- Sweden

- /

- Entertainment

- /

- OM:GBK

Subdued Growth No Barrier To Goodbye Kansas Group AB (publ) (STO:GBK) With Shares Advancing 32%

Goodbye Kansas Group AB (publ) (STO:GBK) shares have continued their recent momentum with a 32% gain in the last month alone. But the last month did very little to improve the 89% share price decline over the last year.

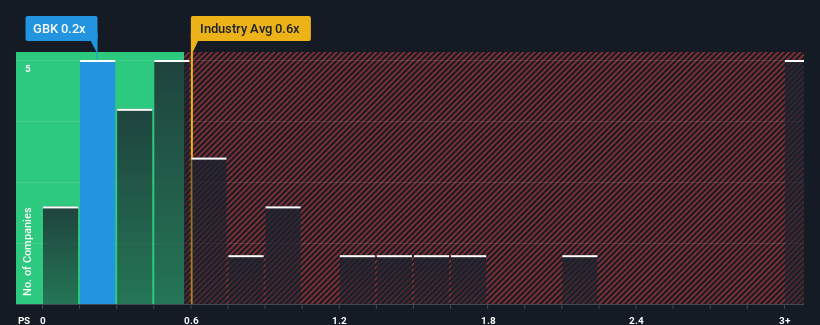

In spite of the firm bounce in price, it's still not a stretch to say that Goodbye Kansas Group's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Entertainment industry in Sweden, where the median P/S ratio is around 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Goodbye Kansas Group

What Does Goodbye Kansas Group's Recent Performance Look Like?

For instance, Goodbye Kansas Group's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Goodbye Kansas Group will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Goodbye Kansas Group?

Goodbye Kansas Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 36%. This means it has also seen a slide in revenue over the longer-term as revenue is down 30% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 0.6% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Goodbye Kansas Group's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Final Word

Goodbye Kansas Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We find it unexpected that Goodbye Kansas Group trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Goodbye Kansas Group is showing 6 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Goodbye Kansas Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GBK

Goodbye Kansas Group

Supplies technology driven visual content in Sweden.

Medium-low and slightly overvalued.

Market Insights

Community Narratives