- Sweden

- /

- Entertainment

- /

- OM:EMBRAC B

Embracer Group (STO:EMBRAC B investor three-year losses grow to 78% as the stock sheds kr3.1b this past week

As an investor, mistakes are inevitable. But really bad investments should be rare. So consider, for a moment, the misfortune of Embracer Group AB (publ) (STO:EMBRAC B) investors who have held the stock for three years as it declined a whopping 78%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And more recent buyers are having a tough time too, with a drop of 26% in the last year. Shareholders have had an even rougher run lately, with the share price down 28% in the last 90 days.

After losing 9.7% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Embracer Group

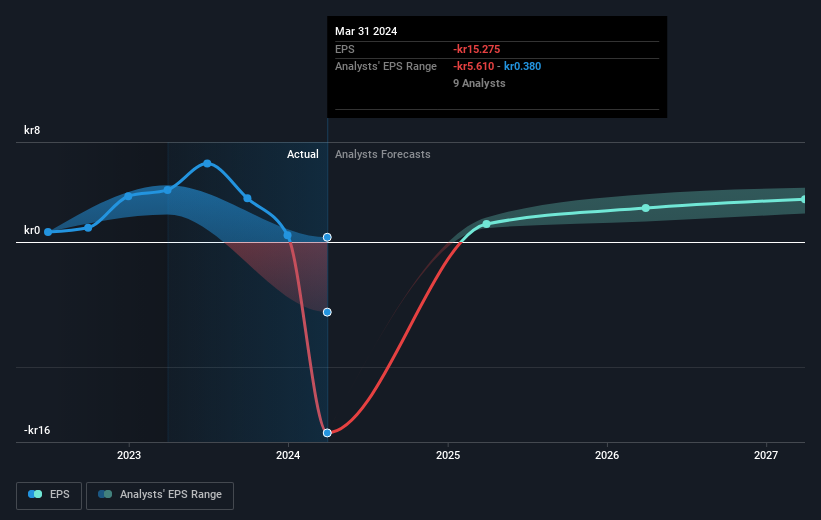

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the three years that the share price declined, Embracer Group's earnings per share (EPS) dropped significantly, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Embracer Group's earnings, revenue and cash flow.

A Different Perspective

Embracer Group shareholders are down 26% for the year, but the market itself is up 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course Embracer Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Embracer Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EMBRAC B

Embracer Group

Develops and publishes PC, console, mobile, VR, and board games for the games market worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives