- Sweden

- /

- Communications

- /

- OM:ERIC B

Exploring Embracer Group And 2 Other High Growth Tech Stocks In Sweden

Reviewed by Simply Wall St

As global markets face uncertainty due to geopolitical tensions and economic fluctuations, the European market, including Sweden, has seen investor caution reflected in key indices like the STOXX Europe 600 Index. In this environment, identifying promising high-growth tech stocks such as those in Sweden requires a focus on companies with strong innovation capabilities and resilience to broader market challenges.

Top 10 High Growth Tech Companies In Sweden

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Truecaller | 20.32% | 21.61% | ★★★★★★ |

| Xbrane Biopharma | 53.90% | 118.02% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Bonesupport Holding | 33.76% | 31.20% | ★★★★★★ |

| Hemnet Group | 20.12% | 25.41% | ★★★★★★ |

| Skolon | 32.63% | 122.14% | ★★★★★★ |

| BioArctic | 42.38% | 98.40% | ★★★★★★ |

| Biovica International | 81.67% | 78.55% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Yubico | 20.52% | 42.18% | ★★★★★★ |

We'll examine a selection from our screener results.

Embracer Group (OM:EMBRAC B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Embracer Group AB (publ) is a global company that, along with its subsidiaries, focuses on developing and publishing games across various platforms including PC, console, mobile, VR, and board games; it has a market cap of approximately SEK39.47 billion.

Operations: Embracer Group, with a market cap of approximately SEK39.47 billion, generates revenue primarily from PC/console games (SEK13.10 billion), tabletop games (SEK14.65 billion), mobile games (SEK5.87 billion), and entertainment & services (SEK6.13 billion).

Embracer Group is navigating a transformative phase, evidenced by its projected revenue growth of 3.2% annually, outpacing the Swedish market's 1.3%. Despite current unprofitability, forecasts suggest a robust profit surge, with earnings expected to grow by an impressive 104.4% per year over the next three years. This growth trajectory is supported by strategic leadership changes and securing a new EUR 600 million credit facility to bolster financial flexibility. However, it's crucial to monitor their R&D expenditures which are pivotal in sustaining innovation and competitiveness in the high-stakes gaming industry.

- Click here to discover the nuances of Embracer Group with our detailed analytical health report.

Understand Embracer Group's track record by examining our Past report.

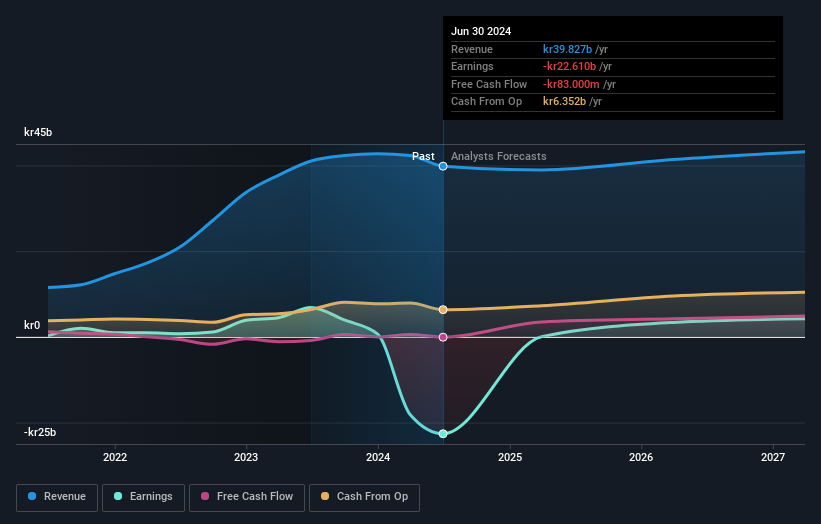

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Telefonaktiebolaget LM Ericsson (publ) offers mobile connectivity solutions to telecom operators and enterprise customers across multiple regions, with a market cap of approximately SEK2.58 trillion.

Operations: Ericsson generates revenue primarily through its Networks segment, which accounts for SEK157.93 billion, followed by Cloud Software and Services at SEK63.35 billion and Enterprise at SEK25.83 billion. The company's focus on providing mobile connectivity solutions spans various regions, catering to both telecom operators and enterprise customers.

Telefonaktiebolaget LM Ericsson, amid a challenging market, is poised for significant transformation with revenue growth projected at 2.3% annually, outstripping Sweden's average. This growth is underpinned by robust forecasts of earnings expansion by 103.6% per year over the next three years, signaling potential profitability and competitive edge in telecommunications. The company's commitment to innovation is evident from its R&D focus; last year's R&D expenses were substantial, reflecting ongoing investment in technology development to maintain relevance and drive future growth in the fast-evolving tech landscape. Recent strategic alliances and client expansions further demonstrate Ericsson’s proactive approach in securing its position as a leader in 5G deployment globally, enhancing long-term value creation through technological advancements and strong partnerships.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of SEK13.59 billion.

Operations: Truecaller AB generates revenue primarily from its communications software segment, amounting to SEK1.72 billion. The company's focus is on developing mobile caller ID applications for a global audience, including regions like India, the Middle East, and Africa.

Truecaller, a leader in communication safety and efficiency, is demonstrating significant growth potential with its innovative solutions. The company's revenue is expected to surge by 20.3% annually, outpacing the Swedish market average of 1.3%. This growth trajectory is supported by an anticipated earnings increase of 21.6% per year. Truecaller's commitment to innovation is further underscored by its substantial investment in R&D, which has been pivotal in developing cutting-edge technologies such as the Verified Business Caller ID solution. This tool not only enhances user experience by ensuring communication authenticity but also solidifies Truecaller’s position within the tech industry amidst increasing concerns over communication security. The recent strategic partnership with Halan underscores Truecaller’s proactive approach to leveraging its technology for broader application in financial services, enhancing both security and customer engagement through verified communications.

- Click here and access our complete health analysis report to understand the dynamics of Truecaller.

Gain insights into Truecaller's historical performance by reviewing our past performance report.

Key Takeaways

- Click this link to deep-dive into the 79 companies within our Swedish High Growth Tech and AI Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telefonaktiebolaget LM Ericsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ERIC B

Telefonaktiebolaget LM Ericsson

Provides mobile connectivity solutions for telcom operators and enterprise customers in various sectors in North America, Europe, Latin America, the Middle East, Africa, North East Asia, South East Asia, Oceania, and India.

Flawless balance sheet with high growth potential.