As European markets respond to the European Central Bank's recent interest rate cuts, expectations for further monetary easing have buoyed investor sentiment, with major stock indexes in the region seeing gains. Against this backdrop, small-cap stocks in Sweden present intriguing opportunities for investors seeking potential growth, as these companies often benefit from favorable economic conditions and innovative business models that can thrive amidst changing market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AQ Group | 16.75% | 15.13% | 21.34% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Bulten | 62.00% | 16.31% | 20.43% | ★★★★☆☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

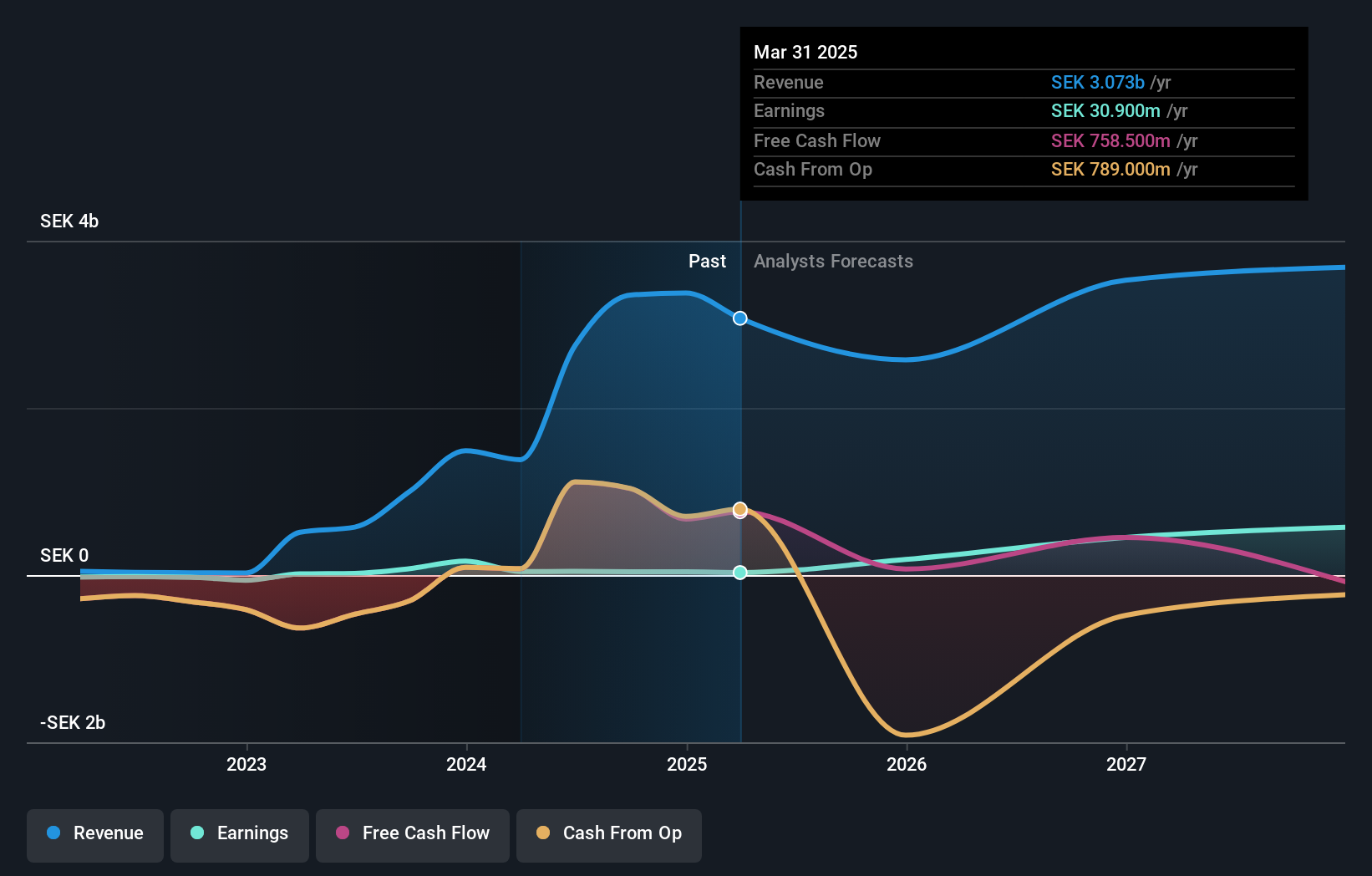

Besqab (OM:BESQAB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Besqab (ticker: OM:BESQAB) is involved in the green field development of residential buildings and the conversion of commercial real estate into residential premises, with a market cap of approximately SEK2.68 billion.

Operations: Besqab's revenue streams primarily stem from the development of residential buildings and the conversion of commercial properties into residential spaces. The company has a market capitalization of approximately SEK2.68 billion.

Besqab, a nimble player in the real estate sector, has seen its earnings surge by 126% over the past year, outpacing the broader Consumer Durables industry. However, this growth includes a significant one-off gain of SEK 61 million. Despite a satisfactory net debt to equity ratio of 36.5%, interest payments are poorly covered with an EBIT coverage of just 0.1x. The company's profit margin has slipped to 1.7% from last year's 3.6%. Recent projects like Aspen and Utsikten highlight Besqab's commitment to eco-friendly construction but shareholder dilution remains a concern amidst these expansions.

- Click to explore a detailed breakdown of our findings in Besqab's health report.

Assess Besqab's past performance with our detailed historical performance reports.

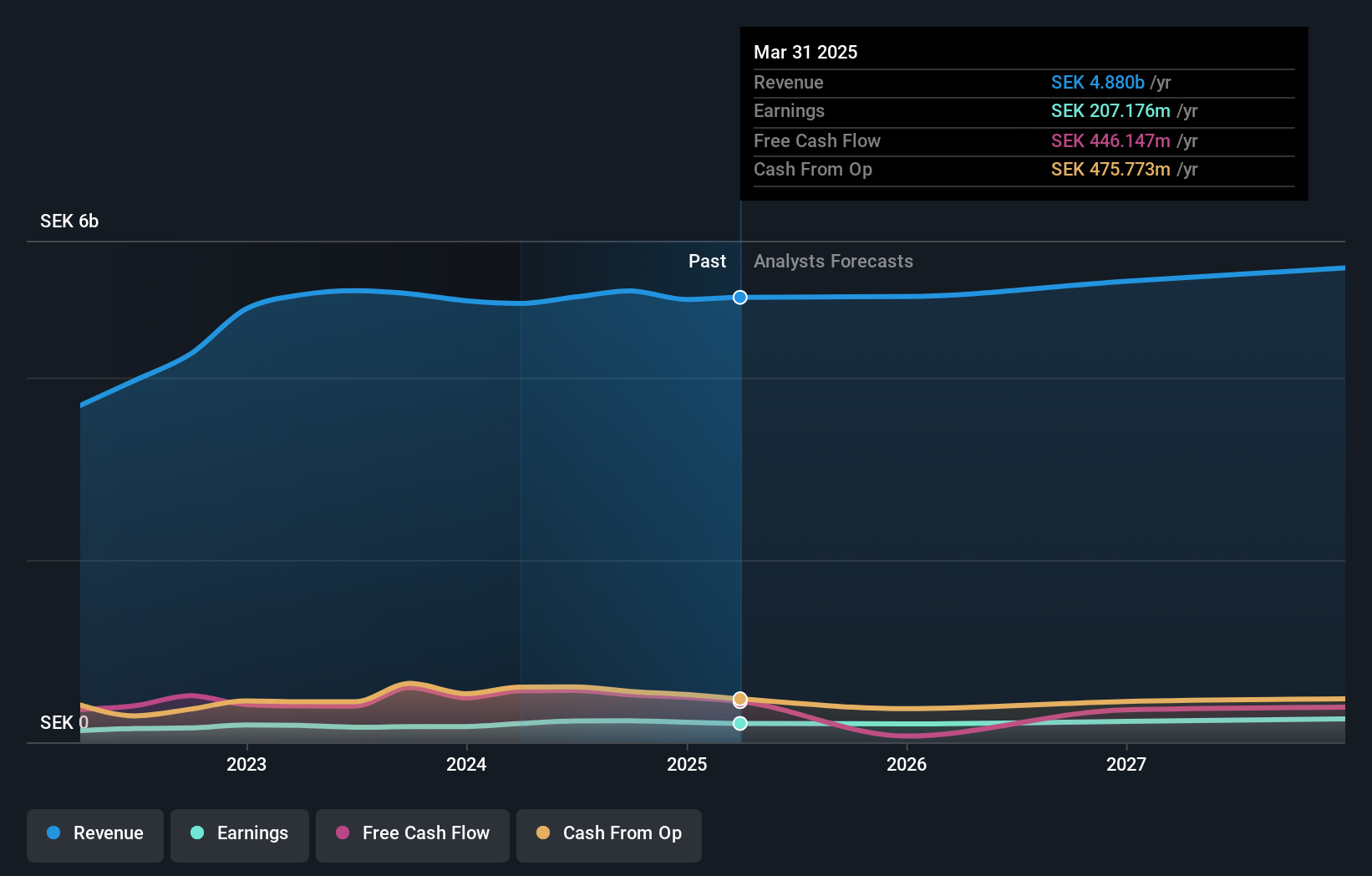

Proact IT Group (OM:PACT)

Simply Wall St Value Rating: ★★★★★★

Overview: Proact IT Group AB (publ) offers data and information management services focusing on cloud services and data center solutions across Sweden, the United Kingdom, the Netherlands, Germany, and other international markets, with a market capitalization of approximately SEK3.91 billion.

Operations: Revenue streams for Proact IT Group AB are primarily derived from its operations in the Nordics & Baltics, which contribute SEK2.59 billion, followed by Central Europe (Czech Republic and Germany) with SEK877 million, and the West (Belgium and Netherlands) with SEK834 million.

Sweden's Proact IT Group seems to be an intriguing player in the IT sector, with its earnings growth of 41.7% over the past year significantly outpacing the industry average of -6.3%. The company appears to be trading at a considerable discount, 40.8% below its estimated fair value, suggesting potential upside for investors. Financially robust, Proact has reduced its debt-to-equity ratio from 78.3% to 48.8% over five years and maintains strong interest coverage with EBIT covering interest payments 32 times over. Recent leadership changes include Jamie Ford joining as business unit director UK, potentially bolstering strategic initiatives.

- Take a closer look at Proact IT Group's potential here in our health report.

Evaluate Proact IT Group's historical performance by accessing our past performance report.

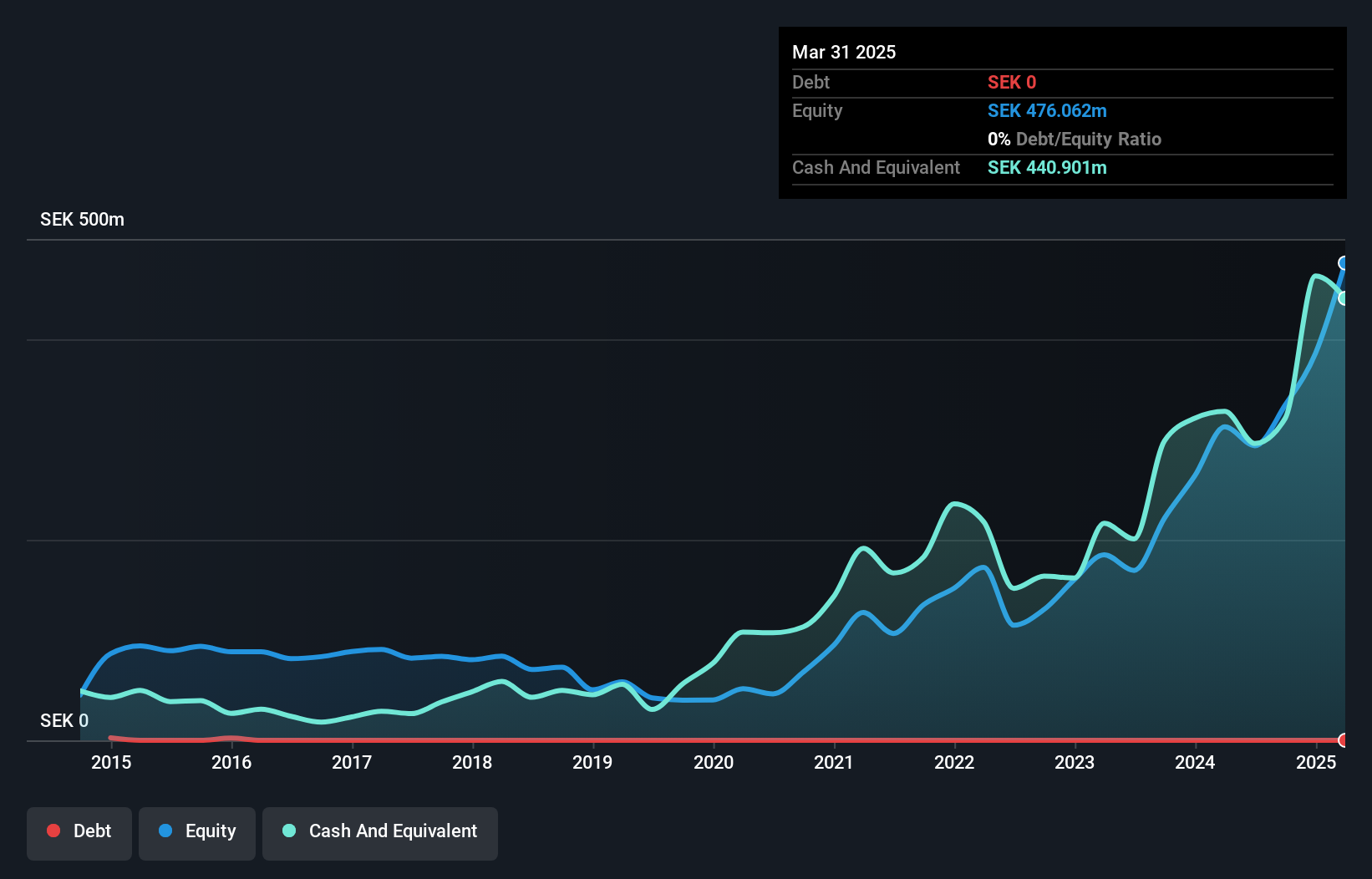

Zinzino (OM:ZZ B)

Simply Wall St Value Rating: ★★★★★★

Overview: Zinzino AB (publ) is a direct sales company that offers dietary supplements and skincare products in Sweden and internationally, with a market cap of approximately SEK3.09 billion.

Operations: Zinzino generates revenue primarily from its Zinzino (Incl. VMA Life) segment, which accounts for SEK1.83 billion, while Faun contributes SEK170.31 million.

Zinzino, a Swedish company in the retail distributors sector, has been performing impressively with earnings growth of 66.9% over the past year, outpacing the industry average of -3.1%. The firm is debt-free and trades at 60.5% below its estimated fair value, suggesting potential undervaluation. Recent sales announcements highlight a robust revenue increase of 39% in August to SEK 178.7 million compared to SEK 128.4 million last year. For the second quarter of 2024, net income rose to SEK 47.99 million from SEK 36.8 million previously, with basic earnings per share improving from SEK 1.09 to SEK 1.41.

- Unlock comprehensive insights into our analysis of Zinzino stock in this health report.

Gain insights into Zinzino's historical performance by reviewing our past performance report.

Taking Advantage

- Get an in-depth perspective on all 56 Swedish Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PACT

Proact IT Group

Provides data and information management services with cloud services and data center solutions in Sweden, the United Kingdom, the Netherlands, Germany, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives