- Sweden

- /

- Entertainment

- /

- OM:MTG B

Investors Appear Satisfied With Modern Times Group MTG AB's (STO:MTG B) Prospects

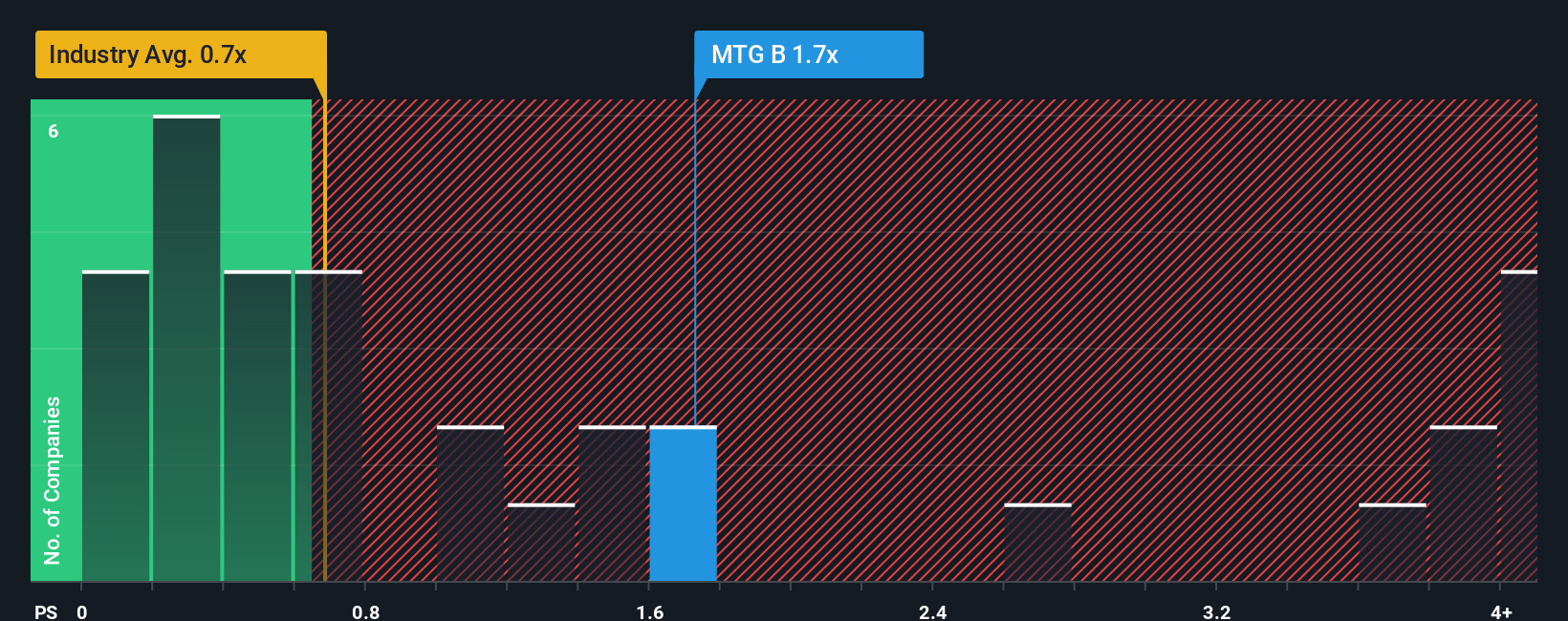

When close to half the companies in the Entertainment industry in Sweden have price-to-sales ratios (or "P/S") below 0.7x, you may consider Modern Times Group MTG AB (STO:MTG B) as a stock to potentially avoid with its 1.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Modern Times Group MTG

How Modern Times Group MTG Has Been Performing

Revenue has risen firmly for Modern Times Group MTG recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Modern Times Group MTG will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

Modern Times Group MTG's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. Pleasingly, revenue has also lifted 40% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 2.6% shows it's noticeably more attractive.

With this information, we can see why Modern Times Group MTG is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Modern Times Group MTG can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Modern Times Group MTG with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:MTG B

Modern Times Group MTG

Through its subsidiaries, engages in the provision of game franchises in Sweden, the United Kingdom, Germany, rest of Europe, Singapore, India, the United States, and New Zealand.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives