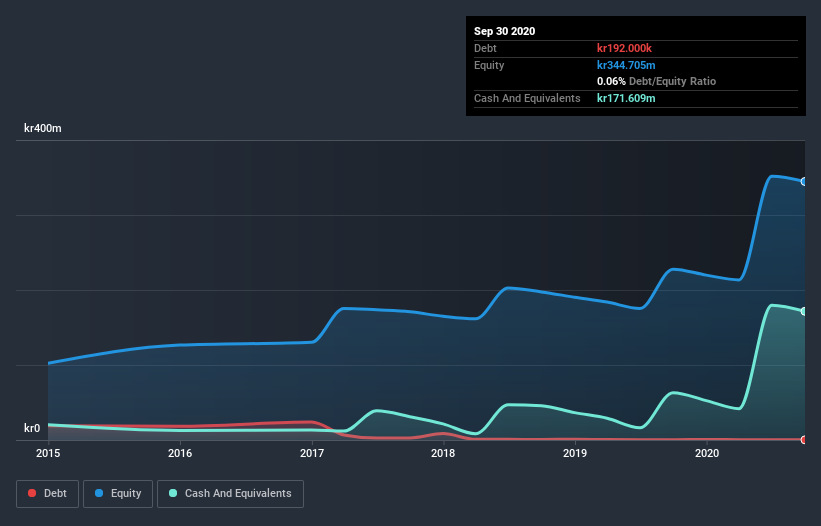

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. Intervacc has such a small amount of debt that we'll set it aside, and focus on the kr172m in cash it held at September 2020. In the last year, its cash burn was kr35m. Therefore, from September 2020 it had 4.9 years of cash runway. A runway of this length affords the company the time and space it needs to develop the business. You can see how its cash balance has changed over time in the image below.

How Is Intervacc's Cash Burn Changing Over Time?

In our view, Intervacc doesn't yet produce significant amounts of operating revenue, since it reported just kr7.2m in the last twelve months. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. With cash burn dropping by 12% it seems management feel the company is spending enough to advance its business plans at an appropriate pace. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Intervacc Raise More Cash Easily?

While Intervacc is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Intervacc's cash burn of kr35m is about 1.4% of its kr2.6b market capitalisation. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

So, Should We Worry About Intervacc's Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way Intervacc is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. Its weak point is its cash burn reduction, but even that wasn't too bad! After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. On another note, we conducted an in-depth investigation of the company, and identified 2 warning signs for Intervacc (1 can't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade Intervacc, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Intervacc, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:IVACC

Flawless balance sheet slight.

Market Insights

Community Narratives