- Sweden

- /

- Paper and Forestry Products

- /

- OM:RROS

Rottneros AB (publ)'s (STO:RROS) Stock Retreats 26% But Revenues Haven't Escaped The Attention Of Investors

Rottneros AB (publ) (STO:RROS) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

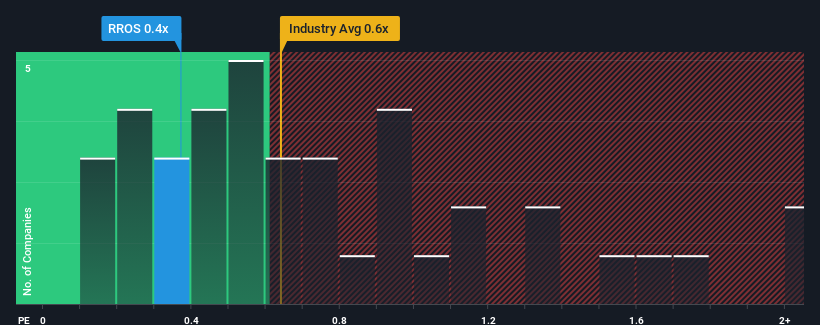

Although its price has dipped substantially, it's still not a stretch to say that Rottneros' price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Forestry industry in Sweden, where the median P/S ratio is around 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Rottneros

How Rottneros Has Been Performing

Rottneros hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Rottneros' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Rottneros' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 1.6% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 18% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 5.6% over the next year. That's shaping up to be similar to the 4.4% growth forecast for the broader industry.

In light of this, it's understandable that Rottneros' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Rottneros' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Rottneros' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Forestry industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Having said that, be aware Rottneros is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:RROS

Rottneros

Develops and produces chemical and mechanical market pulp worldwide.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives