- Sweden

- /

- Life Sciences

- /

- OM:GENO

This Is Why Genovis AB (publ.)'s (STO:GENO) CEO Compensation Looks Appropriate

Key Insights

- Genovis AB (publ.) will host its Annual General Meeting on 15th of May

- Salary of kr1.50m is part of CEO Fredrik Olsson's total remuneration

- The total compensation is 34% less than the average for the industry

- Genovis AB (publ.)'s three-year loss to shareholders was 34% while its EPS grew by 112% over the past three years

Shareholders may be wondering what CEO Fredrik Olsson plans to do to improve the less than great performance at Genovis AB (publ.) (STO:GENO) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 15th of May. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

Check out our latest analysis for Genovis AB (publ.)

Comparing Genovis AB (publ.)'s CEO Compensation With The Industry

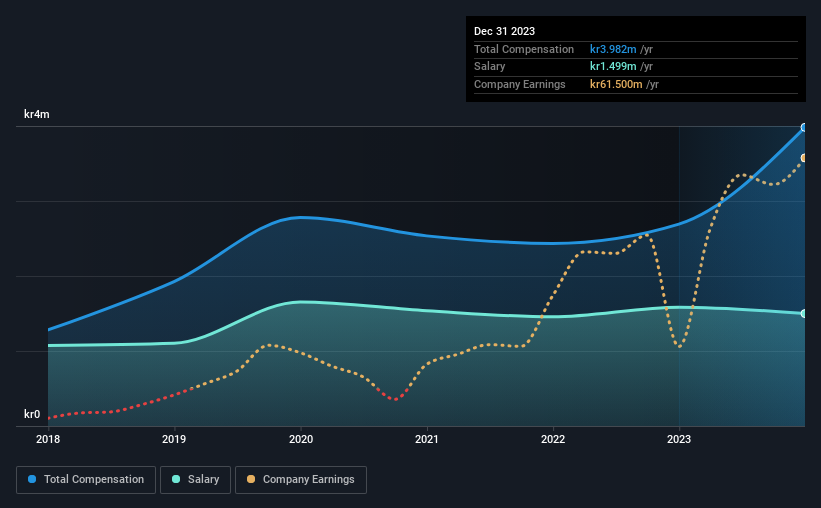

At the time of writing, our data shows that Genovis AB (publ.) has a market capitalization of kr1.9b, and reported total annual CEO compensation of kr4.0m for the year to December 2023. That's a notable increase of 48% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at kr1.5m.

On comparing similar companies from the Swedish Life Sciences industry with market caps ranging from kr1.1b to kr4.4b, we found that the median CEO total compensation was kr6.0m. In other words, Genovis AB (publ.) pays its CEO lower than the industry median. Furthermore, Fredrik Olsson directly owns kr4.6m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr1.5m | kr1.6m | 38% |

| Other | kr2.5m | kr1.1m | 62% |

| Total Compensation | kr4.0m | kr2.7m | 100% |

Speaking on an industry level, nearly 48% of total compensation represents salary, while the remainder of 52% is other remuneration. Genovis AB (publ.) sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Genovis AB (publ.)'s Growth

Over the past three years, Genovis AB (publ.) has seen its earnings per share (EPS) grow by 112% per year. Its revenue is up 54% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Genovis AB (publ.) Been A Good Investment?

The return of -34% over three years would not have pleased Genovis AB (publ.) shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

The loss to shareholders over the past three years is certainly concerning. The share price trend has diverged with the robust growth in EPS however, suggesting there may be other factors that could be driving the price performance. A key question may be why the fundamentals have not yet been reflected into the share price. In the upcoming AGM, shareholders will get the opportunity to discuss these concerns with the board and assess if the board's plan is likely to improve company performance.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Genovis AB (publ.) that you should be aware of before investing.

Switching gears from Genovis AB (publ.), if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you're looking to trade Genovis AB (publ.), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GENO

Genovis AB (publ.)

Develops and sells tools for the development of new treatment methods and diagnostics for customers in the pharmaceutical and research industries.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives