- Sweden

- /

- Entertainment

- /

- OM:SF

We're Not Counting On Stillfront Group (STO:SF) To Sustain Its Statutory Profitability

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. In this article, we'll look at how useful this year's statutory profit is, when analysing Stillfront Group (STO:SF).

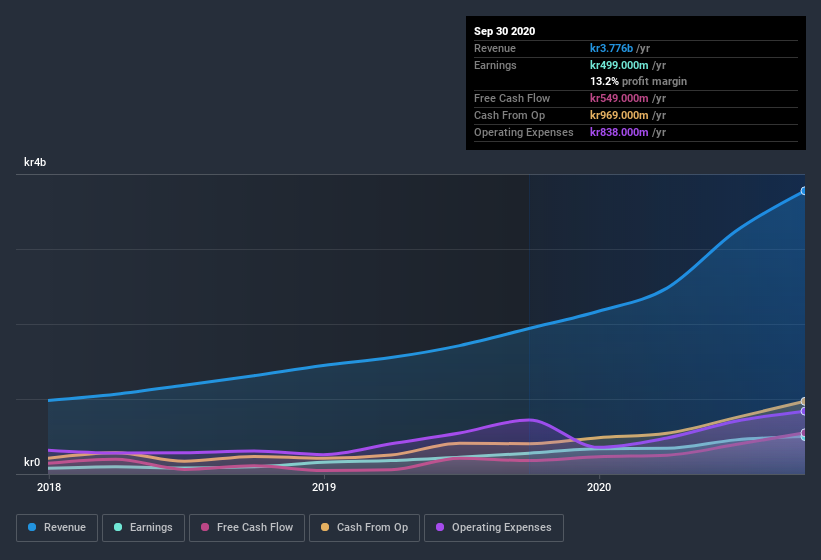

It's good to see that over the last twelve months Stillfront Group made a profit of kr499.0m on revenue of kr3.78b. At the risk of seeming quaint, we do like to at least examine profit, even when a stock is improving revenue and considered a 'growth stock'.

See our latest analysis for Stillfront Group

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. In this article we will consider how Stillfront Group's decision to issue new shares in the company has impacted returns to shareholders. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Stillfront Group increased the number of shares on issue by 30% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Stillfront Group's EPS by clicking here.

How Is Dilution Impacting Stillfront Group's Earnings Per Share? (EPS)

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. The good news is that profit was up 80% in the last twelve months. On the other hand, earnings per share are only up 45% over the same period. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if Stillfront Group can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Stillfront Group's Profit Performance

Stillfront Group shareholders should keep in mind how many new shares it is issuing, because, dilution clearly has the power to severely impact shareholder returns. Because of this, we think that it may be that Stillfront Group's statutory profits are better than its underlying earnings power. The good news is that, its earnings per share increased by 45% in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. In terms of investment risks, we've identified 3 warning signs with Stillfront Group, and understanding these should be part of your investment process.

Today we've zoomed in on a single data point to better understand the nature of Stillfront Group's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Stillfront Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Stillfront Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:SF

Stillfront Group

Designs, develops, markets, publishes, and sells digital games in Europe, North America, the United Kingdom, and the Middle East and North Africa region.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives