BioInvent International (STO:BINV) shareholders are up 15% this past week, but still in the red over the last five years

This week we saw the BioInvent International AB (publ) (STO:BINV) share price climb by 15%. But that is little comfort to those holding over the last half decade, sitting on a big loss. Indeed, the share price is down 64% in the period. So is the recent increase sufficient to restore confidence in the stock? Not yet. But it could be that the fall was overdone.

The recent uptick of 15% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for BioInvent International

BioInvent International wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, BioInvent International grew its revenue at 28% per year. That's better than most loss-making companies. In contrast, the share price is has averaged a loss of 10% per year - that's quite disappointing. This could mean high expectations have been tempered, potentially because investors are looking to the bottom line. Given the revenue growth we'd consider the stock to be quite an interesting prospect if the company has a clear path to profitability.

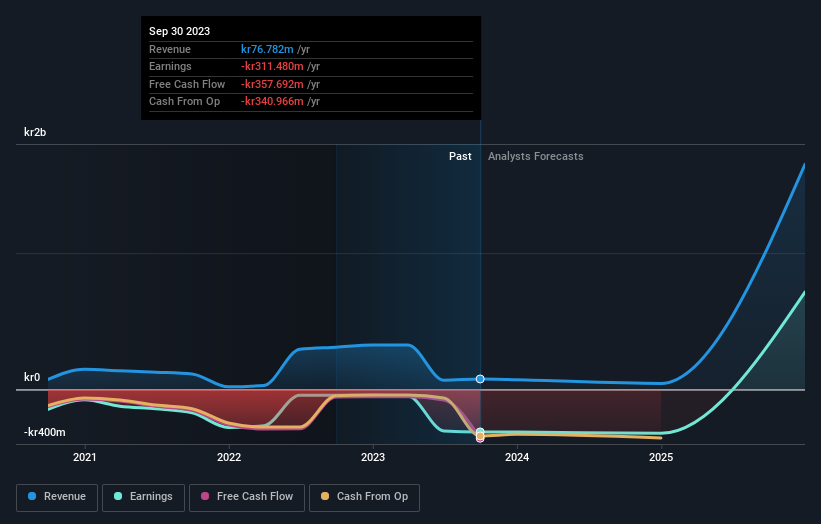

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling BioInvent International stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Investors in BioInvent International had a tough year, with a total loss of 53%, against a market gain of about 6.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BioInvent International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BINV

BioInvent International

A clinical-stage company, discovers, and develops novel immuno-modulatory antibodies for the treatment of cancer in Sweden, Europe, the United States, and internationally.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives