- Denmark

- /

- Healthtech

- /

- CPSE:NNIT

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets continue to navigate economic complexities, U.S. stock indexes are climbing toward record highs, driven by growth stocks outpacing value shares and a notable rise in the Nasdaq Composite. Despite small-cap stocks lagging behind larger indices like the S&P 500, investors remain focused on identifying high-growth tech opportunities that can thrive amid shifting inflation expectations and evolving trade policies. In this environment, a good tech stock might be characterized by its ability to innovate and adapt quickly to changing market dynamics while maintaining strong fundamentals.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 25.36% | 25.10% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Ascendis Pharma | 33.05% | 58.72% | ★★★★★★ |

Click here to see the full list of 1209 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

NNIT (CPSE:NNIT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NNIT A/S is an IT services provider catering to the life sciences, public, and private sectors across Denmark, Europe, the United States, and Asia with a market cap of DKK2.05 billion.

Operations: NNIT A/S generates revenue primarily from its IT services across various regions, with Denmark contributing the largest share at DKK828.30 million, followed by Europe at DKK494.80 million. The company also has significant operations in the United States and Asia, with revenues of DKK366.10 million and DKK139.30 million respectively.

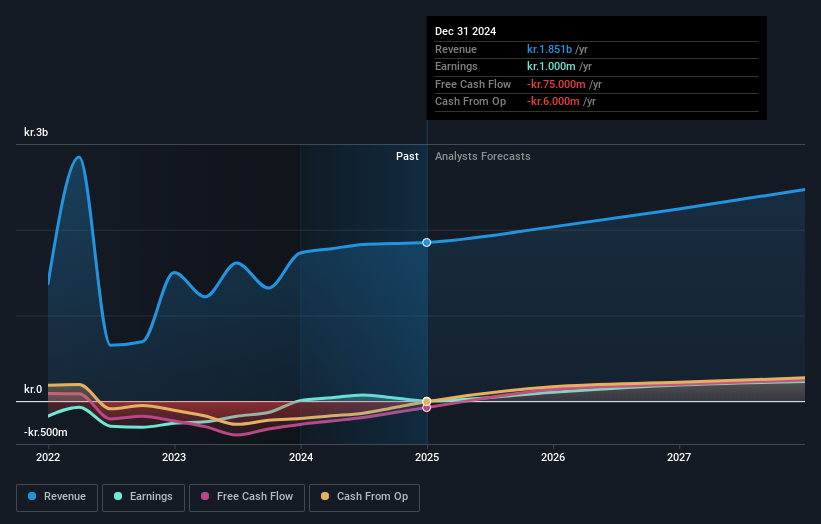

NNIT, a company that recently transitioned to profitability, demonstrates promising potential with an annual revenue growth rate of 9.7%, slightly outpacing the Danish market's 9.4%. This growth is complemented by an impressive forecast of earnings increasing at 50.9% annually, signaling robust future prospects in a competitive landscape. Despite challenges in maintaining high free cash flow, NNIT's strategic focus on expanding its technological and service offerings could enhance its market position. By investing significantly in R&D, NNIT not only fosters innovation but also aligns with industry shifts towards more integrated and advanced solutions, ensuring its relevance in the evolving tech landscape.

- Dive into the specifics of NNIT here with our thorough health report.

Understand NNIT's track record by examining our Past report.

Genomictree (KOSDAQ:A228760)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Genomictree Inc. is a biomarker-based molecular diagnostics company that focuses on developing and commercializing products for cancer and infectious disease detection, with a market cap of ₩427.02 billion.

Operations: The company generates revenue primarily from its Cancer Molecular Diagnosis Business, contributing ₩2.06 billion, while its Genomic Analysis and Other Business adds ₩0.14 billion.

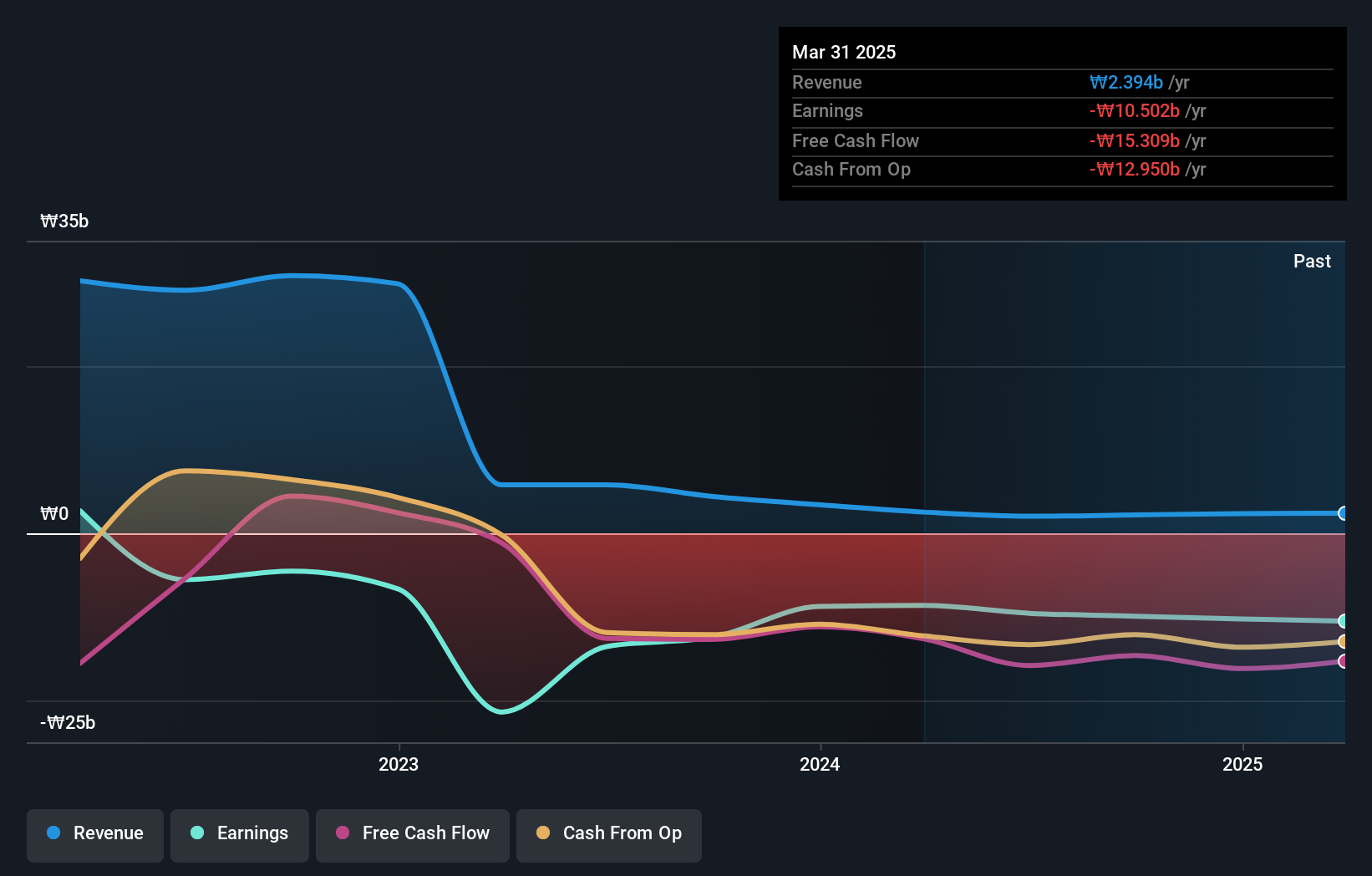

Genomictree is poised for significant growth, with revenue expected to surge by 97.8% annually, outstripping the Korean market's average of 8.9%. This rapid expansion is complemented by an anticipated earnings growth of 115.9% per year, positioning it well above many peers in the biotech sector. Despite currently lacking profitability and meaningful revenue (₩2B), the company's focus on becoming profitable within three years showcases its potential in a fiercely competitive landscape. Moreover, Genomictree's commitment to innovation is evident from its strategic investments in R&D, essential for maintaining relevance and driving future growth in high-stakes biotechnological advancements.

- Click to explore a detailed breakdown of our findings in Genomictree's health report.

Gain insights into Genomictree's past trends and performance with our Past report.

Karnov Group (OM:KAR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Karnov Group AB (publ) offers information products and services for professionals in legal, tax and accounting, environmental, and health and safety sectors across Denmark, Norway, France, Sweden, Portugal, and Spain with a market cap of approximately SEK9.54 billion.

Operations: The company generates revenue through its operations in Region North and Region South, with SEK1.16 billion and SEK1.38 billion, respectively.

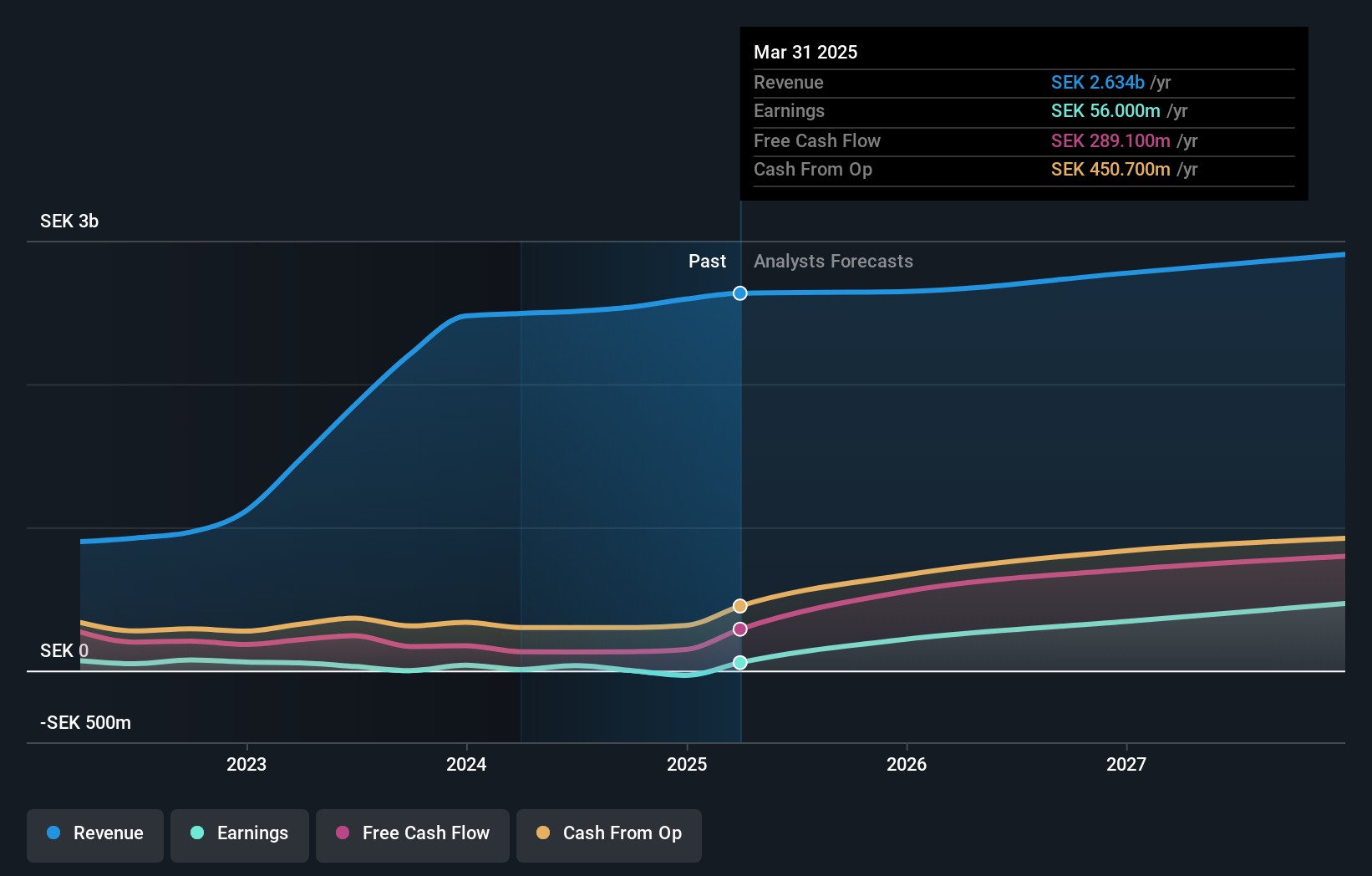

Karnov Group, while grappling with a one-off loss of SEK 3.6 million, shows robust potential with earnings forecasted to expand at an impressive rate of 121% annually, far outpacing the Swedish market's growth expectation of 10.7%. This significant uptick is not just a spike but part of a consistent upward trajectory in earnings growth over the past year by 466.7%, notably surpassing its industry's average increase of 30.4%. Despite these strong profit growth projections and a positive free cash flow status, revenue growth remains moderate at an annual rate of 4.4%, slightly ahead of the market’s pace at 1.1%. These figures underscore Karnov’s resilience and potential for scaling operations amidst financial nuances marked by exceptional items impacting its financial results.

- Unlock comprehensive insights into our analysis of Karnov Group stock in this health report.

Evaluate Karnov Group's historical performance by accessing our past performance report.

Next Steps

- Dive into all 1209 of the High Growth Tech and AI Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NNIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NNIT

NNIT

Provides information technology services to life sciences, public, and private sectors in Denmark, Europe, the United States, and Asia.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives