As global markets grapple with geopolitical tensions and economic shifts, the pan-European STOXX Europe 600 Index recently ended lower due to escalating conflicts in the Middle East, reflecting a cautious investor sentiment. In this climate of uncertainty, identifying promising small-cap stocks in Sweden can offer unique opportunities for growth as these companies often possess innovative potential and resilience that may not be immediately apparent to broader market participants.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Bonesupport Holding (OM:BONEX)

Simply Wall St Value Rating: ★★★★★★

Overview: Bonesupport Holding AB (publ) is an orthobiologics company that develops and commercializes injectable bio-ceramic bone graft substitutes across Europe, North America, and internationally, with a market cap of SEK20.41 billion.

Operations: Bonesupport generates revenue primarily from its pharmaceuticals segment, amounting to SEK735.16 million. The company's financial performance is highlighted by a focus on this core revenue stream.

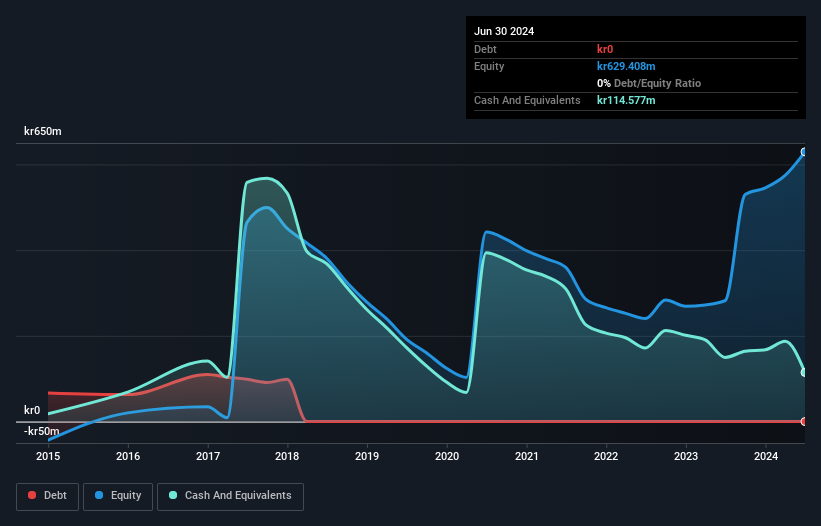

Bonesupport Holding, a dynamic player in the biotech arena, recently turned profitable and is trading slightly below its fair value. The company showcases high-quality earnings with significant non-cash components. Recent highlights include a 31% forecasted annual earnings growth and no debt burden over the past five years. Notably, the SOLARIO study demonstrated that their products can drastically cut antibiotic use while maintaining infection control. However, recent insider selling may warrant attention from potential investors.

- Click here to discover the nuances of Bonesupport Holding with our detailed analytical health report.

Understand Bonesupport Holding's track record by examining our Past report.

Cloetta (OM:CLA B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cloetta AB (publ) is a confectionery company with a market capitalization of approximately SEK7.21 billion.

Operations: Cloetta generates revenue primarily from packaged branded goods and candy not packed in small bags, with sales figures of SEK6.24 billion and SEK2.22 billion, respectively.

