- Sweden

- /

- Entertainment

- /

- OM:FRAG

Positive Sentiment Still Eludes Fragbite Group AB (publ) (STO:FRAG) Following 26% Share Price Slump

Unfortunately for some shareholders, the Fragbite Group AB (publ) (STO:FRAG) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 99% share price decline.

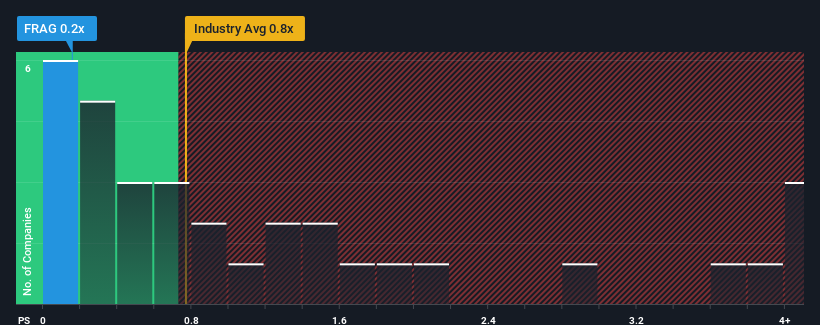

Following the heavy fall in price, it would be understandable if you think Fragbite Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in Sweden's Entertainment industry have P/S ratios above 0.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Fragbite Group

How Fragbite Group Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, Fragbite Group has been doing quite well of late. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. Those who are bullish on Fragbite Group will be hoping that this isn't the case and the company continues to beat out the industry.

Want the full picture on analyst estimates for the company? Then our free report on Fragbite Group will help you uncover what's on the horizon.How Is Fragbite Group's Revenue Growth Trending?

In order to justify its P/S ratio, Fragbite Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 6.3% gain to the company's revenues. Pleasingly, revenue has also lifted 271% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 104% as estimated by the only analyst watching the company. With the industry only predicted to deliver 1.4%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Fragbite Group's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Fragbite Group's P/S

The southerly movements of Fragbite Group's shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Fragbite Group's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Fragbite Group you should know about.

If these risks are making you reconsider your opinion on Fragbite Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FRAG

Fragbite Group

Develops and publishes games and esports content for the GAMING, ESPORTS, and WEB3 markets in the Nordic region.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.