In December 2024, global markets have been marked by a divergence in major stock indexes, with growth stocks rallying and outperforming value stocks significantly. As the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite reach record highs amid a favorable economic backdrop including robust job growth and potential Federal Reserve rate cuts, investors are keenly observing high-growth tech stocks that can capitalize on these conditions. In this environment, identifying promising tech stocks involves looking for companies with strong innovation pipelines and the ability to adapt swiftly to changing market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1293 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Believe (ENXTPA:BLV)

Simply Wall St Growth Rating: ★★★★☆☆

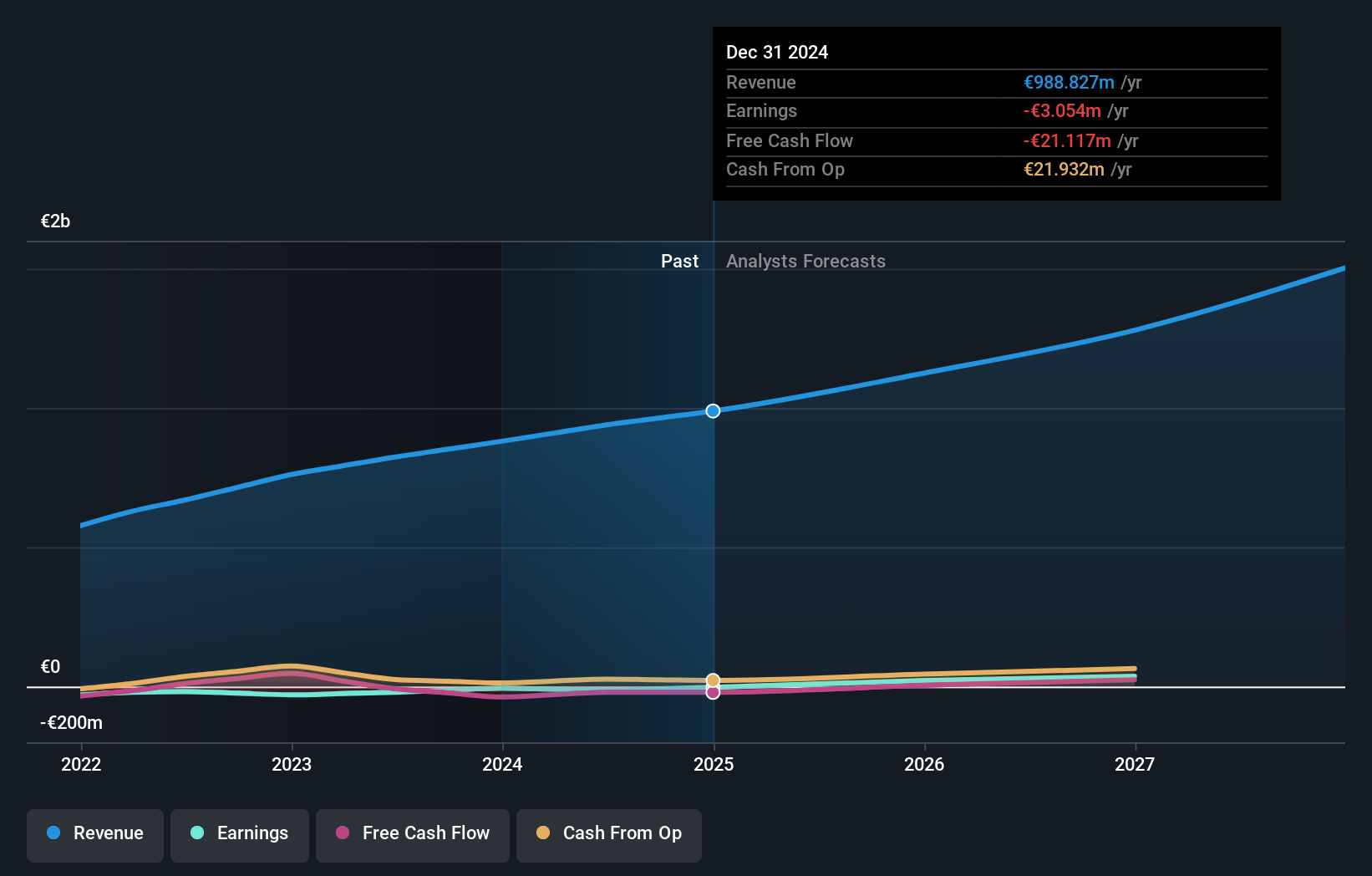

Overview: Believe S.A. offers digital music services to independent labels and local artists across various regions including France, Germany, the rest of Europe, the Americas, Asia, Oceania, and the Pacific with a market capitalization of approximately €1.48 billion.

Operations: The company generates revenue primarily through Premium Solutions, contributing €877.53 million, and Automated Solutions, adding €61.50 million.

Believe's trajectory in the tech sector is marked by a robust revenue growth forecast of 12.9% annually, outpacing the French market's average of 5.6%. This growth is underpinned by significant investments in R&D, which are essential for maintaining competitive advantage and fueling future innovations; last year, R&D expenses were notably high at $200 million. Despite current unprofitability, earnings are expected to surge by 56.8% per year, showcasing potential for substantial financial improvement. The company's focus on expanding its digital music platform through these investments could redefine its market standing and enhance long-term prospects in an industry increasingly reliant on streaming and digital services.

- Click to explore a detailed breakdown of our findings in Believe's health report.

Evaluate Believe's historical performance by accessing our past performance report.

Hemnet Group (OM:HEM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hemnet Group AB (publ) operates a residential property platform in Sweden and has a market cap of approximately SEK33.15 billion.

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to SEK1.31 billion. It operates a residential property platform in Sweden, focusing on connecting buyers and sellers within the real estate market.

Hemnet Group AB, with its recent executive changes and robust financial performance, exemplifies resilience in the tech sector. The company's revenue is expected to grow by 19.5% annually, outstripping the Swedish market's growth of 0.3%. This surge is supported by a projected annual earnings increase of 24.8%, significantly above the market average of 15.2%. Moreover, Hemnet has demonstrated a remarkable past year earnings growth of 52%, surpassing its industry peers' growth rate of 30.4%. These figures underscore Hemnet’s capacity to leverage its leadership changes and strategic initiatives for sustained financial health and market dominance in interactive media and services.

- Click here to discover the nuances of Hemnet Group with our detailed analytical health report.

Gain insights into Hemnet Group's historical performance by reviewing our past performance report.

Macbee Planet (TSE:7095)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Macbee Planet, Inc. engages in analytics consulting and marketing technology services in Japan, with a market capitalization of ¥38.46 billion.

Operations: The company generates revenue primarily through its LTV Marketing Business, contributing ¥41.43 billion. It operates within the analytics consulting and marketing technology sectors in Japan.

Macbee Planet's strategic maneuvers, including a significant share repurchase program and robust dividend projections, underscore its commitment to enhancing shareholder value. The company has repurchased 4.26% of its shares for ¥1,622.7 million, reflecting confidence in its financial health and future prospects. This is complemented by an anticipated revenue growth of 16.2% per year and earnings growth of 21.1% per year, figures that notably outpace the broader Japanese market's averages of 4.1% and 7.8%, respectively. These financial strategies are not just about immediate gains but are aligned with long-term stability and growth in the tech sector, positioning Macbee Planet favorably among peers with a forward-looking approach to capital management and market expansion.

- Dive into the specifics of Macbee Planet here with our thorough health report.

Explore historical data to track Macbee Planet's performance over time in our Past section.

Summing It All Up

- Click this link to deep-dive into the 1293 companies within our High Growth Tech and AI Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hemnet Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HEM

Outstanding track record with high growth potential.