- Sweden

- /

- Life Sciences

- /

- OM:GENO

Genovis AB (publ.)'s (STO:GENO) 26% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Genovis AB (publ.) (STO:GENO) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 55% share price decline.

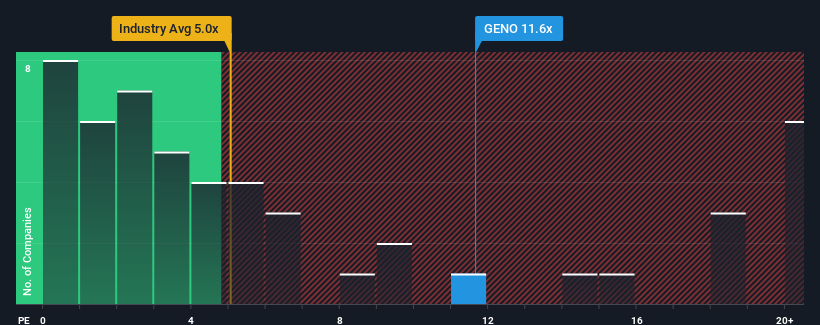

Although its price has dipped substantially, Genovis AB (publ.)'s price-to-sales (or "P/S") ratio of 11.6x might still make it look like a strong sell right now compared to other companies in the Life Sciences industry in Sweden, where around half of the companies have P/S ratios below 4.1x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Genovis AB (publ.)

How Genovis AB (publ.) Has Been Performing

While the industry has experienced revenue growth lately, Genovis AB (publ.)'s revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Genovis AB (publ.)'s future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Genovis AB (publ.) would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 84% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 9.8% during the coming year according to the three analysts following the company. With the industry predicted to deliver 8.2% growth , the company is positioned for a comparable revenue result.

In light of this, it's curious that Genovis AB (publ.)'s P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Genovis AB (publ.)'s P/S

Even after such a strong price drop, Genovis AB (publ.)'s P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Analysts are forecasting Genovis AB (publ.)'s revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Before you settle on your opinion, we've discovered 2 warning signs for Genovis AB (publ.) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GENO

Genovis AB (publ.)

Develops and sells tools for the development of new treatment methods and diagnostics in North America, Europe, and Asia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives