Shareholders May Find It Hard To Justify Increasing OrganoClick AB (publ)'s (STO:ORGC) CEO Compensation For Now

Key Insights

- OrganoClick's Annual General Meeting to take place on 15th of May

- CEO Marten Hellberg's total compensation includes salary of kr1.45m

- The overall pay is comparable to the industry average

- OrganoClick's EPS grew by 8.3% over the past three years while total shareholder loss over the past three years was 71%

In the past three years, the share price of OrganoClick AB (publ) (STO:ORGC) has struggled to grow and now shareholders are sitting on a loss. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 15th of May. They could also influence management through voting on resolutions such as executive remuneration. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

Check out our latest analysis for OrganoClick

How Does Total Compensation For Marten Hellberg Compare With Other Companies In The Industry?

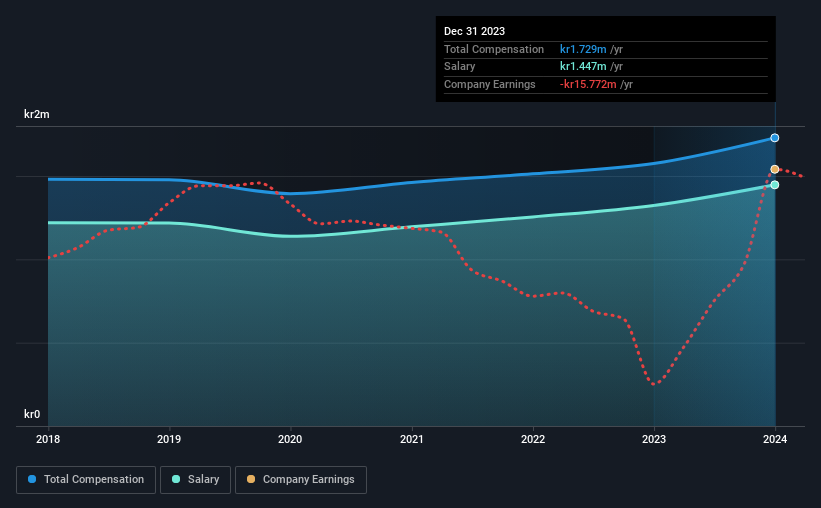

According to our data, OrganoClick AB (publ) has a market capitalization of kr299m, and paid its CEO total annual compensation worth kr1.7m over the year to December 2023. Notably, that's an increase of 9.8% over the year before. Notably, the salary which is kr1.45m, represents most of the total compensation being paid.

In comparison with other companies in the Swedish Chemicals industry with market capitalizations under kr2.2b, the reported median total CEO compensation was kr1.7m. So it looks like OrganoClick compensates Marten Hellberg in line with the median for the industry. What's more, Marten Hellberg holds kr23m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr1.4m | kr1.3m | 84% |

| Other | kr282k | kr252k | 16% |

| Total Compensation | kr1.7m | kr1.6m | 100% |

On an industry level, roughly 82% of total compensation represents salary and 18% is other remuneration. OrganoClick is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

OrganoClick AB (publ)'s Growth

OrganoClick AB (publ)'s earnings per share (EPS) grew 8.3% per year over the last three years. Its revenue is up 12% over the last year.

We would argue that the modest growth in revenue is a notable positive. And the modest growth in EPS isn't bad, either. So while performance isn't amazing, we think it really does seem quite respectable. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has OrganoClick AB (publ) Been A Good Investment?

Few OrganoClick AB (publ) shareholders would feel satisfied with the return of -71% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for OrganoClick that investors should think about before committing capital to this stock.

Important note: OrganoClick is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ORGC

OrganoClick

A green chemical company, develops and markets biobased and biodegradable chemical products and material technologies for the treatment of nonwoven, technical textile, and wood in Sweden, Other Nordics, the Rest of Europe, Asia, North America, and Oceania.

Reasonable growth potential and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion