Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Nitro Games Oyj (STO:NITRO) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Nitro Games Oyj

What Is Nitro Games Oyj's Debt?

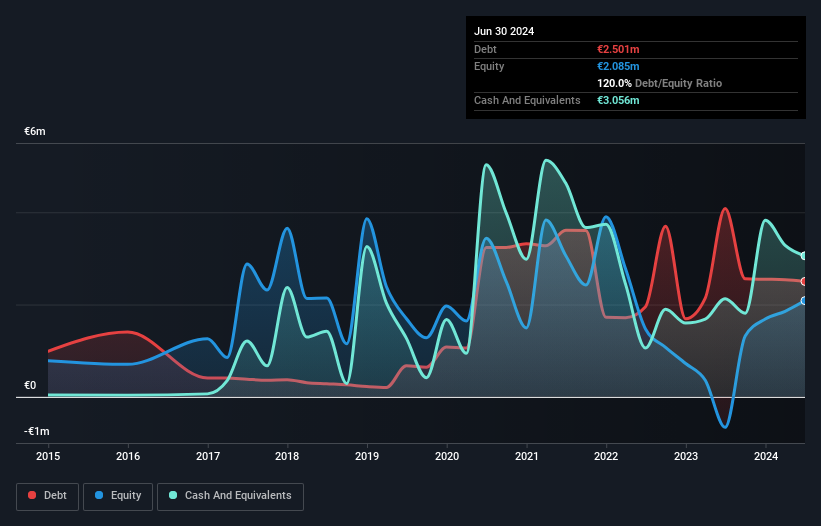

As you can see below, Nitro Games Oyj had €2.50m of debt at June 2024, down from €4.08m a year prior. But it also has €3.06m in cash to offset that, meaning it has €555.4k net cash.

How Strong Is Nitro Games Oyj's Balance Sheet?

We can see from the most recent balance sheet that Nitro Games Oyj had liabilities of €4.56m falling due within a year, and liabilities of €2.57m due beyond that. Offsetting these obligations, it had cash of €3.06m as well as receivables valued at €958.6k due within 12 months. So it has liabilities totalling €3.12m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of €4.96m, so it does suggest shareholders should keep an eye on Nitro Games Oyj's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. Despite its noteworthy liabilities, Nitro Games Oyj boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Nitro Games Oyj can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Nitro Games Oyj reported revenue of €11m, which is a gain of 37%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

So How Risky Is Nitro Games Oyj?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that Nitro Games Oyj had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through €1.1m of cash and made a loss of €1.6m. But the saving grace is the €555.4k on the balance sheet. That means it could keep spending at its current rate for more than two years. With very solid revenue growth in the last year, Nitro Games Oyj may be on a path to profitability. Pre-profit companies are often risky, but they can also offer great rewards. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Nitro Games Oyj (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Nitro Games Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NITRO

Nitro Games Oyj

Develops and publishes games for mobiles in the European Union, North America, the United Kingdom, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives