- Sweden

- /

- Entertainment

- /

- OM:EMBRAC B

Most Shareholders Will Probably Agree With Embracer Group AB (publ)'s (STO:EMBRAC B) CEO Compensation

Key Insights

- Embracer Group will host its Annual General Meeting on 21st of September

- Salary of kr1.00m is part of CEO Lars Wingefors's total remuneration

- The total compensation is 93% less than the average for the industry

- Embracer Group's three-year loss to shareholders was 68% while its EPS grew by 118% over the past three years

Shareholders may be wondering what CEO Lars Wingefors plans to do to improve the less than great performance at Embracer Group AB (publ) (STO:EMBRAC B) recently. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 21st of September. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. In our opinion, CEO compensation does not look excessive and we discuss why.

See our latest analysis for Embracer Group

Comparing Embracer Group AB (publ)'s CEO Compensation With The Industry

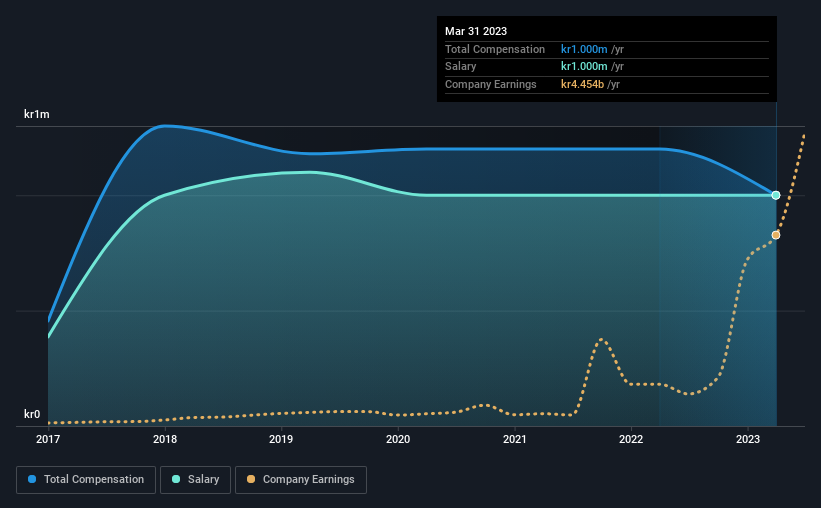

According to our data, Embracer Group AB (publ) has a market capitalization of kr36b, and paid its CEO total annual compensation worth kr1.0m over the year to March 2023. We note that's a decrease of 17% compared to last year. Notably, the salary of kr1.0m is the entirety of the CEO compensation.

On examining similar-sized companies in the Swedish Entertainment industry with market capitalizations between kr22b and kr71b, we discovered that the median CEO total compensation of that group was kr14m. Accordingly, Embracer Group pays its CEO under the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr1.0m | kr1.0m | 100% |

| Other | - | kr200k | - |

| Total Compensation | kr1.0m | kr1.2m | 100% |

Talking in terms of the industry, salary represented approximately 71% of total compensation out of all the companies we analyzed, while other remuneration made up 29% of the pie. Speaking on a company level, Embracer Group prefers to tread along a traditional path, disbursing all compensation through a salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Embracer Group AB (publ)'s Growth Numbers

Over the past three years, Embracer Group AB (publ) has seen its earnings per share (EPS) grow by 118% per year. In the last year, its revenue is up 101%.

This demonstrates that the company has been improving recently and is good news for the shareholders. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Embracer Group AB (publ) Been A Good Investment?

With a total shareholder return of -68% over three years, Embracer Group AB (publ) shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Embracer Group pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The fact that shareholders are sitting on a loss is certainly disheartening. This contrasts to the strong EPS growth recently however, and suggests that there may be other factors at play driving down the share price. There needs to be more focus by management and the board to examine why the share price has diverged from fundamentals. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 4 warning signs for Embracer Group (of which 1 makes us a bit uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Embracer Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EMBRAC B

Embracer Group

Develops and publishes PC, console, mobile, VR, and board games for the games market worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success