Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Genovis AB (publ.) (STO:GENO). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Genovis AB (publ.)

Genovis AB (publ.)'s Improving Profits

In the last three years Genovis AB (publ.)'s earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a falcon taking flight, Genovis AB (publ.)'s EPS soared from kr0.094 to kr0.14, over the last year. That's a commendable gain of 49%.

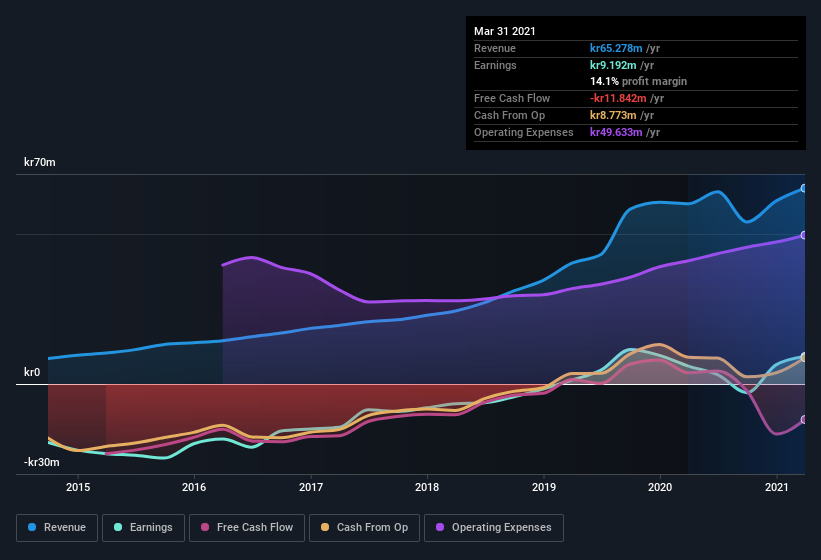

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Genovis AB (publ.) maintained stable EBIT margins over the last year, all while growing revenue 8.6% to kr65m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Genovis AB (publ.) Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Genovis AB (publ.) insiders refrain from selling stock during the year, but they also spent kr1.3m buying it. That's nice to see, because it suggests insiders are optimistic. We also note that it was the General Counsel, Susanne Ahlberg, who made the biggest single acquisition, paying kr507k for shares at about kr46.23 each.

On top of the insider buying, it's good to see that Genovis AB (publ.) insiders have a valuable investment in the business. Given insiders own a small fortune of shares, currently valued at kr541m, they have plenty of motivation to push the business to succeed. That holding amounts to 16% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Fredrik Olsson is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between kr1.7b and kr7.0b, like Genovis AB (publ.), the median CEO pay is around kr5.1m.

The CEO of Genovis AB (publ.) only received kr2.5m in total compensation for the year ending . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Genovis AB (publ.) Deserve A Spot On Your Watchlist?

You can't deny that Genovis AB (publ.) has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. However, before you get too excited we've discovered 1 warning sign for Genovis AB (publ.) that you should be aware of.

The good news is that Genovis AB (publ.) is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Genovis AB (publ.), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:GENO

Genovis AB (publ.)

Develops and sells tools for the development of new treatment methods and diagnostics for customers in the pharmaceutical and research industries.

Flawless balance sheet with moderate growth potential.