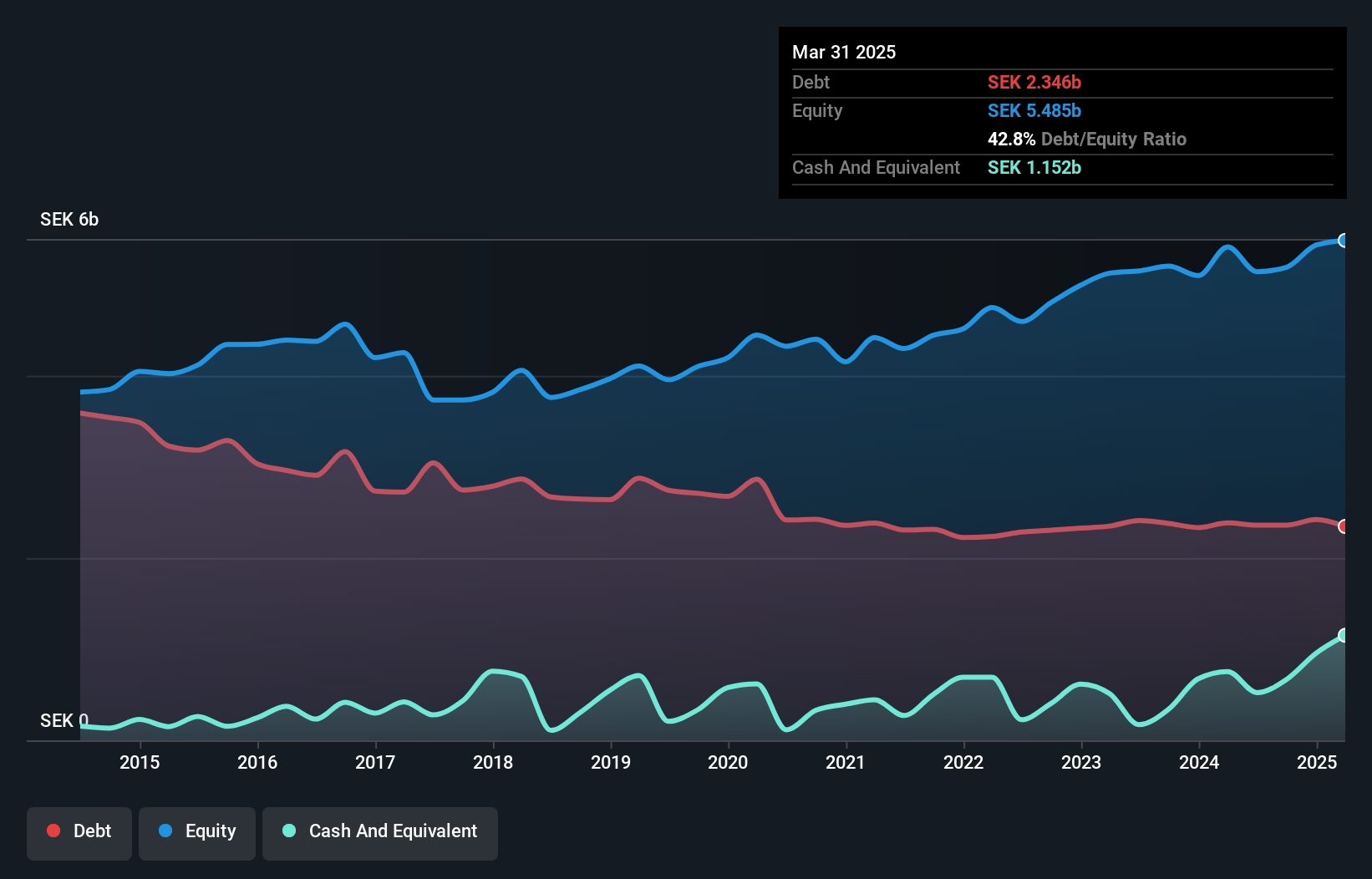

Cloetta, a notable player in the confectionery sector, has seen its earnings grow by 29.8% over the past year, surpassing industry growth of 26%. Trading at 16.9% below estimated fair value, it offers potential upside for investors. The company reported SEK 4.13 billion in sales for the first half of 2024 with net income rising to SEK 189 million from SEK 138 million last year. Despite significant insider selling recently, Cloetta's debt to equity ratio improved from 69.4% to a satisfactory level of 35.7%.

- Delve into the full analysis health report here for a deeper understanding of Cloetta.

Examine Cloetta's past performance report to understand how it has performed in the past.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★☆☆

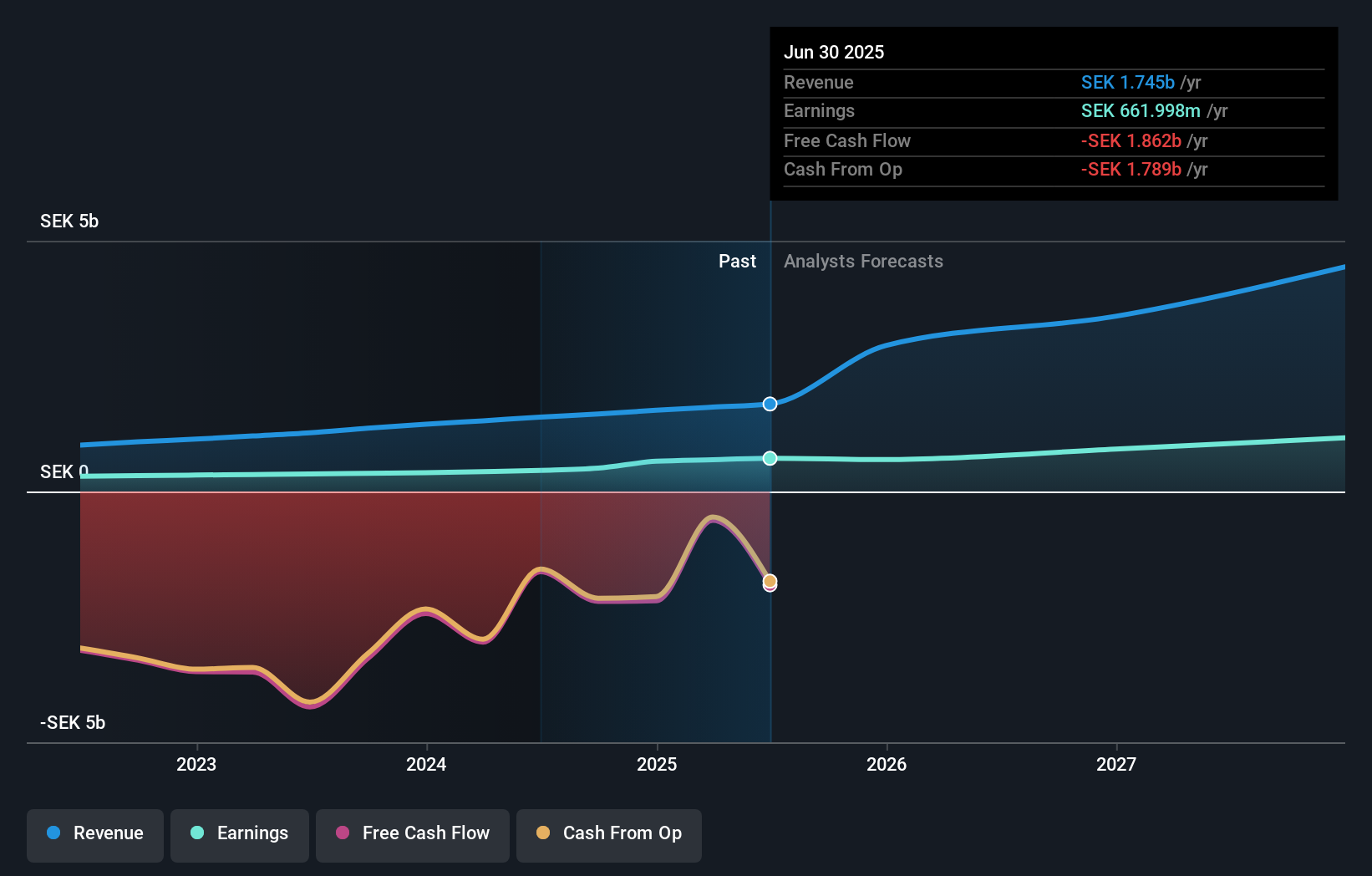

Overview: TF Bank AB (publ) is a digital bank offering consumer banking services and e-commerce solutions through its proprietary IT platform, with a market cap of SEK5.96 billion.

Operations: TF Bank generates revenue primarily from three segments: Credit Cards (SEK 511.24 million), Consumer Lending (SEK 607.24 million), and Ecommerce Solutions excluding Credit Cards (SEK 363.28 million).

TF Bank, a nimble player in Sweden's financial scene, showcases high-quality earnings and a low bad loan allowance at 62%, though it grapples with a high level of bad loans at 10.6%. With total assets of SEK24.1B and equity of SEK2.4B, the bank relies on low-risk funding sources for 95% of its liabilities. Recent issuance of SEK100M in subordinated bonds aims to optimize capital structure while establishing Rediem Capital AB to tackle non-performing loans signals strategic growth moves.

- Unlock comprehensive insights into our analysis of TF Bank stock in this health report.

Gain insights into TF Bank's historical performance by reviewing our past performance report.

Seize The Opportunity

- Click here to access our complete index of 56 Swedish Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CLA B

Excellent balance sheet with acceptable track record.