- Sweden

- /

- Life Sciences

- /

- NGM:LEVBIO

Do AlphaHelix Molecular Diagnostics's (NGM:ALPH) Earnings Warrant Your Attention?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in AlphaHelix Molecular Diagnostics (NGM:ALPH). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for AlphaHelix Molecular Diagnostics

AlphaHelix Molecular Diagnostics's Improving Profits

Over the last three years, AlphaHelix Molecular Diagnostics has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, AlphaHelix Molecular Diagnostics's EPS shot from kr0.043 to kr0.078, over the last year. Year on year growth of 81% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

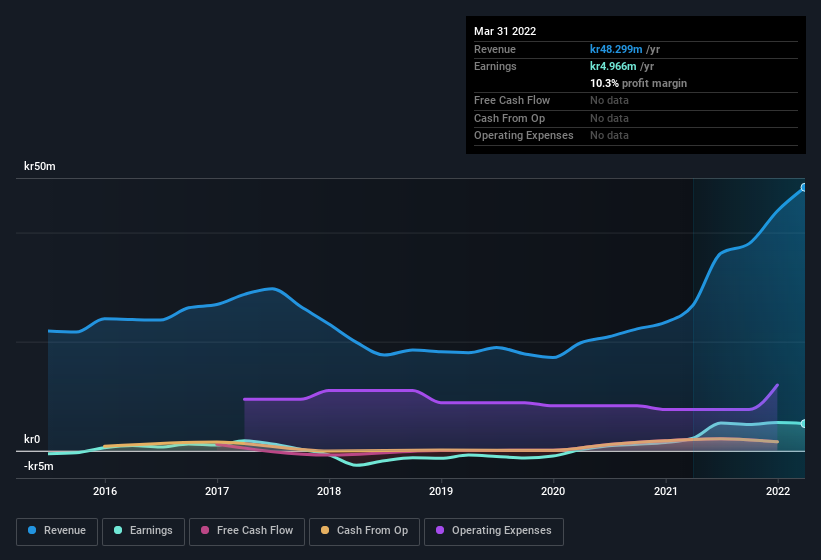

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note AlphaHelix Molecular Diagnostics's EBIT margins were flat over the last year, revenue grew by a solid 81% to kr48m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since AlphaHelix Molecular Diagnostics is no giant, with a market capitalization of kr65m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are AlphaHelix Molecular Diagnostics Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalizations under kr2.0b, like AlphaHelix Molecular Diagnostics, the median CEO pay is around kr2.3m.

The CEO of AlphaHelix Molecular Diagnostics was paid just kr114k in total compensation for the year ending . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add AlphaHelix Molecular Diagnostics To Your Watchlist?

AlphaHelix Molecular Diagnostics's earnings per share have taken off like a rocket aimed right at the moon. With rocketing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. Meanwhile, the very reasonable CEO pay reassures me a little, since it points to an absence profligacy. While I couldn't be sure without a deeper dive, it does seem that AlphaHelix Molecular Diagnostics has the hallmarks of a quality business; and that would make it well worth watching. Don't forget that there may still be risks. For instance, we've identified 4 warning signs for AlphaHelix Molecular Diagnostics (1 is a bit unpleasant) you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:LEVBIO

Level Bio

Manufactures and distributes cutting-edge and diagnostic solutions in the Nordic region and internationally.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives