- Sweden

- /

- Interactive Media and Services

- /

- OM:BETCO

High Growth Tech Stocks In Sweden For October 2024

Reviewed by Simply Wall St

As the European Central Bank's recent rate cuts fuel optimism for further monetary easing, Sweden's tech sector remains a focal point for investors seeking high growth opportunities amidst a broader positive market sentiment. In this dynamic environment, identifying stocks with strong fundamentals and innovative capabilities can be key to capitalizing on potential growth in the Swedish tech landscape.

Top 10 High Growth Tech Companies In Sweden

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Fortnox | 20.12% | 24.20% | ★★★★★★ |

| Hemnet Group | 20.74% | 26.12% | ★★★★★★ |

| Truecaller | 20.45% | 21.76% | ★★★★★★ |

| Xbrane Biopharma | 53.90% | 118.02% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| BioArctic | 42.38% | 98.40% | ★★★★★★ |

| Bonesupport Holding | 33.76% | 31.20% | ★★★★★★ |

| KebNi | 32.82% | 87.24% | ★★★★★★ |

| Yubico | 20.52% | 42.18% | ★★★★★★ |

| Skolon | 32.37% | 135.49% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Better Collective (OM:BETCO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Better Collective A/S is a digital sports media company operating in Europe, North America, and internationally with a market cap of SEK13.91 billion.

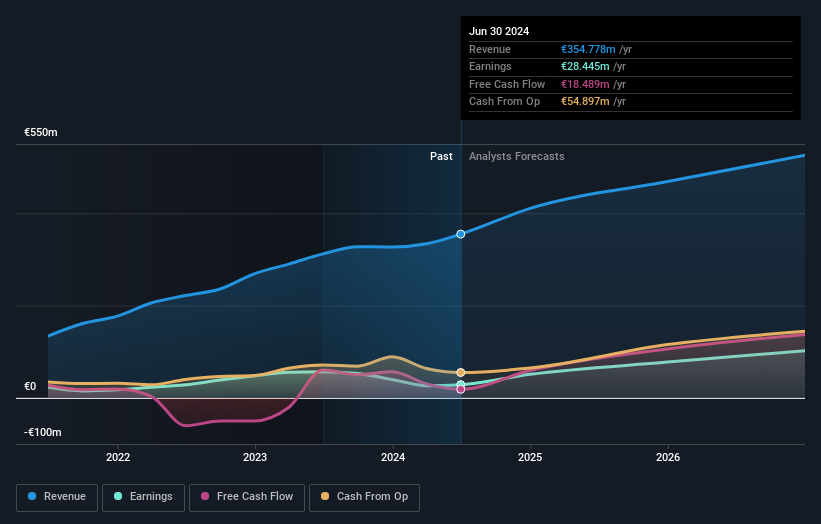

Operations: The company generates revenue primarily through its Publishing segment (€245.06 million) and Paid Media segment (€109.72 million).

Better Collective, a Swedish tech firm, has recently demonstrated robust financial growth with a notable increase in sales from EUR 78.12 million to EUR 99.12 million year-over-year as of June 2024. Despite this surge, the company's net profit margins have dipped to 8% from last year’s 18.1%, reflecting some underlying challenges despite top-line growth. The firm is poised for future earnings expansion, projected at an impressive rate of 44.2% annually, outpacing the broader Swedish market's expectation of 15.8%. This forecast aligns with Better Collective’s strategic initiatives presented at the SBC Summit and recent executive board enhancements aimed at bolstering governance and market position.

- Get an in-depth perspective on Better Collective's performance by reading our health report here.

Gain insights into Better Collective's past trends and performance with our Past report.

BioInvent International (OM:BINV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BioInvent International AB (publ) is a clinical-stage company focused on discovering, researching, and developing novel immuno-modulatory antibodies for cancer treatment globally, with a market cap of approximately SEK2.85 billion.

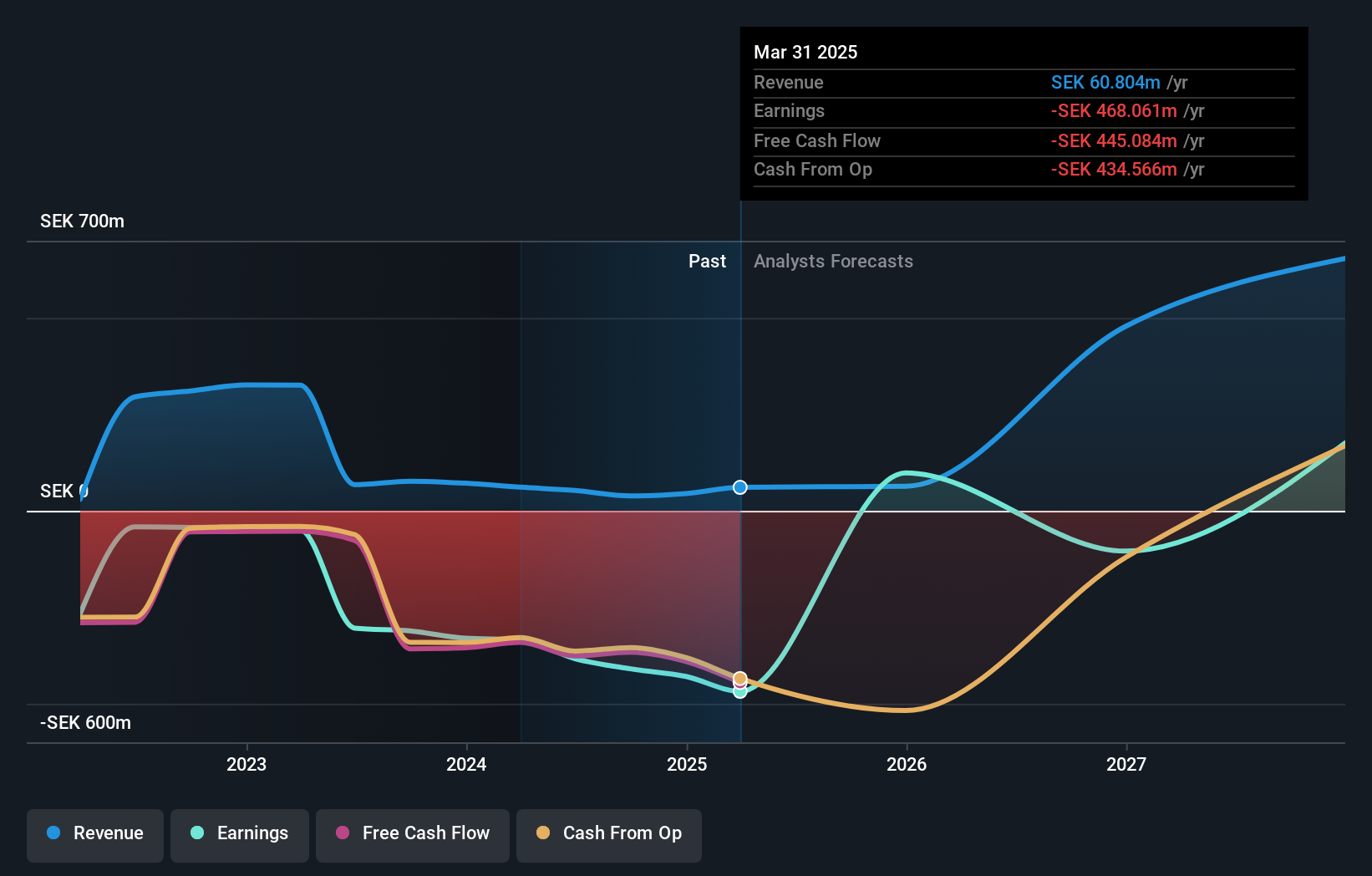

Operations: BioInvent International generates revenue primarily through the development of antibody-based drugs, amounting to SEK52.67 million. The company is engaged in the clinical-stage research and development of novel immuno-modulatory antibodies aimed at cancer treatment across various international markets.

BioInvent International, amidst a challenging landscape, is navigating with promising strides in its oncological research. Recent data from their Phase 2/2a study on BT-001 showcased notable antitumor activity, potentially revolutionizing treatment for refractory solid tumors. Despite a net loss widening to SEK 137.31 million in Q2 2024 from SEK 88.35 million the previous year, the firm's aggressive R&D investment aligns with its revenue forecasts growing at an impressive rate of 77.3% annually. This strategic focus on innovative cancer therapies could position BioInvent favorably as it progresses towards profitability forecasted to surge by 102.7% annually within three years, signaling robust future prospects if current trends persist.

- Dive into the specifics of BioInvent International here with our thorough health report.

Evaluate BioInvent International's historical performance by accessing our past performance report.

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market cap of approximately SEK4.73 billion.

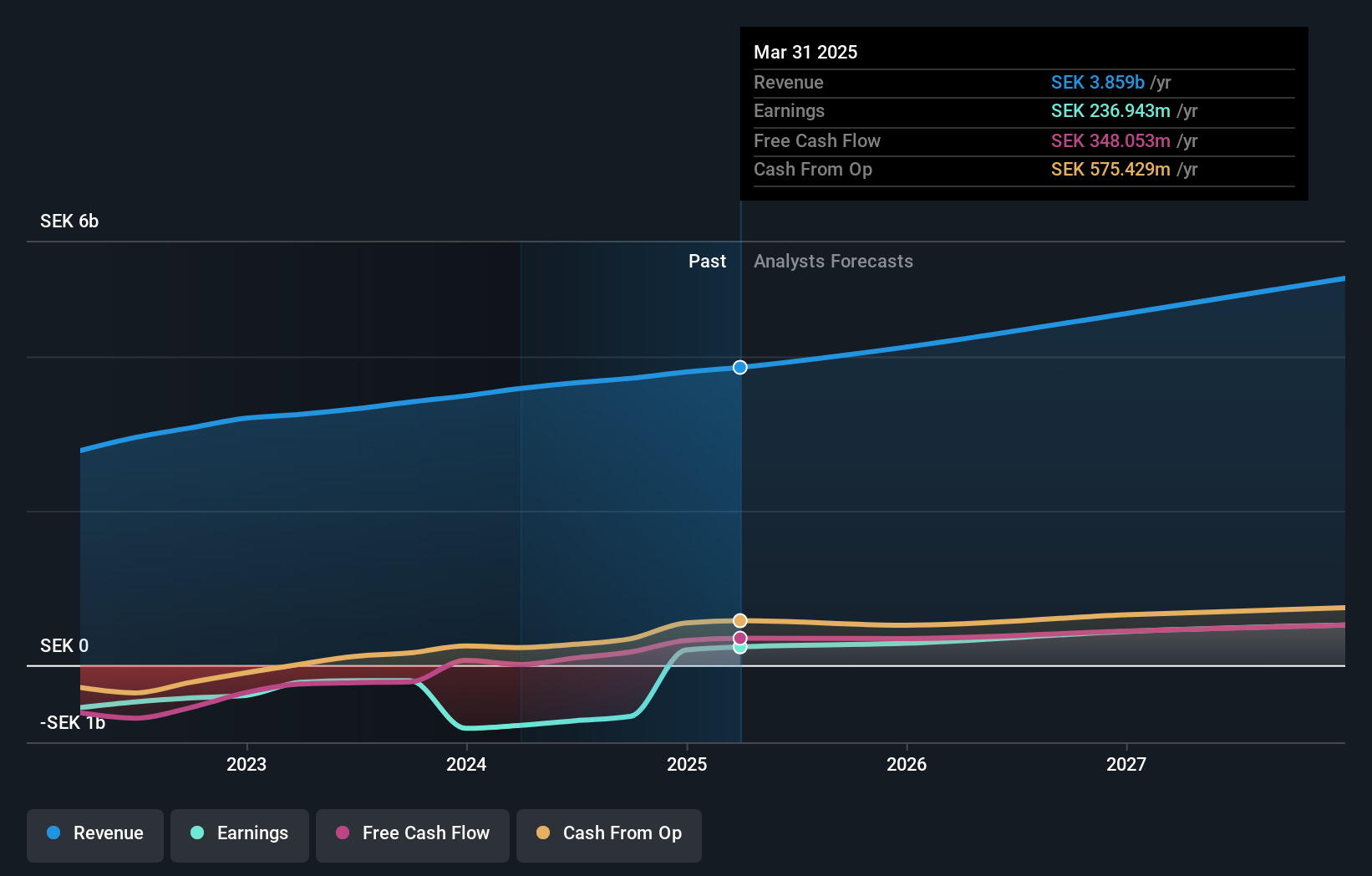

Operations: The company generates revenue primarily from its streaming services for audiobooks and e-books, with books contributing SEK825.91 million. Segment adjustments account for an additional SEK3.46 billion in the financials.

Storytel, amid Sweden's vibrant tech scene, has demonstrated robust financial and strategic growth. With a revenue increase of 9.2% per year, the company is outpacing the Swedish market's growth rate of 0.07%. This expansion is further supported by a recent partnership with Wellhub across several countries, integrating audiobooks into wellness platforms and potentially enlarging its customer base significantly. The firm also turned a profit this year with SEK 29.22 million in Q2, contrasting sharply with last year’s loss of SEK 31.72 million in the same quarter, showcasing effective operational improvements and market adaptation strategies. These developments position Storytel on a promising trajectory as it leverages innovative collaborations to enhance its service offerings globally.

- Delve into the full analysis health report here for a deeper understanding of Storytel.

Review our historical performance report to gain insights into Storytel's's past performance.

Seize The Opportunity

- Navigate through the entire inventory of 84 Swedish High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Better Collective might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BETCO

Better Collective

Operates as a digital sports media company in Europe, North America, and internationally.

Moderate and good value.