- Sweden

- /

- Entertainment

- /

- OM:SF

Optimistic Investors Push Stillfront Group AB (publ) (STO:SF) Shares Up 41% But Growth Is Lacking

Those holding Stillfront Group AB (publ) (STO:SF) shares would be relieved that the share price has rebounded 41% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 52% share price decline over the last year.

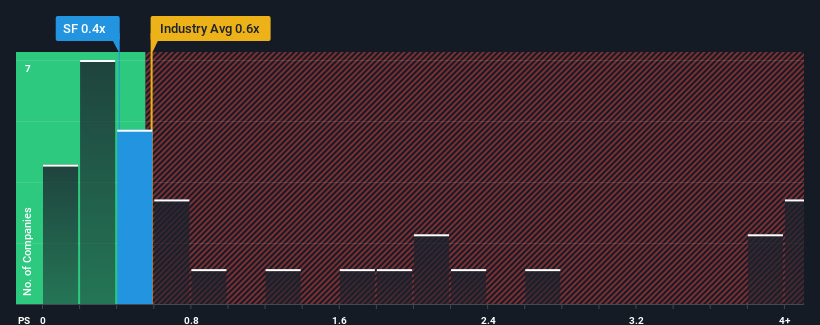

Although its price has surged higher, you could still be forgiven for feeling indifferent about Stillfront Group's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Entertainment industry in Sweden is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Stillfront Group

How Has Stillfront Group Performed Recently?

While the industry has experienced revenue growth lately, Stillfront Group's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Stillfront Group will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Stillfront Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Stillfront Group's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.8%. Regardless, revenue has managed to lift by a handy 11% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 8.9% as estimated by the five analysts watching the company. With the industry predicted to deliver 3.0% growth, that's a disappointing outcome.

In light of this, it's somewhat alarming that Stillfront Group's P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Stillfront Group's P/S?

Its shares have lifted substantially and now Stillfront Group's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our check of Stillfront Group's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Stillfront Group with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SF

Stillfront Group

Designs, develops, markets, publishes, and sells digital games in Europe, North America, the Middle East and North Africa, and the Asia-Pacific.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026