Viaplay Group (OM:VPLAY B): Annual Losses Worsen 53.3% as Profitability Remains Elusive

Reviewed by Simply Wall St

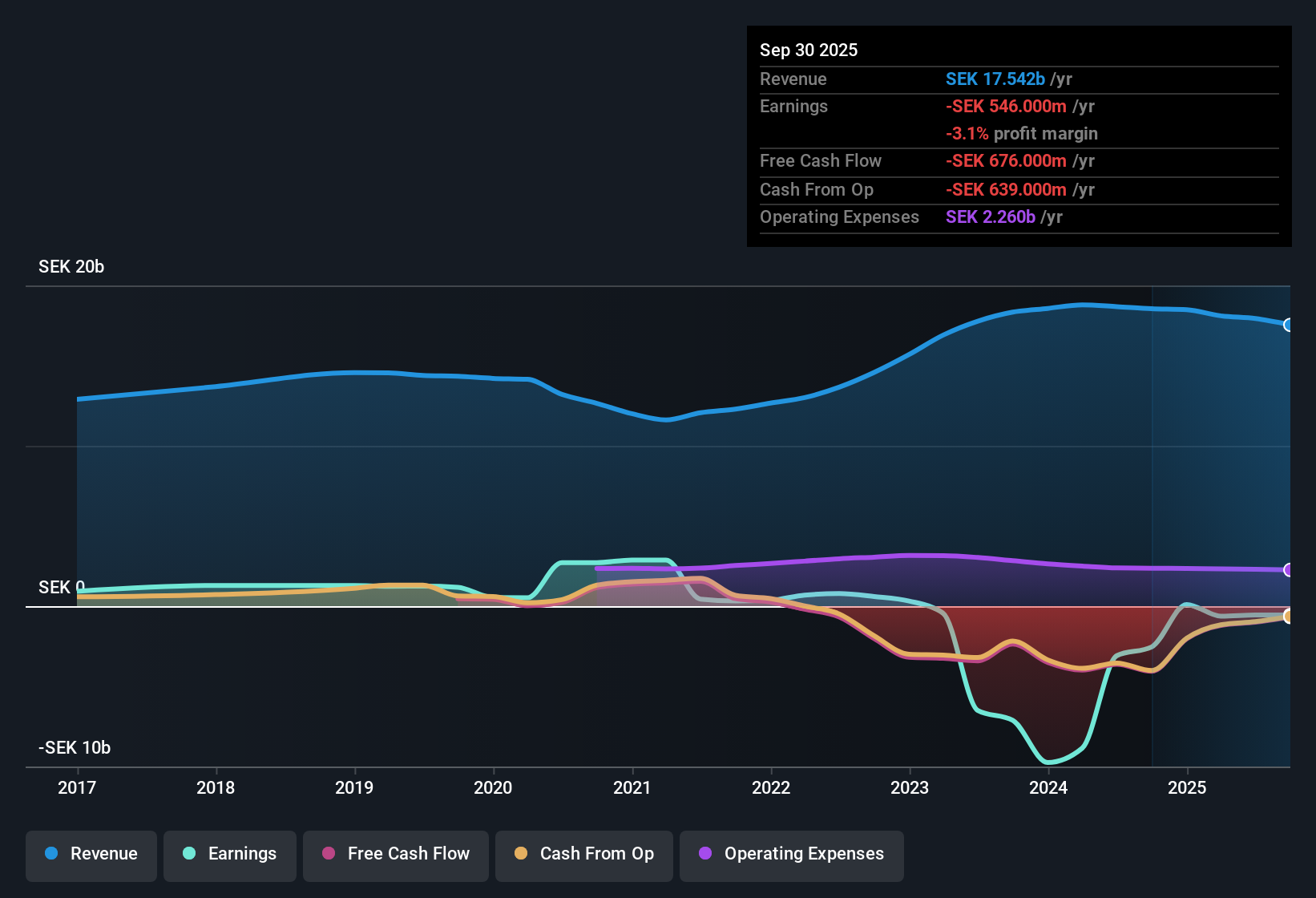

Viaplay Group (OM:VPLAY B) is currently unprofitable, with losses accelerating at a 53.3% annual rate over the past five years. There has been no sign of an improved net profit margin in the last year, and the company’s recent results indicate persistent challenges in generating positive earnings. With no sign of growth in revenue or earnings, and a share price at 1.051, investors are left considering negative profit trends while weighing risk signals around future stability.

See our full analysis for Viaplay Group.Next up, we will compare these earnings numbers with the dominant market narratives and community perspectives to see where consensus and facts align, and where there might be surprises.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Mount Against Weak Margins

- Viaplay Group’s annual losses have grown at a rapid 53.3% per year over the last five years, with no indication of margin improvement in the latest period.

- The prevailing market view focuses on persistent operational headwinds, noting:

- Bulls hoping for a turnaround are challenged by the continued lack of profitability, as even recent results show no lift in net profit margin to build optimism.

- While positive news such as effective cost cuts or new partnerships could trigger a shift in sentiment, the data so far gives little support for a credible path to stabilization.

Price-to-Sales Ratio Stands Out

- With a Price-To-Sales Ratio of just 0.3x, Viaplay B trades at a significant discount versus both the European media industry average of 0.7x and key peers at 1.4x.

- Despite that low multiple, the market’s prevailing narrative is cautious:

- Buyers attracted to the discounted valuation must weigh it against accelerating losses and the absence of revenue or earnings growth.

- Critics highlight that, while the ratio looks attractive on paper, fundamentals such as deteriorating margins and ongoing losses are key reasons the discount persists.

No Reward Signals, Risks Dominate

- No rewards have been flagged for the business, while notable risks include a weak financial position, unstable share price in the past three months, and no expected growth in either revenue or earnings.

- As the prevailing market view reinforces, risk factors continue to weigh heavily on sentiment:

- With profitability elusive and financial stability uncertain, the cautious stance from investors remains grounded in persistent risk signals highlighted in the latest data.

- Any surprise to the upside would need not just a change in sentiment, but clear evidence of improved results, something not seen to date.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Viaplay Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Viaplay Group’s mounting losses, weak financial position, and absence of growth highlight how ongoing risks and instability threaten long-term performance.

If stable financials and resilience matter to you, try solid balance sheet and fundamentals stocks screener (1980 results) to discover companies with robust balance sheets built to withstand tough markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VPLAY B

Viaplay Group

Operates as an entertainment provider company in Sweden, rest of Nordics, rest of Europe, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives