- Sweden

- /

- Life Sciences

- /

- OM:GENO

Genovis AB (publ.)'s (STO:GENO) 36% Jump Shows Its Popularity With Investors

Genovis AB (publ.) (STO:GENO) shareholders are no doubt pleased to see that the share price has bounced 36% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 29% over that time.

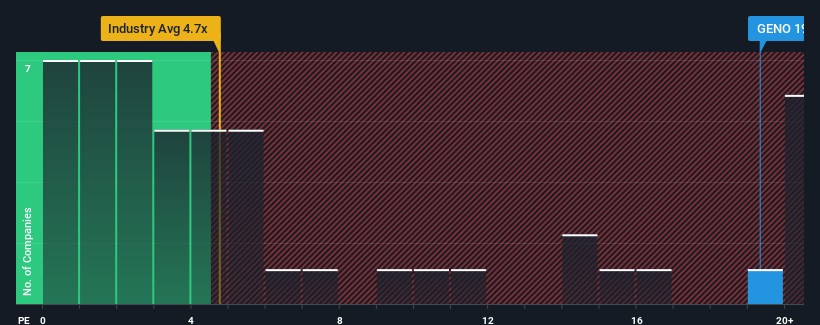

After such a large jump in price, when almost half of the companies in Sweden's Life Sciences industry have price-to-sales ratios (or "P/S") below 3.4x, you may consider Genovis AB (publ.) as a stock not worth researching with its 19.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Genovis AB (publ.)

How Has Genovis AB (publ.) Performed Recently?

Genovis AB (publ.) could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Genovis AB (publ.) will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Genovis AB (publ.) would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.7%. Even so, admirably revenue has lifted 97% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 26% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 9.8% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Genovis AB (publ.)'s P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Genovis AB (publ.)'s P/S?

The strong share price surge has lead to Genovis AB (publ.)'s P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Genovis AB (publ.)'s analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Genovis AB (publ.), and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Genovis AB (publ.), explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GENO

Genovis AB (publ.)

Develops and sells tools for the development of new treatment methods and diagnostics for customers in the pharmaceutical and research industries.

Flawless balance sheet with moderate growth potential.