Earnings Release: Here's Why Analysts Cut Their OrganoClick AB (publ) (STO:ORGC) Price Target To kr3.00

Investors in OrganoClick AB (publ) (STO:ORGC) had a good week, as its shares rose 2.2% to close at kr3.30 following the release of its first-quarter results. Revenues of kr38m fell short of estimates by 11%, but statutory losses were in line with expectations, at kr0.02 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analyst is forecasting for next year, and see if there's been a change in sentiment towards the company. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analyst has changed their mind on OrganoClick after the latest results.

See our latest analysis for OrganoClick

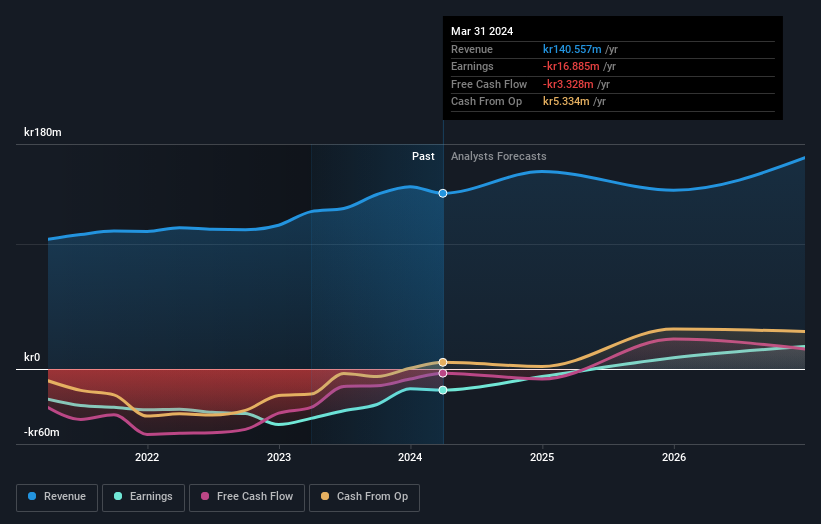

After the latest results, the solitary analyst covering OrganoClick are now predicting revenues of kr158.0m in 2024. If met, this would reflect a meaningful 12% improvement in revenue compared to the last 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 65% to kr0.06. Before this earnings announcement, the analyst had been modelling revenues of kr166.0m and losses of kr0.09 per share in 2024. While the revenue estimates fell, sentiment seems to have improved, with the analyst making a very favorable reduction to losses per share in particular.

The analyst has cut their price target 70% to kr3.00per share, suggesting that the declining revenue was a more crucial indicator than the forecast reduction in losses.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that OrganoClick's rate of growth is expected to accelerate meaningfully, with the forecast 17% annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 12% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 7.8% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that OrganoClick is expected to grow much faster than its industry.

The Bottom Line

The most obvious conclusion is that the analyst made no changes to their forecasts for a loss next year. They also downgraded OrganoClick's revenue estimates, but industry data suggests that it is expected to grow faster than the wider industry. Even so, long term profitability is more important for the value creation process. Furthermore, the analyst also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have analyst estimates for OrganoClick going out as far as 2026, and you can see them free on our platform here.

Even so, be aware that OrganoClick is showing 1 warning sign in our investment analysis , you should know about...

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ORGC

OrganoClick

A green chemical company, develops and markets biobased and biodegradable chemical products and material technologies for the treatment of nonwoven, technical textile, and wood in Sweden, Other Nordics, the Rest of Europe, Asia, North America, and Oceania.

Reasonable growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.